Critical Minerals Report (08.01.2025): The Race Intensifies Amid Price Floors, Espionage, and New Alliances

In Washington, the Trump administration took a bold step to bolster domestic rare earth production. Top White House officials, led by trade adviser Peter Navarro convened tech companies and rare earth firms on July 24 to outline a pandemic-style support plan. The strategy centers on guaranteeing a price floor for rare earth elements – a measure akin to COVID-era vaccine programs – to incentivize U.S. mining, processing, and magnet manufacturing and reduce reliance on China. Navarro confirmed the meeting, emphasizing the need to move at “Trump Time” – as fast as possible – to build an end-to-end critical minerals supply chain domestically. Industry sources say this price support, first extended to MP Materials Corp. (NYSE: MP) earlier in July, will not be a one-off, suggesting more deals are imminent. Participants, including Apple, Microsoft, and Corning, were urged to invest in rare earth ventures, with follow-up talks planned in a matter of weeks. While some in the meeting pushed for export bans on U.S. rare earth magnets to force domestic recycling, Navarro cautioned against any move that might hand China leverage until American capacity matures.

Washington’s focus on rare earth security extends overseas as well. In an exclusive strategy shift, U.S. officials have even entertained proposals to tap Myanmar’s heavy rare earth deposits – minerals currently processed almost entirely in China. According to Reuters, informal pitches have floated easing sanctions or striking deals either with Myanmar’s junta or directly with rebel groups like the Kachin Independence Army that control rich rare earth mines. Though fraught with legal and ethical hurdles, the discussions underscore how U.S. policymakers are exploring unprecedented avenues to secure strategic minerals outside of China’s orbit. Similarly, recent diplomatic dialogues hint at a U.S.-Philippines critical minerals partnership. At a meeting in Kuala Lumpur on July 10th, U.S. Secretary of State Marco Rubio lauded the Philippines’ untapped rare earth “wealth” and stressed diversifying supply chains. The Philippines may hold vast reserves of elements like scandium, neodymium, and others in its nickel-rich soils, much of which have historically flowed unprocessed to China. Only about 5% of the country’s critical mineral reserves have been explored so far. U.S. interest in helping develop these resources – possibly via joint exploration or technology support – signals a new front in countering China’s near-monopoly on rare earth processing (currently ~90% of global capacity). Experts note, however, that the Philippines (like Myanmar) faces steep challenges: unquantified reserves, minimal extraction infrastructure, environmental risks, and the need for careful oversight in any foreign partnership.

