The Critical Minerals Institute Report (CMI 11.2023): Neodymium price is down 33% over the Past Year, Record Plug-In EV Car Sales for September

Welcome to the November 2023 Critical Minerals Institute (“CMI”) report, designed to keep you up to date on all the latest major news across the critical minerals markets. Here is the CMI list of critical minerals (CMI List of Critical Minerals) or visit the CMI Library where critical minerals expert Alastair Neill tracks the latest critical mineral lists worldwide.

Global macro view

High interest rates (and cost of living increases) in most Western countries continue to be a drag on the global economy. Europe, in particular, continues to struggle. Last month saw a welcome fall in US inflation to 3.2%pa suggesting the US Fed may not need to raise rates at their December 12-13 meeting.

China has been ramping up support for their beaten down property sector and economy. The key hope for 2024 is that China’s property market stabilizes and their economy improves. Some early positive signs are appearing.

The Russia-Ukraine war continues as does the Hamas-Israel war. The outcomes of these conflicts can impact oil prices and hence inflation, meaning they are key events to monitor as we head into 2024.

Global electric vehicle (“EV”) update

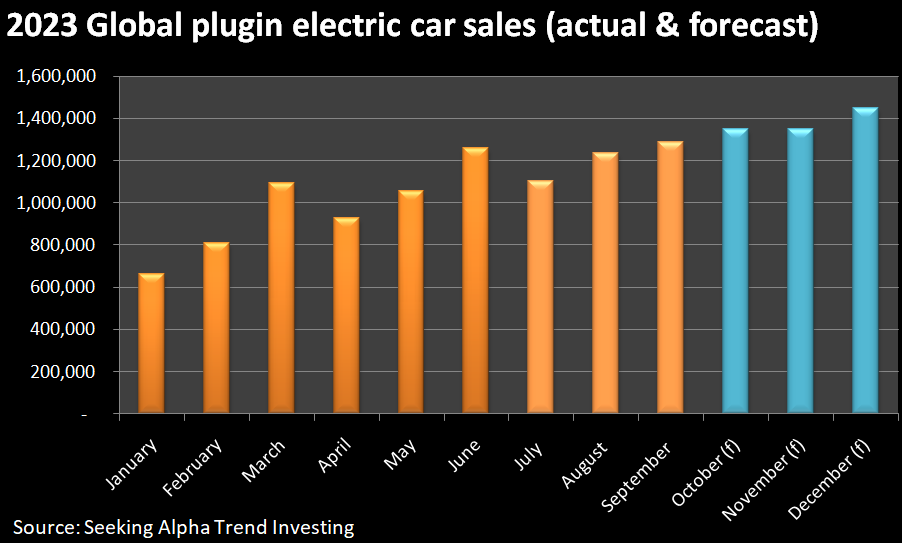

November 2023 saw strong EV sales reported for September 2023. Global plugin electric car sales for September were a record 1,291,000 up 23% YoY to 17% market share.

In September, China sales were up 22% YoY to 37% share. Europe sales were up 15% YoY to 25% share. USA sales were up 59% YoY to 9.9% share.

Results look very promising for October 2023 with global plugin electric car sales on track to reach or exceed ~1.35 million. China’s October sales have been announced and they hit a new record of 956,000 sales.

2023 sales look set to finish at ~13.6 million and 17% market share, which would be a 29% increase on 2022 (10.522 million and 13% market share). A 29% growth rate in 2023 would be a significant slowdown on the 56% growth rate achieved in 2022.

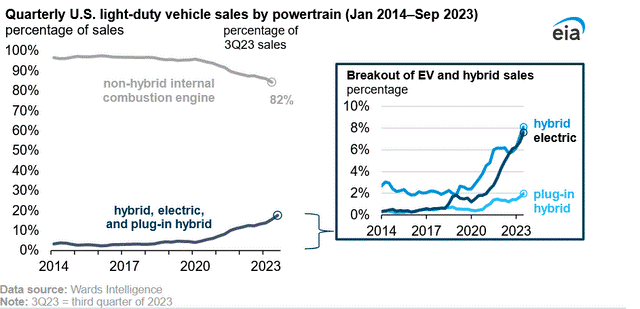

Regarding US Battery Electric Vehicle (“BEV”) car sales, the EIA recently reported that “BEV prices are now within $3,000 of the overall industry average transaction price for light-duty vehicles.”

