An update on the graphite sector and what to expect in 2024 and beyond

2023 has been a rough year for all the EV materials and graphite was no exception. EV battery anodes contain a combination of spherical graphite (sourced from natural flake graphite) and synthetic graphite. Today we take a look at the key trends of 2023 and what we can expect in 2024 and beyond.

2023 graphite trends

A slowdown in the growth rate of EV sales in China along with less demand from the steel industry were mostly to blame for the graphite demand slowdown when compared to 2022. The other key factor was the excess anode capacity that came online during the 2022 China EV boom when EV sales skyrocketed.

China flake graphite prices fell throughout 2023 and have recently risen slightly from their bottom at ~US$550/t. China’s uncoated spherical graphite prices fell to US$2,200/t due to excess supply. China’s synthetic graphite prices were also weaker in 2023, due to slower demand.

A trend in 2023 was the increase in the popularity of synthetic graphite for use in battery anodes, particularly in China. Synthetic graphite prices have typically been much higher than flake graphite prices due to the high energy intensity needed to produce synthetic graphite. However falling energy input costs in 2023 and new capacity resulted in lower synthetic graphite prices and prices much closer to flake graphite. This led to anode producers increasing the ratio of synthetic graphite to spherical graphite in their anodes, and less demand for spherical and flake graphite.

Then in November 2023, the European Union added synthetic graphite to its list of critical materials as part of their Critical Raw Materials Act (“CRMA”).

Finally, in late 2023, China introduced temporary export permits for some graphite products (natural flake graphite, spherical graphite, & synthetic graphite) to apply from December 1, 2023. This has resulted in some recent price increases in the graphite market and a large amount of uncertainty around graphite products supply outside of China. China controls 75% of the global graphite anode supply chain.

The outlook for graphite in 2024

Most analysts are forecasting a fairly balanced graphite market in 2024, with the possibility of some price recovery from the 2023 cyclical lows. UBS tips graphite prices to surge 50% from the 2023 lows and has set its long-term flake graphite price at $850/t. UBS forecasts natural graphite demand rising by six times this decade to reach a demand of 6.3 million tonnes pa, with a deficit forming from 2025.