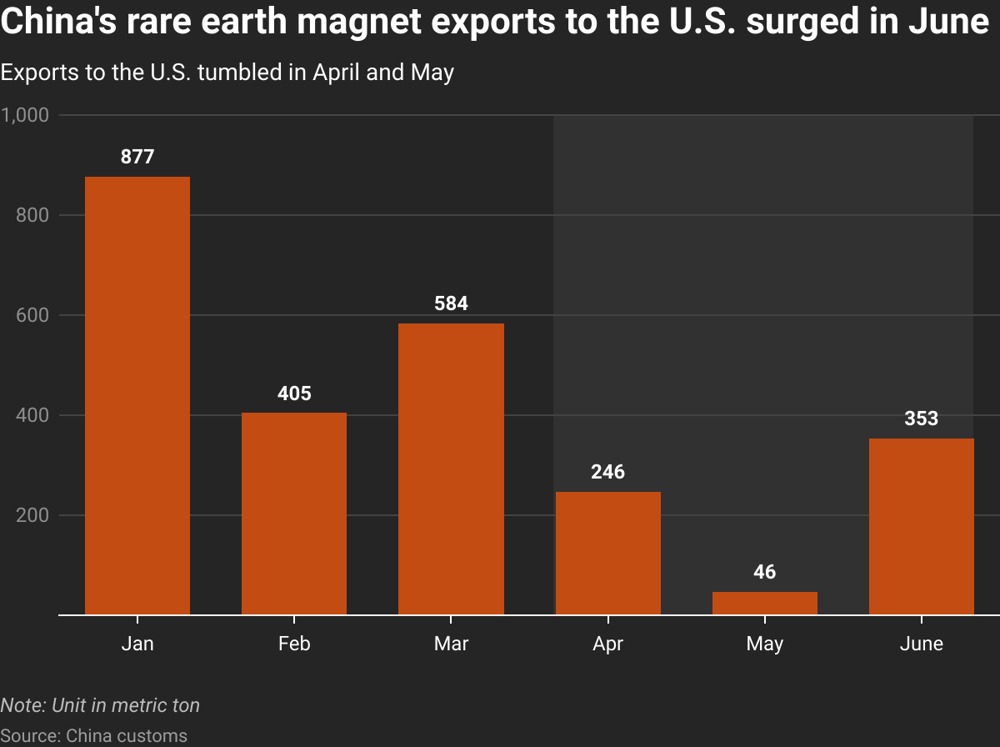

China’s dominance in rare earths has not gone unchallenged by Beijing either. Despite a recent easing of trade tensions, China continues to keep rare earth exports to the U.S. restricted, effectively at about half their normal levels. June shipments to the U.S. (353 tonnes) remained 52% lower than a year ago, even as exports to Europe and Asia rebounded. This sustained squeeze – part of Beijing’s bargaining strategy amid broader tariff and tech disputes – is precisely the scenario spurring Washington’s all-out push for new suppliers and price guarantees. It’s a high-stakes race: rare earth magnet metals are indispensable in everything from smartphones and EV motors to fighter jets. The strategic urgency is echoed in allied nations too. Australia’s intelligence chief, Mike Burgess, warned this week that foreign spies are “aggressively” targeting sectors like rare earth mining, advanced materials research in Antarctica, and the sensitive AUKUS submarine program. Burgess revealed that espionage cost Australia at least A$12.5 billion (US$8 billion) last year in stolen tech and trade secrets. He explicitly name-checked China, Russia, and Iran as persistently attempting to pilfer classified information, including minerals data and defense blueprints. With thousands of Australians in defense and academia being targeted, Australia is tightening security – and highlighting how critical minerals sit at the nexus of economic and national security concerns worldwide.

China’s rare earth magnet exports to the U.S. plunged in April–May 2025 before partially rebounding in June. The bar chart above illustrates this dramatic volatility, with June exports (353 metric tons) jumping seven-fold from May’s low (46 tons) after new trade understandings were reached. Despite the rebound, June’s U.S.-bound exports remained 52% lower than a year earlier, underscoring how China’s export curbs have kept shipments at roughly half their normal levels.This visual highlights why Washington is racing to secure alternative rare earth supplies – the spring export squeeze disrupted supply chains and even caused some automakers outside China to halt production for lack of magnets. Such gyrations in China’s export flow (dominating 90+% of magnet supply) emphasize the strategic vulnerability the U.S. is urgently trying to address.

Trade Turbulence: Copper Tariffs and Climate Policy Reversals

Washington’s aggressive trade actions shook commodity markets and climate policy in equal measure this week. U.S. copper prices whipsawed after President Trump abruptly unveiled a 50% tariff on imported copper products, effective August 6. The tariff – aimed at copper wire, pipes, and other semi-fabricated items – initially sparked panic buying and a price spike in early July when traders feared it would cover all copper imports. But once clarified that raw forms like concentrate, cathodes, and scrap were exempt, the market flipped. Comex copper futures plunged nearly 20% in a day, the steepest drop since at least the 1980s. The frenzy of stockpiling that had driven U.S. prices to records unwound almost overnight, erasing an unusual domestic premium and realigning U.S. copper prices with global levels.

In the new landscape, winners and losers are starkly delineated. American manufacturers of copper-intensive goods (electronics, appliances, etc.) stand to benefit from pricier imported parts, which could give locally made components a competitive edge. However, U.S. copper miners and smelters gained nothing tangible – the tariff pointedly excludes the raw copper they produce, and America’s capacity to refine copper remains limited. Shares of major U.S. producers like Freeport-McMoRan Inc. (NYSE: FCX) sank 9.5%, and junior miner Ivanhoe Electric Ltd. (TSX: IVN | OTCQX: IVPAF) plummeted 17%, as hopes for a mining boom evaporated. “It’s a boost for Chile and Peru, not Arizona,” quipped one analyst, noting the tariff effectively favors South American copper suppliers who can still ship refined cathodes tariff-free. Indeed, Chile and Peru – world leaders in copper mining – could see increased demand as U.S. manufacturers look to source raw copper abroad and avoid the levy. Critics argue this episode is a cautionary tale of policy by headline: an initial blanket tariff threat ignited a speculative rally, only for a last-minute revision to crash the market and sow confusion. Without accompanying measures to streamline mine permitting or build smelters, tariffs alone add cost “without offering a sustainable path forward” for U.S. supply, as Bernstein’s Bob Brackett observed.

