Can the US match China’s critical mineral stockpiles?

A global critical mineral stockpile race has begun

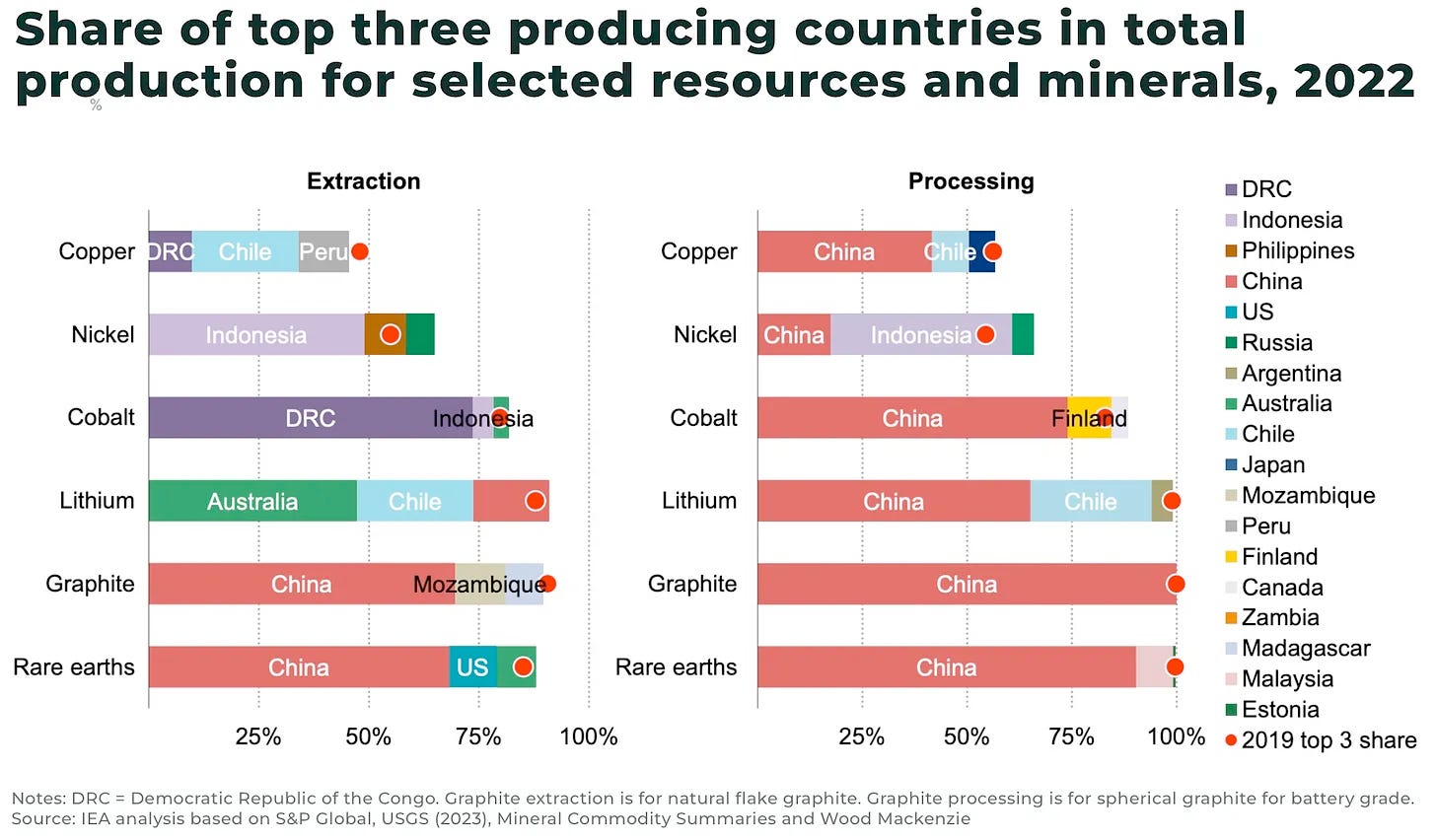

China’s strategic reserves of critical minerals, including copper and nickel, are estimated to be more than 35% to 133% of the country’s annual demand. This substantial stockpiling has raised concerns across the West — with bipartisan calls for the US to do the same.

The challenge is that global supply chains are already under pressure with increasing demands for critical minerals from data centers, net-zero targets, and military production.

Can the USA match China with its own critical mineral stockpile?

China

The official size and strategy of China’s national commodity stockpiles are state secrets — run by China’s National Food and Strategic Reserves Administration (or, State Reserve Bureau) — but is reported to stock aluminum, antimony, cadmium, cobalt, gallium, germanium, indium, molybdenum, rare earth elements, tantalum, tin, tungsten, and zirconium.