Global plugin electric car ‘monthly’ sales in 2023 (source)

Finally, reports of a slowdown in US EV demand are ‘fake news’. US electric car sales are achieving record sales in 2023 as we saw in the US Energy Information (“EIA”) announcement on November 27, 2023. The chart below gives a good summary. The fact that Ford Motor Company (NYSE: F) and General Motors (NYSE: GM) are slowing down their EV production plans due to weak EV sales says more about their failure to produce well priced and desirable EVs rather than the US market as a whole. There is a similar situation with Volkswagen AG in Europe. Both BYD Company Limited (OTC: BYDDF) and Tesla Inc. (NASDAQ: TSLA) continue to rapidly expand their production and EV sales. Legacy automakers need to up their game or be left behind by the EV leaders Tesla and BYD who continue to go from strength to strength.

Electric vehicles and hybrids grow to a record-high 18% of U.S. light-duty vehicle sales (source)

Global critical minerals update

Western governments, led by the USA, have continued to ramp up support for a Western EV and battery supply chain. In November we had two key announcements:

- On October 31 The Government of Canada announced: “Government of Canada to enhance critical minerals sector with launch of $1.5 billion Infrastructure Fund…“Our investments will help the mining industry develop important enabling and supporting infrastructure such as roads and energy facilities required prior to construction of mines.”

- On November 15 Energy.gov announced: “Biden-Harris Administration announces $3.5 Billion to strengthen domestic battery manufacturing…As part of President Biden’s Investing in America agenda, the funding will create new, retrofitted, and expanded domestic facilities for battery-grade processed critical minerals, battery precursor materials, battery components, and cell and pack manufacturing…”

These are positive developments, however not enough is being done upstream to support the critical minerals ‘miners’ to get into production. The Canadian Government’s announcement above is reasonably well directed, but it is to be spread over 7 years and is nowhere near enough money for what is needed. The US Government’s effort is further supported on the back of previous announcements as part of the 2022 Inflation Reduction Act (“IRA”) which intends to spend US$369 billion in energy security and climate change programs over ten years. However, most of the funds so far are to support battery manufacturing and EV plants and subsidies. More funds need to be put to use to help support the critical mineral mining companies, particularly as key critical minerals such as lithium is the bottle neck to ramp up western production of EV’s and energy stationary storage.

The IRA has been extremely successful so far at bringing EV and battery investments to the USA. For example, in November we heard a report of yet another US factory being planned with Toyota planning to invest US$8 billion in a North Carolina battery plant to increase EV capacity.

Over in Europe, the EU Critical Raw Materials Act (“CRMA”) has progressed to the next stage with ‘provisional’ agreement achieved, noting the increased focus on recycling. On November 13, the European Union Council announced:

“The Council and the European Parliament today reached a deal on the proposed regulation establishing a framework to ensure a secure and sustainable supply of critical raw materials, better known as the Critical Raw Materials Act. The agreement is provisional, pending formal adoption in both institutions…The political agreement reached today keeps the overall objectives of the original proposal but strengthens several elements. It includes aluminium in the list of strategic and critical materials, reinforces the benchmark of recycling, clarifies the permitting procedure for strategic projects, and requires relevant companies to perform a supply-chain risk assessment on their sourcing of strategic raw materials…On the global stage, the regulation identified measures to diversify imports of critical raw materials ensuring that not more than 65% of the Union’s consumption of each strategic raw material comes from a single third country…The provisional agreement keeps the benchmarks of 10% for extraction of raw materials and 40% for processing but increases the benchmark for recycling to at least 25% of EU’s annual consumption of raw materials…The provisional compromise also unifies the timings of the permit procedure. The total duration of the permit granting process should not exceed 27 months for extraction projects and 15 months for processing and recycling projects…Next steps. The provisional agreement reached with the European Parliament now needs to be endorsed and formally adopted by both institutions.”