On the climate front, the U.S. signaled a dramatic U-turn that could leave Europe’s green agenda in the dust. The Environmental Protection Agency announced a proposal to revoke the legal foundation for regulating greenhouse gas emissions from vehicles, citing updated science and recent court rulings. This means rescinding the 2009 “endangerment finding” that declared carbon emissions a threat to public health. If finalized, the rollback would eliminate federal CO₂ limits on car and truck tailpipes – essentially gutting America’s cornerstone climate rules in the transportation sector. EPA Administrator Lee Zeldin, flanked by the Energy Secretary at an Indiana car dealership, touted it as the largest deregulatory move in U.S. history, claiming it could save $54 billion annually in compliance costs. He argued that under recent Supreme Court logic, EPA lacks clear authority to police carbon unless Congress explicitly says so.

The implications are seismic. Environmental groups blasted the proposal as “the end of the road for U.S. action against climate change” and warned it will put American automakers on a vastly different trajectory than their European counterparts. Europe’s carmakers are still on the hook to meet strict EU emissions targets and phase in electric vehicles, while U.S. manufacturers may soon face no such federal mandates. “It’s like the U.S. is hitting the brakes while Europe floors the accelerator toward EVs,” one industry observer noted. The Department of Energy, under a White House climate-skeptic “Climate Working Group,” even released a report asserting that climate damages from CO₂ might be less severe than thought and that overly aggressive mitigation could backfire economically. The DOE’s review downplayed links between emissions and extreme weather, and argued U.S. climate policies have “undetectably small” global impact – conclusions sharply at odds with mainstream science. These findings are now up for public comment, but they are already providing political cover for the EPA’s rollbacks. Should the U.S. formally abandon its vehicle emissions standards – effectively giving Detroit a pass on CO₂ – it could create a transatlantic rift in auto regulations. European officials worry about a competitive imbalance: EU automakers would incur higher costs to meet green rules, potentially making their cars pricier than American models in the long run. For now, the EPA proposal faces 45 days of public feedback (and almost certain legal challenges). But the signal is clear – the U.S. is prioritizing short-term industrial and consumer cost relief over longer-term climate commitments, even as climate extremes intensify globally.

Tech Industry Seeks Resilience: Tesla’s Battery and Chip Deals, Lithium Rebounds

Amid these policy gyrations, the private sector is recalibrating critical supply chains. Tesla Inc. (NASDAQ: TSLA) made headlines by inking two mega-deals aimed at reducing its dependence on China. First, Tesla signed a $4.3 billion agreement with South Korea’s LG Energy Solution for lithium iron phosphate (LFP) batteries to be made in Michigan. These LFP batteries – destined for Tesla’s energy storage systems – will be supplied from 2027 through 2030, with an option to extend up to 2037. Crucially, by sourcing from LG’s U.S. plant, Tesla sidesteps the “outsized” U.S. tariffs it currently pays on Chinese-made LFP cells. Tesla’s CFO noted those tariffs have been a heavy drag on its battery business. Now, LG stands as the only major LFP producer on U.S. soil, giving Tesla a local supply of these lower-cost, cobalt-free batteries at scale. The move reflects a broader trend: EV and storage companies are scrambling to localize battery production. Even as EV sales cool slightly, demand for stationary storage (boosted by data centers and AI computing needs) is surging, and Tesla’s energy division has been a bright spot, growing ~10% of revenue. “Not many people appreciate just how gigantic the scale of battery demand is,” Elon Musk remarked recently – a nod to why Tesla is aggressively securing non-Chinese battery sources.

Just days earlier, Tesla also announced a $16.5 billion deal with Samsung Electronics to fabricate Tesla’s next-generation automotive AI chips in the U.S.. Samsung will dedicate part of its new Taylor, Texas semiconductor fab to produce Tesla’s custom AI processors (dubbed “HW 5” and future “HW 6”) around 2027–2028. The partnership is a boon to Samsung’s fledgling contract chip business, which had struggled to fill its Texas fab capacity. Musk highlighted that Tesla engineers will work closely with Samsung to “maximize manufacturing efficiency” – even quipping that the chip plant is conveniently near his house. While these chips won’t hit cars or Optimus robots for a few years, the deal underscores a supply-chain shift: advanced components for EVs and autonomous systems are increasingly being produced in America or allied nations, not just in East Asia. These dual Tesla deals – batteries and chips – exemplify how Western companies are reducing exposure to China. By securing local or allied suppliers, Tesla can buffer against geopolitical risks (tariffs, export curbs) that might otherwise disrupt its ambitious plans for energy storage and AI-driven vehicles. South Korea’s trade officials, in fact, rushed to clinch broader agreements with the U.S. before an August 1 tariff deadline, aiming to cement partnerships in chips, shipbuilding, and batteries. We are witnessing a realignment of tech supply chains, with “friendshoring” replacing offshoring in key areas.