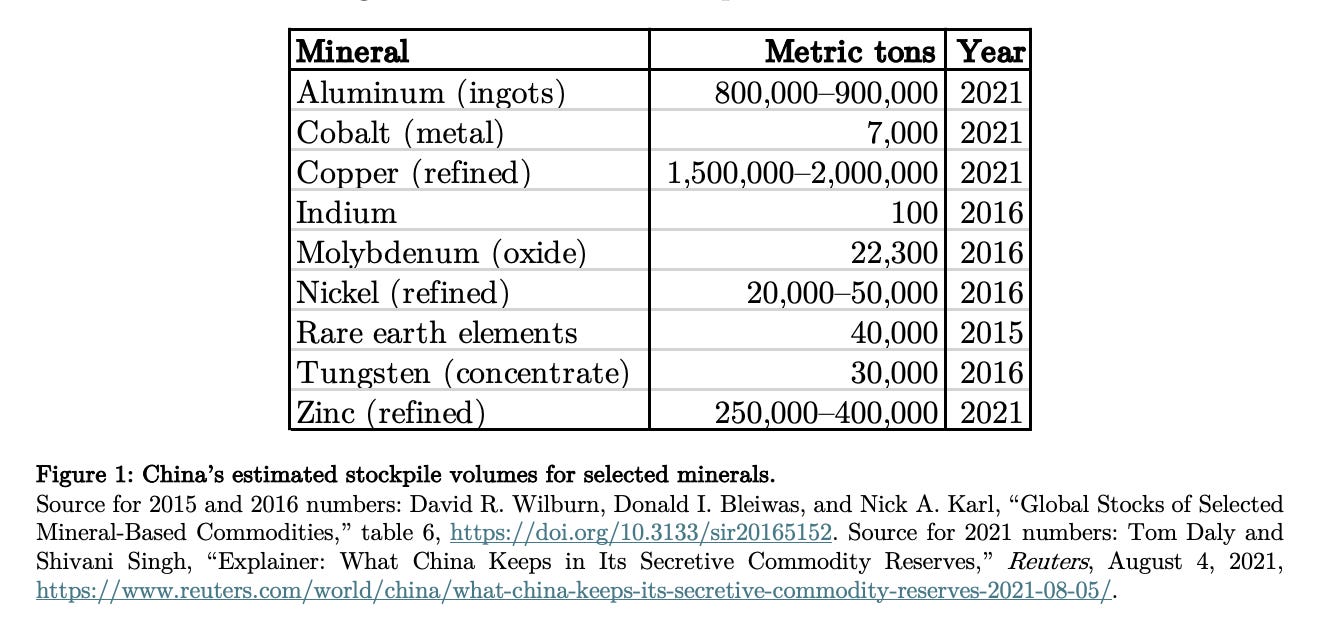

Analysis in 2021 suggested China’s stockpiles included:

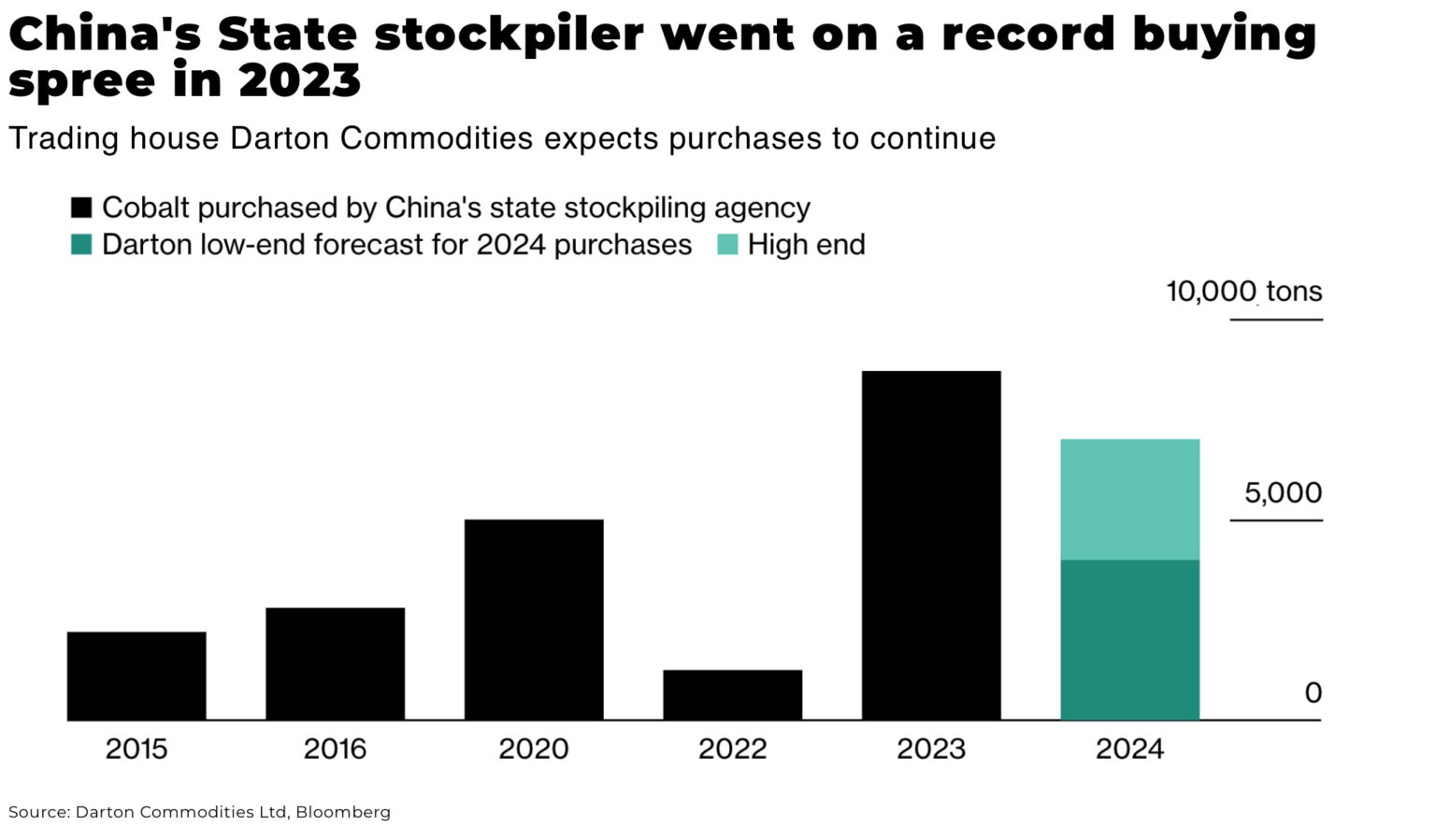

But, since then, the State Reserve Bureau has been spending significant amount more in 2023-2024