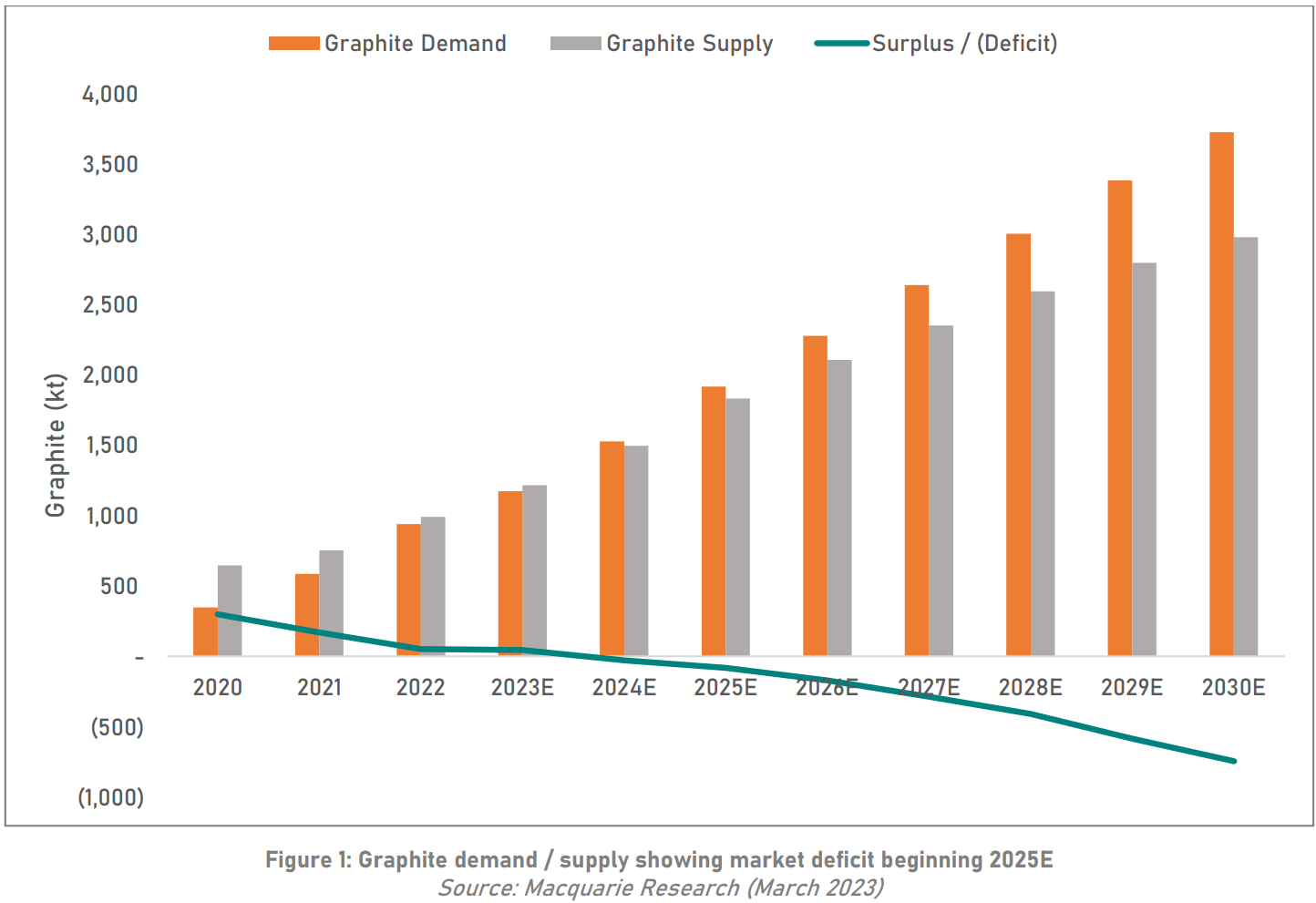

Others such as Macquarie Research are forecasting graphite deficits to begin in 2024 and increase each year to 2030.

Macquarie Research (as of March 2023) forecasts flake graphite deficits starting in mid 2024

The long-term outlook for graphite

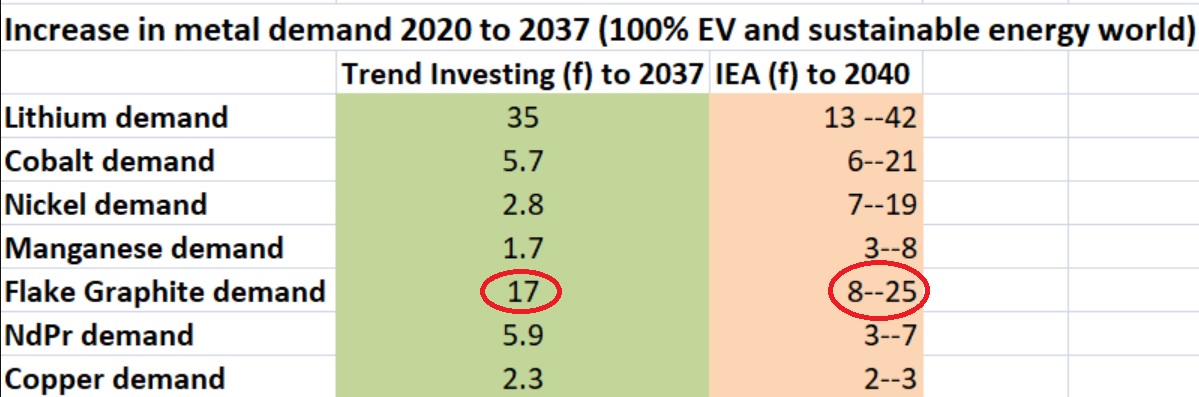

Looking out further graphite demand is set to surge this decade and next due to the expected massive rise in global EV sales and energy stationary storage (“ESS”) battery demand. Below are 3 demand forecasts that give a guide as to what may happen over the long term.

- Benchmark Mineral Intelligence forecasts we will need 97 new 56,000tpa natural flake graphite mines from 2022 to 2035 to meet surging demand.

- The IEA forecasts flake graphite demand to rise 8-25x from 2020 to 2040.

- Trend Investing forecasts flake graphite demand to rise 17x from 2020 to 2037.

Trend Investing forecasts flake graphite demand to increase 17x from 2020 to 2037. The IEA forecasts a 8-25x increase from 2020 to 2040

Closing remarks

While 2023 has been a very tough year for the graphite sector the future looks much brighter, especially beyond 2025 when possible deficits are forecast to increase each year. For now, the flake graphite miners that are low-cost producers and who can develop integrated ‘flake to spherical graphite’ production stand to perform best. Several western graphite companies are rapidly advancing in this direction and are worth following closely.

Those graphite miners that can qualify their product to meet the IRA and/or the CRMA should also be at an advantage, especially with the U.S. Foreign Entity of Concern (“FEOC”) rules for critical materials commencing in 2025.

We will keep you updated on the graphite sector and miners in 2024.