In the lithium market, signs of life have returned after a prolonged slump – largely due to China’s sway over both supply and demand. Lithium carbonate prices in China had cratered a staggering 90% from late 2022 highs, bottoming out around $8,500 per ton in June. But in the past month, prices rebounded roughly 20% to about $10,300/ton, catalyzed by two forces: booming EV sales in China and Chinese production cutbacks. China’s passenger electric vehicle sales are soaring (over 1 million EVs sold per month in June, a 53% market penetration) thanks to rural subsidies and pent-up demand. At the same time, Chinese authorities have curtailed output from some lithium mines and brine operations – roughly 5% of global supply is now offline due to environmental checks and export restrictions. This pincer movement – stoking demand while tightening supply – has lifted lithium off its lows. Analysts say it’s no coincidence: Beijing can leverage commodities like lithium as both economic tools and diplomatic leverage. After all, China remains the 800-pound gorilla in EVs (expected 14+ million sales this year) and refines the majority of the world’s battery chemicals. Western suppliers have taken notice. Albemarle Corporation, the world’s largest lithium producer, reported a surprise Q2 profit, crediting steady EV battery demand even amid lower prices. Albemarle’s net sales of $1.33 billion beat expectations despite being 7% lower than last year, as higher volumes offset the price decline. Lithium usage for cars and grid storage jumped 24% last year and is projected to grow ~12% annually for the next decade. To ride out the price turbulence, Albemarle Corporation (NYSE: ALB) has slashed costs – laying off staff, canceling a major U.S. lithium refinery project – and trimmed 2025 capital spending, aiming to generate positive free cash flow next year. The strategy is paying off: the company swung to an adjusted profit of $0.11/share, versus an expected loss, sending its stock up 6%. Still, Albemarle and its peers remain cautious. Global lithium oversupply hasn’t vanished; analysts warn the recent price bump could be short-lived without deeper production cuts. For now, though, China’s grip on this “white gold” market is giving it renewed pricing power – a reminder that control of critical minerals can translate to economic muscle.

On the horizon, a different kind of energy breakthrough was literally breaking ground: nuclear fusion. In central Washington state, startup Helion Energy has begun construction of what it hopes will be the world’s first commercial fusion power plant, aimed at supplying Microsoft (NASDAQ: MSFT) by 2028. The plant, dubbed “Orion,” is rising in the town of Malaga along the Columbia River, fortuitously near an existing substation from a hydro dam. Helion – backed by over $1 billion from investors including Sam Altman and SoftBank – secured a landmark deal with Microsoft in 2023 to purchase fusion power if the plant comes online. The planned 50 megawatt reactor will use an inertial-electrostatic fusion approach, and Helion’s CEO proclaimed the groundbreaking as ushering in “a new era of energy independence”. Of course, fusion remains an experimental bet – no one has yet achieved net-positive energy from fusion reactions for a sustained period.

Skeptics note Helion’s timeline (operation by 2028) is extremely ambitious, and regulatory permits are still in progress. Yet the project’s mere existence speaks volumes about the long-term stakes of critical energy innovation. Microsoft’s Chief Sustainability Officer said the tech giant is “proud to support” fusion’s development as part of a broader clean energy commitment, even if commercial viability is not guaranteed. In a week dominated by wrangling over earthbound minerals, the fusion news was a reminder that the race for sustainable power – much like the critical minerals race – invites bold moves and big gambles. Whether digging into the ground for rare elements or fusing atoms in a reactor, the world’s leading economies and companies are in a frenzied pursuit of the resources and technologies that will define the future.