- for example, purchasing a total of more than 15,000 tons of cobalt. Reuters and Bloomberg report the National Food and Strategic Reserves Administration was preparing to buy a record 15,000 tonnes of cobalt from local Chinese producers over 2024 for domestic stockpiles

- China imported a record high of 1.18 billion tonnes of iron ore in 2023

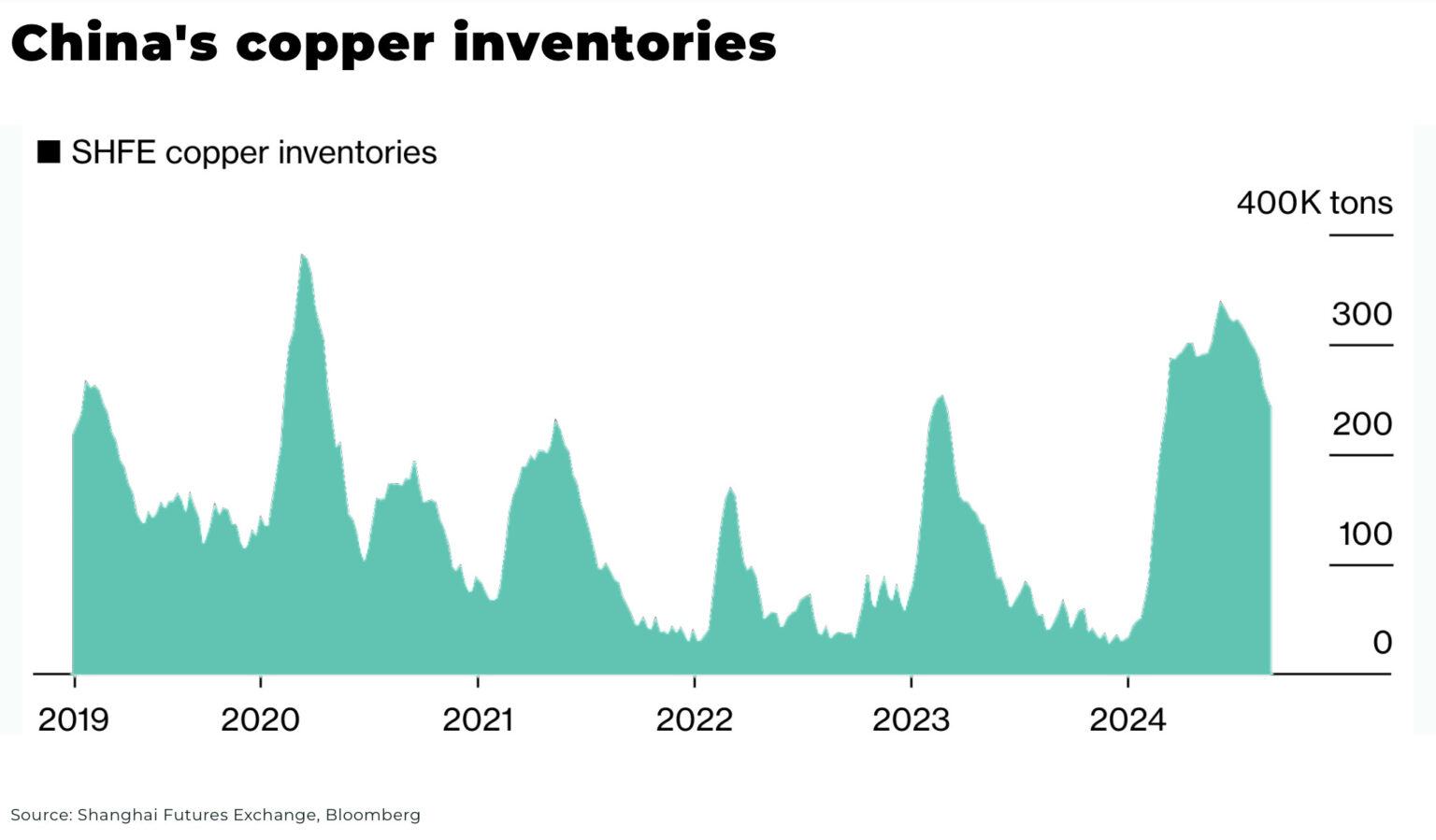

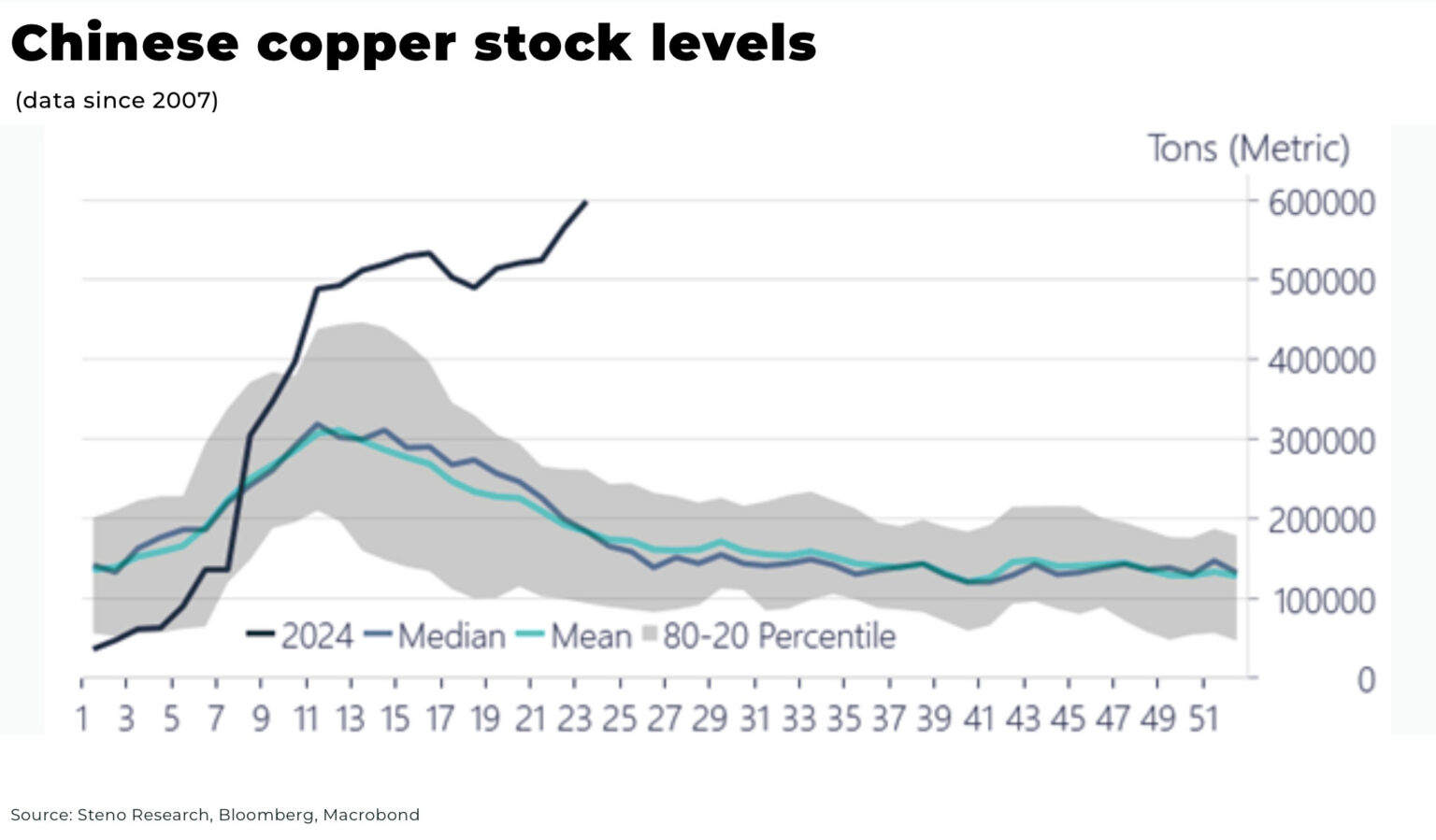

- copper inventories have also been increasing, with stockpiles held in Shanghai Futures Exchange warehouses ended in June well above 300,000 tons.