Note: Bold emphasis by the author. Synthetic graphite was also added.

In November we did hear some more reports on sodium-ion batteries and how they can help meet the incredible battery demand needed for the green energy transition. Sodium-ion can help around the margin, but it will not replace lithium-ion. Sodium-ion batteries will be used for energy stationary storage and cheap (<US$10,000) low-end, low-range, small EVs. Beyond that, the sodium-ion battery as exists today will have limited demand. CATL is leading the way with sodium-ion battery manufacturing and is one to watch.

On November 25 The Fraser Institute reported:

“A total of 388 new mines must be built to produce the metals required to meet international government mandates for electric vehicle…The International Energy Agency (IEA) suggests that to meet international EV adoption pledges, the world will need 50 new lithium mines by 2030, along with 60 new nickel mines, and 17 new cobalt mines…Historically, however, mining and refining facilities are both slow to develop and are highly uncertain endeavors plagued by regulatory uncertainty and by environmental and regulatory barriers. Lithium production timelines, for example, are approximately 6 to 9 years, while production timelines (from application to production) for nickel are approximately 13 to 18 years, according to the IEA…The risk that mineral and mining production will fall short of projected demand is significant, and could greatly affect the success of various governments’ plans for EV transition.”

Note: Bold emphasis by the author.

Lithium

China lithium carbonate spot prices fell significantly in November 2023, with the price now at CNY 126,500/t (US$ 17,870/t) and down 78% over the past year. At these prices, marginal cost lithium producers in China are shutting down and Albemarle Corporation (NYSE: ALB) and JV partners at the Greenbushes Mine are considering production cuts in H1, 2024. A bottom is likely to form soon at or above CNY 100,000/t assuming global EV sales hold up at current rates of about 30% growth in 2023 and 2024.

Lithium takeovers continue despite weak sentiment

Chile’s SQM recently increased their takeover offer for Azure Minerals Limited (ASX: AZS) to US$900 million. Meanwhile, Mineral Resources Limited (ASX: MIN) has been building an equity stake in Azure Minerals as well as buying a 19.85% equity interest in Wildcat Resources Limited (ASX: WC8), another WA lithium junior miner. Not to be outdone, Australian billionaire Gina Reinhart has recently bought a 19% interest in Azure Minerals. Reinhart was active in buying Liontown Resources Limited (ASX: LTR), ultimately leading Albemarle to withdraw their takeover offer.

At least it looks like the Allkem-Livent merger is still going ahead. Allkem Limited (ASX: AKE) and Livent Corporation (NYSE: LTHM) have received all required regulatory approvals globally for their ‘merger of equals’, expected to close by January 4, 2024.

All of this takeover activity from the major lithium companies suggests that we are near a bottom in the lithium price cycle and that the mid to long-term outlook for lithium remains very strong.

Rare Earths

Neodymium (“Nd”) prices fell in November and are currently sitting at CNY 610,000/t. The neodymium price is down 33% over the past year, but still well above the 2019 price.

Neodymium 5 year price chart (source)

On November 16 Rare Element Resources Ltd. (OTCQB: REEMF) announced receipt of the final NEPA approval for their rare earth processing and separation demonstration plant to be built in Upton, Wyoming, USA. The news stated: “The Company is awaiting next stage budget approval from the DOE, which is providing approximately 50% of the project costs, to commence construction.”

Cobalt, Graphite, Nickel, Manganese and other critical minerals

Cobalt prices (currently at US$14.85/lb) remained flat the past month and continue to be very depressed. China’s demand for NMC cathode material for EVs has been weak as LFP cathodes (no nickel or cobalt) have gained in popularity.

Flake graphite prices also remain very weak with prices near the marginal cost of production. The big news in the graphite world is China’s intention to temporarily enforce export license permits on three synthetic graphite-related items and six natural graphite-related items, starting from December 1, 2023. As a result, we have seen some buying activity and flake graphite prices rising in Europe.

Nickel prices fell further to US$16,593/t in November due to oversupply concerns from Indonesia and the depressed Chinese property sector.

Manganese prices also fell slightly in November.