Resource Nationalism Rises: Brazil’s New Rules and China’s Growing Sway

Amid the global jockeying, resource-rich nations are asserting control over their mineral wealth. Brazil’s president Luiz Inácio Lula da Silva this week launched a sweeping plan to guard Brazil’s critical minerals from foreign dominance. Lula announced a new commission to map and oversee strategic deposits of lithium, rare earths, cobalt, nickel and more – commodities essential for EVs, batteries, and renewable grids. Notably, only about 30% of Brazil’s territory has been thoroughly explored for minerals, so the government wants a full accounting of its potential reserves. Lula made it clear that these riches “belong to the Brazilian people” and will not be used as bargaining chips in trade deals. His timing was pointed: just days before Trump’s new 50% tariffs on Brazilian goods were due to kick in. Bristling at U.S. pressure, Lula said foreign firms are welcome to explore and invest, but strictly on Brazil’s terms. Under the emerging policy, any company mining critical minerals in Brazil must be licensed and can only sell their output through the government. Brazil will choose its own development partners, and it pointedly refused U.S. suggestions to tie its minerals into trade concessions. “We won’t trade away our future,” Lula declared in effect.

This assertive stance comes as global demand for these minerals is skyrocketing. Brazil is already a top exporter of iron ore and niobium, and it vaulted into the top five lithium producers in 2023 as new mines came online. In the first half of 2025, Brazil’s lithium exports surged, and projections show much more growth by 2030. Nearly 80% of Brazil’s trade surplus early this year came from the mining sector, underscoring how vital commodities are to its economy. Yet Brazil traditionally exported raw minerals and let others (often China) reap the downstream value. Now the government is investing billions to move up the value chain – speeding up mine permits, encouraging refineries and battery factories domestically, and offering incentives to process ore into advanced products at home. It’s also courting a diverse set of partners beyond the U.S., including in Europe, Asia, and even Russia, to avoid overreliance on any one buyer or supplier. In Lula’s view, this is about more than profit: it’s about sovereignty, jobs, and industrial strategy. By keeping tighter hold over who can extract and who can buy Brazil’s minerals, Brasília aims to dictate its economic destiny in the clean energy era.

Meanwhile, the shifting currents of trade are increasingly favoring China in Brazil’s mineral exports. New data revealed that Brazil’s rare earth shipments to China tripled to US$6.7 million in the first half of 2025, already exceeding the full year 2024 total. (To be sure, those figures are small in absolute terms – Brazil’s rare earth mining is nascent – but symbolically significant.) Almost all of Brazil’s rare earth output now goes to China, which has been investing heavily in Brazil’s mining sector and infrastructure. Brazil holds the world’s second-largest rare earth reserves, yet produces only a fraction of what China does. As U.S.-Brazil relations have chilled – thanks to new tariffs and U.S. trade investigations – China has stepped in to deepen ties. Chinese Premier Li Qiang visited Brazil, and Chinese state firms are forging deals in Brazilian tech, energy, and transit projects. This alignment is showing up in trade flows. While Brazil’s overall exports to China actually fell 7.5% in H1 2025 amid commodity price dips, its imports from China jumped 22%, narrowing a trade surplus that had long been in Brazil’s favor. The surge in rare earth exports suggests China is diversifying its sources of critical minerals, partly to hedge against its own tensions with Washington. “As the U.S. and China harden trade barriers, Brazil ends up absorbing part of that shock,” observed Tulio Cariello of the China-Brazil Business Council. In other words, some U.S.-China decoupling is effectively being rerouted through Brazil and other “neutral” markets. Beijing’s strategic courtship of Brazil may give it leverage over yet another link in the supply chain for high-tech metals – a development not lost on policymakers in Washington and Brasília alike.

In summary, this week’s developments paint a picture of an intensifying global contest over critical minerals and the technologies they enable. From Washington to Canberra to Brasília, governments are racing to secure supply, protect intellectual property, and assert control over resources that will shape the 21st-century economy. Trade policies are being weaponized – whether via tariffs on copper and other goods or through export curbs – with unpredictable consequences for markets. Corporate giants like Tesla are re-engineering their supply lines to be more geopolitics-proof, even as they push the envelope on batteries, chips, and potentially fusion energy. And in the background, China’s formidable presence looms: driving up demand, influencing prices, and quietly extending its reach to mineral-rich corners of the globe. The landscape for critical minerals is nothing short of a global chessboard now, where economic security and national security are one and the same. The past week’s whirlwind of actions and announcements makes one thing clear: the race for critical minerals and clean-energy dominance is not a gentle sprint, but a full-throttle contest rife with opportunity and risk, cooperation and confrontation – and it’s only accelerating from here.