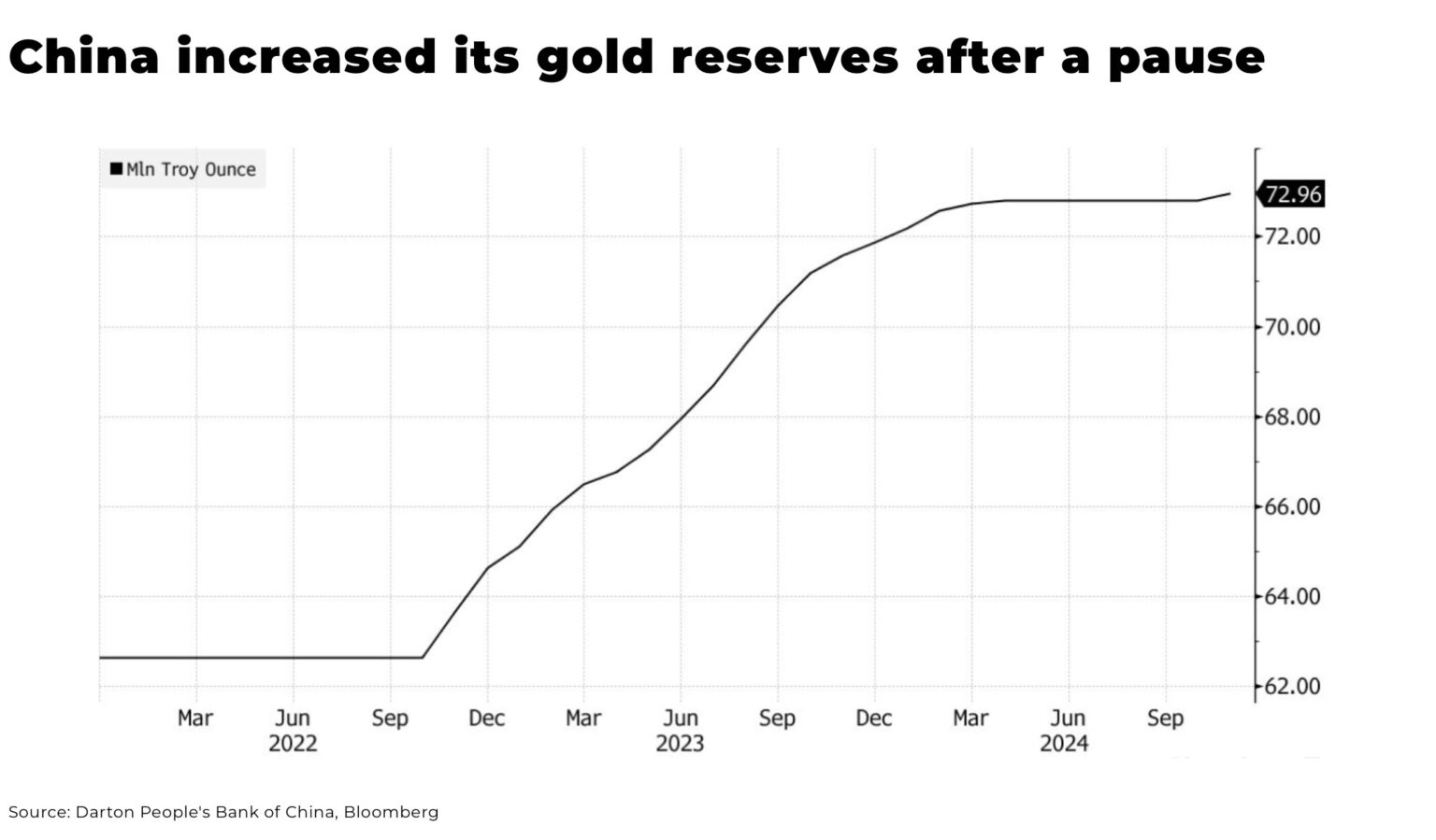

- China’s central bank has been making record purchases of gold, with bullion held by the People’s Bank of China climbing by 160,000 fine troy ounces last month to 72.96 million fine troy ounces, according to official data

And it’s not just metals, for example, with China reportedly asking state firms to add 60 million barrels of oil to reserves, coal inventories rose to a unprecedented 635 million tons at the end of June, from less than 90 million in late 2021, and China’s construction of grain warehouses has increased the national grain storage capacity to over 700 million tonnes by the end of 2023, an increase of 36% from 2014.

Note, these numbers will be highly volatile and are under a great deal of secrecy, so we use them not to give exact specifications, but a general sense of direction.

Each commodity is different and there are a variety of reasons for such significant stockpiling, including:

- the economy is stalling and with output stalling, demand for much of the critical mineral mining infrastructure that China has set up means it can only be put in storage