The Critical Minerals Report (CMR) is a weekly compilation of the top stories selected by the Critical Minerals Institute (CMI) Board of Directors. Now, here are the top stories we reviewed in today’s CMR for the above update, for your review. For access to this board, click here, or to become a Critical Minerals Institute (CMI) Member and have the CMR emailed to you weekly, click here. Check out the new CMI Store — click here!

Trump administration to expand price support for US rare earths projects, sources say (July 31, 2025, Source) – Top White House officials, including trade advisor Peter Navarro, met with tech firms and rare earths companies on July 24 to outline a strategy aimed at rapidly boosting U.S. rare earths production. The administration plans to implement pandemic-style measures, such as guaranteeing minimum prices for rare earth products, to reduce dependence on China. Companies were urged to leverage existing government incentives and encouraged to invest directly in the rare earths sector. Further discussions are expected within four to six weeks to accelerate efforts toward building a domestic supply chain from mining to finished products.

Australia intelligence chief says spies targeting rare earths and Aukus (July 31, 2025, Source) – Australia’s intelligence chief, Mike Burgess, reported that foreign spies are aggressively targeting key sectors, including rare earths, Antarctic research, and the Aukus nuclear submarine pact involving Australia, the US, and the UK. He stated that espionage cost Australia’s economy approximately $8 billion in 2024. ASIO identified China, Russia, and Iran as notably active, citing increased attempts to infiltrate defense industries, academia, and businesses. Recent espionage included theft of defense blueprints and plant varieties. Burgess also highlighted heightened risks from individuals publicly sharing their security clearances online, posing threats to sensitive projects like Aukus.

Tesla signs $4.3 billion LGES battery deal, source says, reducing China reliance (July 30, 2025, Source) – Tesla has signed a $4.3 billion agreement with South Korea’s LG Energy Solution (LGES) to supply lithium iron phosphate (LFP) batteries for energy storage systems. The batteries will be produced at LGES’s Michigan factory, allowing Tesla to reduce its reliance on Chinese suppliers and mitigate U.S. tariff impacts. The contract runs from August 2027 to July 2030, with an option for a seven-year extension. LGES, currently the only major producer of LFP batteries in the U.S., is expanding its storage battery business amid slowing electric vehicle demand and rising global demand driven by data centers.

Trump Just Crashed the Copper Market (July 30, 2025, Source) – U.S. copper futures plunged nearly 20% after President Trump announced a 50% tariff on copper products—such as wire, tubing, and fittings—while excluding raw forms like concentrate, cathodes, and scrap. The tariff, effective August 1, led traders to rush imports, spiking domestic copper prices earlier in July. However, prices fell sharply once the policy was clarified. Major U.S. copper companies like Freeport-McMoRan and Ivanhoe Electric saw stock declines of 9.5% and 17%, respectively. The tariff benefits U.S. manufacturers using copper but does not incentivize domestic mining or smelting, which remains costly and limited in capacity.

Albemarle posts surprise second-quarter profit on lithium demand; shares surge (July 30, 2025, Source) – Albemarle Corporation (NYSE: ALB), the world’s largest lithium producer, reported an unexpected second-quarter profit, driven by sustained lithium demand, particularly from electric vehicles and battery storage. Despite a 7% drop in net sales to $1.33 billion due to lower lithium prices, Albemarle exceeded analysts’ expectations. The company has reduced its planned capital expenditure for 2025 to between $650 million and $750 million and expects positive free cash flow in that year. Albemarle is currently undertaking cost-cutting measures, including job reductions and canceled projects, in response to a significant global decline in lithium prices over the past two years.

America is scrapping green restrictions on cars. It’ll leave Europe in the dust (July 30, 2025, Source) – The U.S. Environmental Protection Agency (EPA) has proposed rescinding federal greenhouse gas emissions standards for vehicles under the Clean Air Act, citing updated scientific assessments and recent Supreme Court rulings. A report from the Department of Energy argues that earlier climate projections were exaggerated and that aggressive mitigation could harm economic welfare. The EPA challenges the legal foundation for regulating CO₂, rooted in the 2007 Massachusetts v. EPA decision. If implemented, this move could significantly weaken U.S. climate policy, especially in the transportation sector, and place Europe’s green mandates at a competitive disadvantage. Public comment is open for 45 days.

US eyes Philippine rare earths to counter China’s ‘chokehold’ (July 30, 2025, Source) – The United States is exploring a potential deal with the Philippines to secure rare earth minerals, aiming to reduce dependence on China amid trade tensions. Philippine reserves of strategic minerals, including scandium in nickel-rich laterite deposits, have largely been exported unprocessed to China, unintentionally aiding China’s dominance in critical technologies. During recent diplomatic meetings, US officials emphasized diversifying supply chains. Experts acknowledge the Philippines’ untapped potential in rare earths but highlight challenges such as insufficient exploration, high costs, and environmental risks associated with mining, suggesting joint US-Philippine cooperation as a potential pathway forward.

Helion Energy starts construction on nuclear fusion plant to power Microsoft data centers (July 30, 2025, Source) – Helion Energy, backed by Sam Altman and SoftBank, has begun construction of a nuclear fusion power plant in Malaga, Washington, aiming to supply electricity to Microsoft data centers by 2028. The project, located near the Columbia River, benefits from existing grid infrastructure tied to the Rock Island Dam. Helion must still obtain final permits but is progressing under a 2023 agreement with Microsoft. The company’s prototype, Polaris, is in Everett, while the new plant, Orion, will connect directly to the grid serving Microsoft. Fusion remains experimental, but Microsoft views it as part of its long-term clean energy strategy.

China to convene gathering in October to discuss next five-year plan (July 30, 2025, Source) – China’s Communist Party will convene its fourth plenary session in October 2025 to discuss the country’s 15th five-year plan (2026–2030), focusing on economic, political, and social priorities amid ongoing tensions with the U.S. The session, involving over 370 Central Committee members, will be held in Beijing before the APEC summit in Seoul. Analysts are watching for shifts in leadership, with at least five committee members expected to be replaced due to corruption investigations or other reasons. The meeting comes amid continued U.S.-China trade and tech rivalry and follows a public consultation on the five-year plan launched in May.

Brazil Moves to Guard Its Critical Minerals as Global Demand Grows (July 29, 2025, Source) – Brazil has launched a new commission to map and control its critical minerals—including lithium, rare earths, cobalt, and nickel—amid rising global demand for clean energy resources. President Lula da Silva emphasized that these resources will remain under national ownership and not be used in trade negotiations, especially as new U.S. tariffs on Brazilian goods take effect. Foreign companies may explore Brazil’s mineral wealth under strict oversight, but sales must go through the government. With lithium exports rising and global supply chains interlinked, Brazil aims to move up the value chain while securing greater control over its mineral assets.

China’s Control Of Supply And Demand Gives Lithium A 20% Boosts (July 29, 2025, Source) – China’s dominance in both electric vehicle (EV) demand and battery material supply has triggered a 20% rebound in lithium prices over the past three weeks, following an 87.5% decline since 2022. Lithium carbonate prices, which fell from $83,500 per ton to $8,500, have recovered to $10,300. Rising EV sales in China, up 32% to 14.6 million vehicles, and tighter Chinese production controls aimed at reducing oversupply, are key factors behind the recovery. Analysts highlight stronger-than-expected global EV sales growth and China’s strategic use of commodities like lithium as potential political bargaining tools influencing market dynamics.

Trump team hears pitches on access to Myanmar’s rare earths (July 28, 2025, Source) – The Trump administration is exploring proposals to secure access to Myanmar’s heavy rare earths—strategic minerals currently processed in China. U.S. officials have received pitches from business lobbyists and advisors advocating either engagement with Myanmar’s ruling junta or direct dealings with the Kachin Independence Army (KIA), which controls key mining areas. Options discussed include easing tariffs, lifting sanctions, and cooperating with India for mineral processing. These talks are preliminary, face major logistical hurdles, and represent a potential shift from longstanding U.S. policy avoiding junta engagement following Myanmar’s 2021 military coup and human rights violations.

Tesla-Samsung $16.5 billion supply deal may spur chipmaker’s US contract business (July 28, 2025, Source) – Tesla has signed a $16.5 billion deal with Samsung Electronics to source AI6 chips from its new factory in Taylor, Texas, aiming to power future self-driving vehicles and Optimus humanoid robots. While production may begin as late as 2027 or 2028, the agreement could boost Samsung’s struggling contract chipmaking business and support U.S. semiconductor manufacturing. Elon Musk emphasized Tesla’s involvement in improving production efficiency. Although the deal is unlikely to impact Tesla’s current EV sales or robotaxi rollout, it signals deeper tech collaboration between a major U.S. automaker and South Korea’s leading chipmaker.