- national security, including preparation for conflict, for example, over Taiwan

- preparation for a trade war with potential tariffs from a Trump administation, including a potential devaluation of the Yuan

We personally think an invasion of Taiwan is unlikely, and China is, instead, preparing for a trade war.

But, whatever the reason, the outcome is the same: these stockpiles give China significant leverage over both the market and the West.

The West

“Over the past several decades, China has cornered the market for processing and refining of key critical minerals, leaving the US and our allies and partners vulnerable to supply chain shocks and undermining economic and national security”

— the White House said in a statement, Biden-Harris Administration Takes Further Action to Strengthen and Secure Critical Mineral Supply Chains

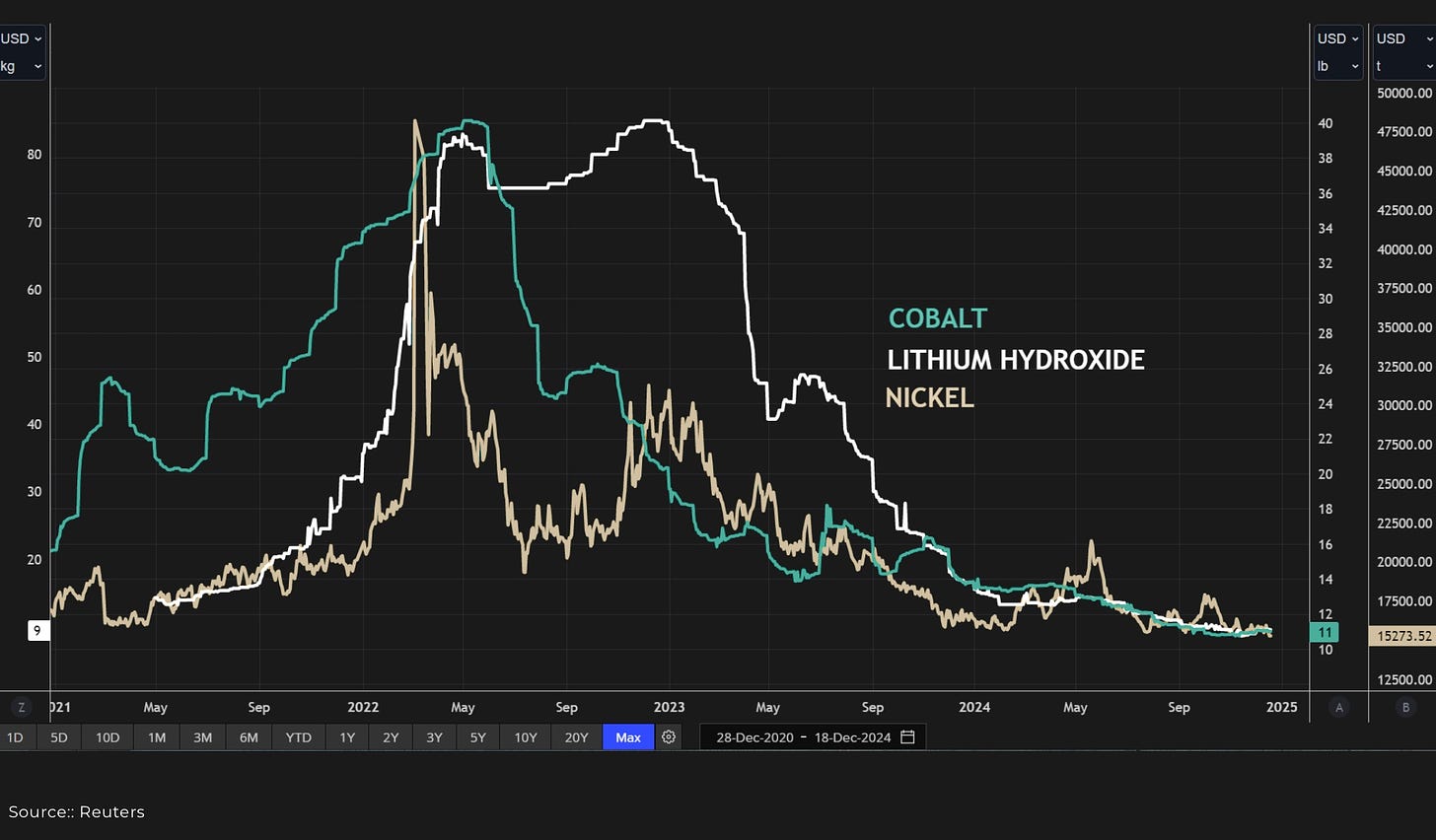

Concerns over US dependency on Chinese supply of critical minerals have been realised with export bans of germanium and gallium, as well as flooding of the market with cheap nickel by Indonesia to take out competition.

In her election campaign, Kamala Harris proposed a national stockpile critical minerals.

The proposed reserve would target minerals with high volatility, low US domestic production, and Chinese import dependence, such as cobalt, graphite, and rare earth elements. This would be similar to how the US Strategic Petroleum Reserve (SPR) is used.

We suggest this is not a partisan issue, and that the idea builds on existing administration’s work — Trump in 2020 asked Congress for US$1.5 billion over 10 years to create a new national stockpile of US-mined uranium — and, so, is likely to continue.

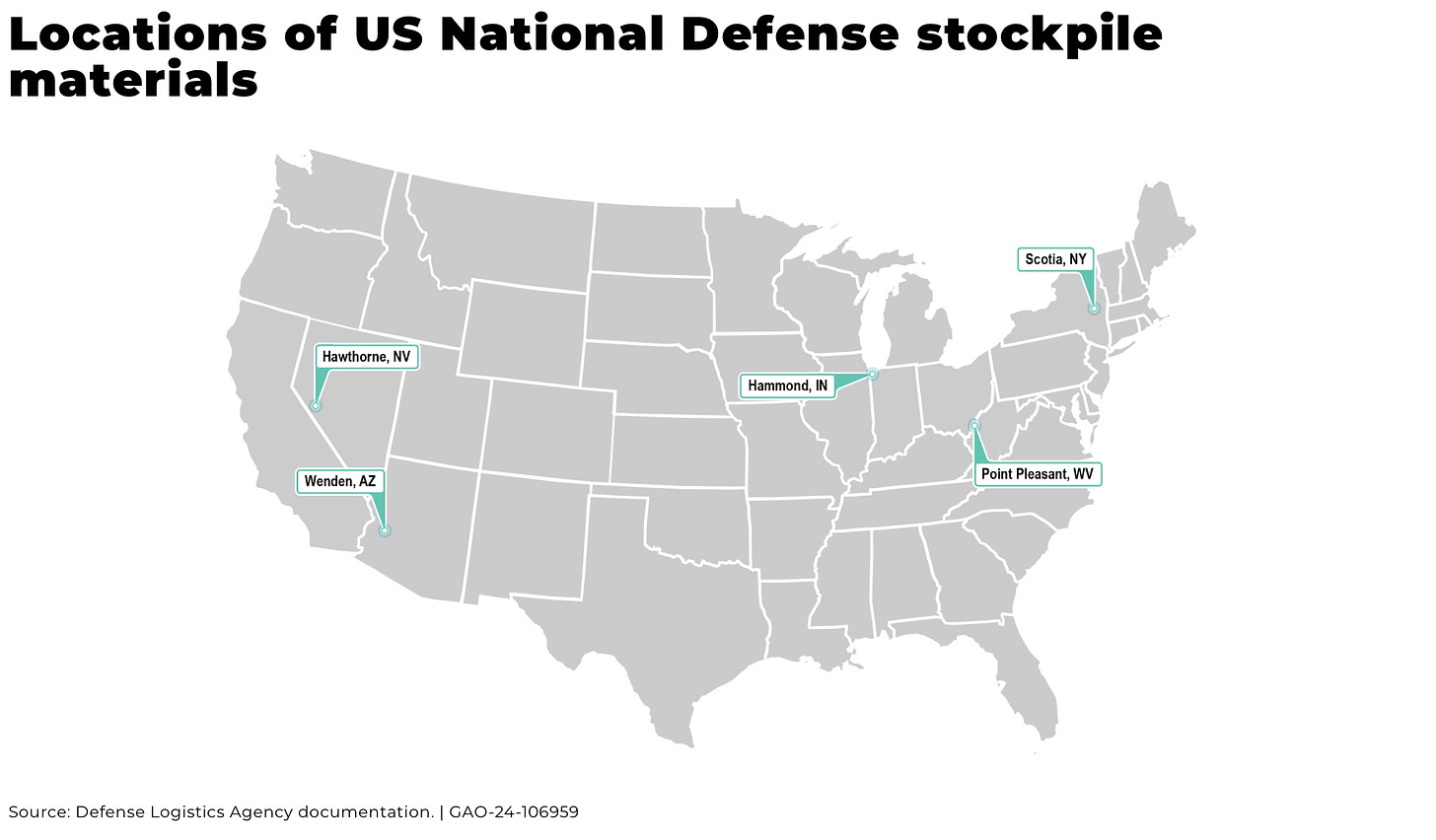

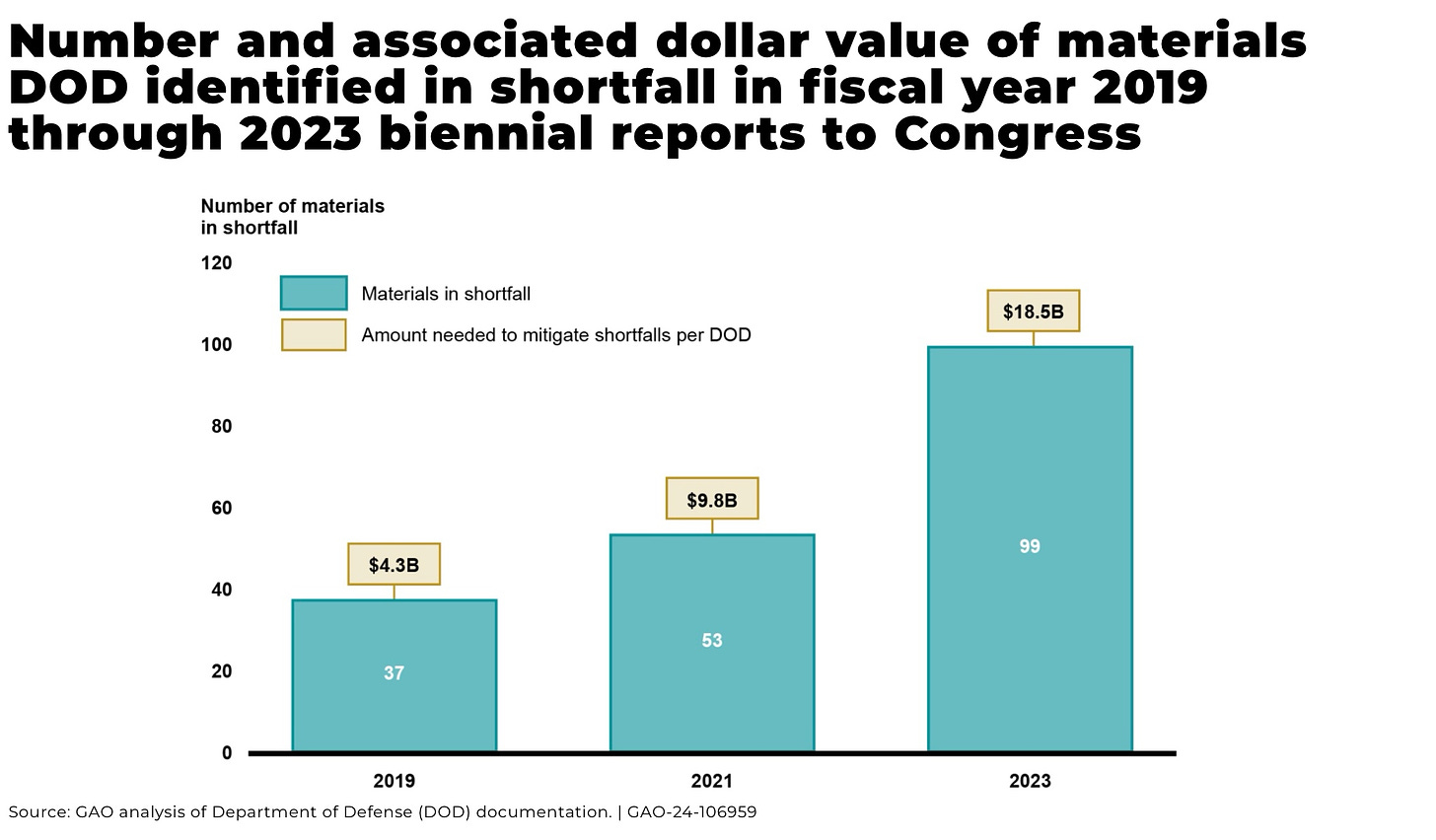

The US does already have an official National Defense Stockpile to be used in emergencies but after decades of neglect, Congress found it “deficient” in 2023.

As of March 2023, the National Defense Stockpile contains US$1.3 billion in total assets, including US$912.3 million of stockpiled material.

Per estimates, as of April 2023, the current inventory mitigates less than half of estimated strategic and critical materials shortfalls for military requirements; less than 10% of essential civilian demand shortfalls; and approximately 6% of total net shortfalls in “base case” national emergency scenarios. The vast majority of the US$13.5 billion gap between current stockpile assets and current stockpile requirements would support non defense critical infrastructure demand in the event of an attack on the US

In December 2023, the US House Select Committee on the Chinese Communist Party called for the creation of a Resilient Resource Reserve to insulate American producers from price volatility and China’s weaponization of its dominance in critical mineral supply chains. This included spending US$1 billion to build out its stockpile of critical minerals as a “buffer.”

The reserve is envisioned as a physical stockpile that can meet US military demands in a major conflict, influence domestic mineral prices to incentivize expanded US production, as well as act as a buffer, both financially and physically, in case of any supply crisis.

The seriousness with which the issue is being taken was highlighted when the US looked into buying cobalt for defence stockpiles last year, with the possibility of the Defense Logistics Agency purchasing more in the future.