Beijing keeps up rare earths pressure on Trump (July 28, 2025, Source) – China continues restricting rare-earth exports to the U.S., maintaining trade at roughly half of typical levels despite a recent agreement with President Trump. June shipments were 353 tonnes, well below the 622-tonne monthly average from earlier this year, and 52% lower year-on-year. In contrast, Europe and Asia have seen faster recoveries. Trade talks between U.S. Treasury Secretary Scott Bessent and Chinese Vice-Premier He Lifeng, focusing on tariffs, Russian oil purchases, and China’s factory overcapacity, are ongoing. Analysts suggest continued Chinese restrictions could prompt the U.S. and its allies to diversify critical mineral supply chains.

Brazil’s Rare Earth Exports to China Triple, Highlighting Shift Away from U.S. Ties (July 27, 2025, Source) – Brazil’s rare earth exports to China surged to $6.7 million in the first half of 2025—tripling 2024’s full-year total—highlighting a growing shift away from U.S. trade ties. Nearly all of this increase went to China, which now dominates demand for Brazilian rare earths used in high-tech and renewable energy applications. Despite holding the world’s second-largest reserves, Brazil’s production remains limited compared to China. As U.S.-Brazil relations cool amid new tariffs and trade probes, China has deepened its economic footprint in Brazil through investments across mining, technology, and infrastructure, gaining strategic leverage in global supply chains.

InvestorNews.com Media Highlights

- July 30, 2025 – In Rubidium, Hallgarten + Company Detects a Critical Mineral Poised to Upend a Quiet Monopoly https://bit.ly/3UHmTtG

- July 30, 2025 – Every idea has its time – Crypto Capital is coming for commodities https://bit.ly/45aARtb

- July 29, 2025 – Arming the Arsenal: Molybdenum’s Role in U.S. Defense and the Top 10 Global Producers https://bit.ly/4l47v5B

InvestorNews.com Video Highlights

- July 28, 2025 – Volta Metals Aims to Break China’s Gallium Grip with High-Grade Ontario Discovery https://youtu.be/8F0qV2MnLFM

InvestorNews.com Member News

- August 1, 2025 – Anomalous Rare Earth Elements in Smoky Quartz Samples within Quantum’s Quest Property https://bit.ly/45dScRL

- July 31, 2025 – Energy Fuels Announces Appointment of President https://bit.ly/41j6Iqc

- July 31, 2025 – Panther Metals PLC: Winston Tailings Assays https://bit.ly/40IAhBq

- July 31, 2025 – American Rare Earths Limited: Quarterly Activities Report for the Period Ending 30 June 2025 https://bit.ly/4oaAOq1

- July 30, 2025 – Homerun Resources Inc. Appoints Strand Hanson Limited as UK Financial Adviser to Explore Dual Listing on London Stock Exchange https://bit.ly/4odrLEt

- July 30, 2025 – American Tungsten Announces Strategic Advancements in IMA Mine Rehabilitation and Exploration Program https://bit.ly/4oer65S

- July 30, 2025 – Panther Metals PLC – Bitcoin Strategy Update: No Capital Raise https://bit.ly/45guVip

- July 29, 2025 – Quantum Welcomes Karl Haase to its Metallurgy Technical Advisory Committee https://bit.ly/4fwxJg5

- July 29, 2025 – Appia Acquires Two New Auger Drills and Launches New Drill Program at Gaia Target Adjacent to Taygeta and Merope, PCH REE Project, Brazil https://bit.ly/4l5m3lf

- July 29, 2025 – Panther Metals PLC – Obonga Project: Awkward PGE and Nickel Assay Results https://bit.ly/3IRGeWu

- July 28, 2025 – CBLT Announces Reexamined Assay Results from Shatford Lake for Tantalum, Rubidium and Gallium https://bit.ly/3J6wBmR

- July 28, 2025 – Homerun Resources Inc. Receives Joint Support Plan from BNDES and FINEP Indicating Financial Instruments Available to Support Homerun’s Business Plan https://bit.ly/3UwAXpR

- July 28, 2025 – Antimony Resources Corp. (ATMY) (K8J0) Intersects More Massive Antimony-Bearing Stibnite (“Sb”), Assays up to 14.91% Sb over 3.3 Meters Including a Zone of Massive Antimony-Bearing Stibnite Which Returned 34% Sb over One Meter https://bit.ly/4l1IAzB

- July 28, 2025 – Australian Strategic Materials Limited: Successful completion of Institutional Placement to raise A$13M https://bit.ly/4lHBbqe