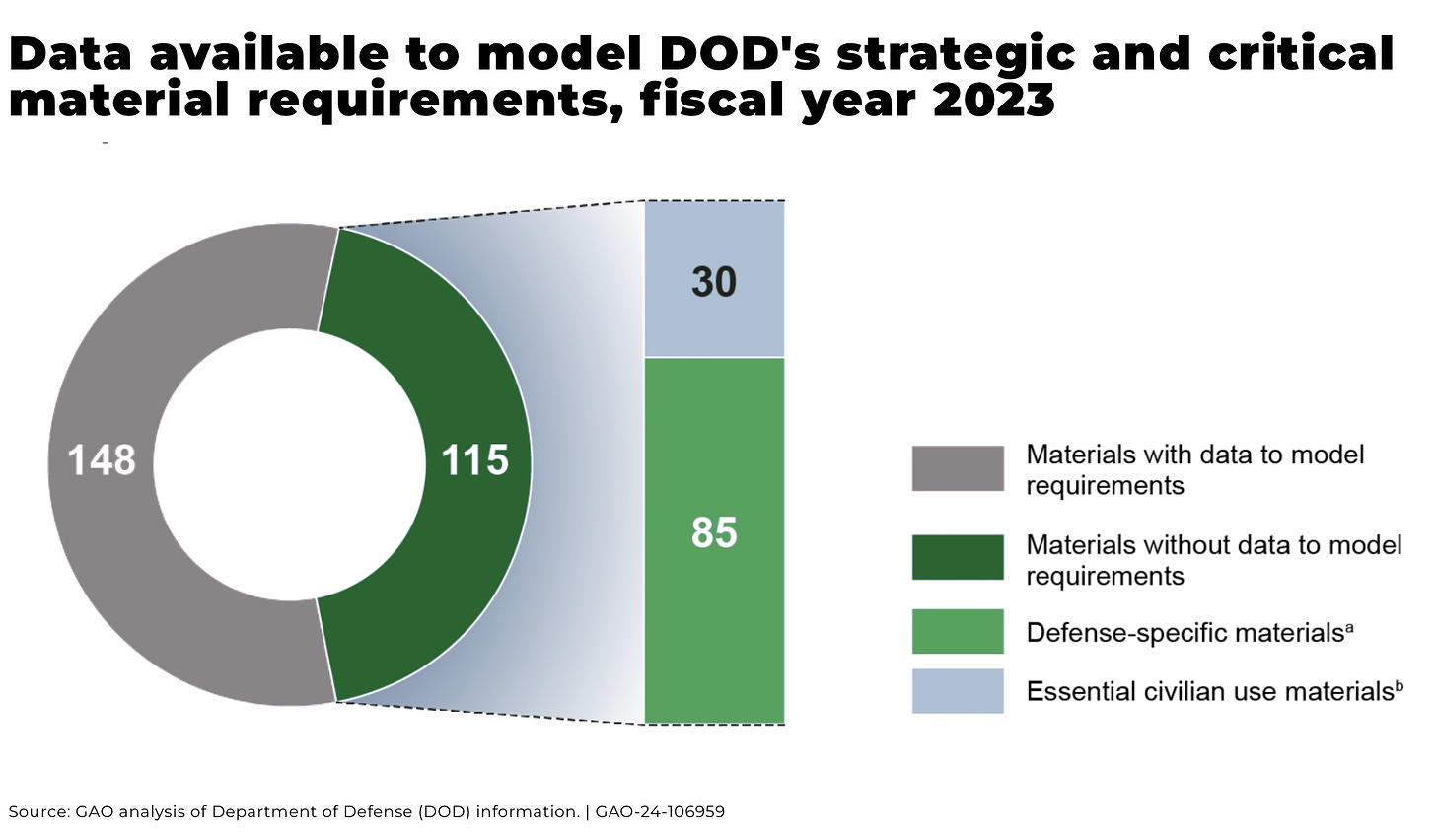

The Department of Defence has developed a process for identifying strategic and critical material requirements However, the Department of Defence did not have the data needed to do so for 115 of the 263 materials — or about 44% — it wanted to model in fiscal year 2023.

And it’s not just the US, for example:

- Canada’s government will buy stockpiled rare earth materials from Vital Metals Ltd. in a deal that prevents the company from selling its production to a Chinese buyer

- The South Korea government has started to build up a national stockpile of lithium reserves through the state-owned Korea Mine Rehabilitation & Mineral Resources Corp (KOMIR), Fastmarkets was told on Tuesday May 21

- Most of Europe does not even have a critical mineral stockpile

Other initiatives

The IEA is also developing a new Critical Minerals Security Programme, modelled after its oil security mechanism. Key aspects of the programme include:

- the programme would serve as a “safety net” for critical mineral supply chains

- collaboration between 31 governments

- draws lessons from the IEA’s oil security mechanism, which requires member countries to hold 90 days of oil stocks

Further details of the programme are expected to be announced in the coming year.

Market implications

Stockpiles have a significant impact on the market – both upsides and downsides:

Demand and price stability: the creation of a US national stockpile, coupled with China’s ongoing stockpiling efforts, could lead to a sustained increase in demand for critical minerals, including a floor for prices, offering miners offtake and buyer-of-last-resort agreements, which could encourage new investment across the industry.

Global critical mineral alliances: as the US seeks to build critical mineral supply chains with allies, we are likely to see increased international cooperation across the mining sector. This could lead to new joint ventures, technology transfers, and trade agreements focused on critical minerals.

Decentalization and market diversification: the push for diversified supply chains could benefit junior miners and exploration companies operating in geopolitically stable regions outside of China’s sphere of influence. This could lead to a more robust, globally distributed mining sector.

But, it could also lead to overcapacity risks and market distortions if not carefully managed, with sudden large purchases or sales from national stockpiles potentially creating price volatility.

A race to secure and control critical minerals could also exacerbate geopolitical tensions, with trade disputes, resource nationalism and export restrictions leading to global supply chain disruption and threats to national security.

Conclusion

A US national stockpile is essential as a buffer in any national emergency, and low prices across many critical minerals, such as nickel, offers a perfect opportunity for governments to buy.

However, although stockpiles are set up to alleviate pressures on supply, any decision by major economies like China and the US to build substantial stockpiles of critical minerals are likely to exacerbate existing supply chain pressures.

And the faster the US wants to stockpile, the higher the pressure on supply.

Already demand is expected to exceed supply across a range of critical minerals due to net zero targets, defence expansion, and the surge of data centers for artificial intelligence.

Increased stockpiling efforts may compound existing pressures, heightening the risk of short-term price volatility and market destabilization.

To become a Critical Minerals Institute (CMI) member, click here

The upcoming CMI Summit IV, themed The War for Critical Minerals and Capital Resources, is scheduled to take place in Toronto, Ontario, on May 13-14, 2025. The CMI Summit aims to foster strategic partnerships and develop actionable solutions that support the growing demand for critical minerals, crucial for the advancement of clean energy, technology, and national security.

To secure a CMI Membership, click here or to secure a CMI Summit IV 2-day Delegates Pass, click here