Turbulence in global titanium supply

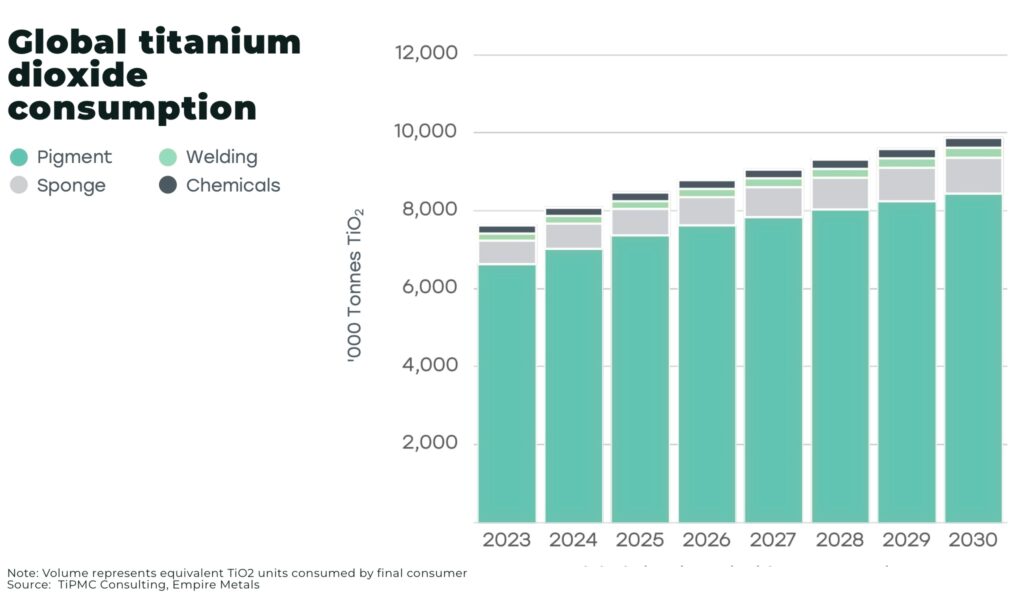

Titanium, prized for its strength and versatility, is essential across advanced defense, aerospace, automotive, medical, and industrial sectors. From everyday pigments to jet engines, the titanium dioxide (TiO₂) market was valued at US$24 billion in 2024, with a projected CAGR of 3.7% from 2023-2030.

The US, EU, UK, Canada, Australia and Japan all classify titanium as a critical mineral.

The titanium market now faces supply disruptions and regional deficits as geopolitical challenges and rising defense industry demands increase pressure. Growth in Chinese dominance of global pigment markets has also driven supply deficits of high value titanium dioxide minerals such as rutile. The largest global producers of titanium metal and pigments are feeling the strain—creating a clear market opportunity for new entrants and strategic investments in new long-term sources of titanium feedstocks.

What is titanium

Titanium is as strong as steel but 40% lighter, providing an impressive strength-to-weight ratio; it also has excellent corrosion resistance, a high melting-point, and is non-toxic. Its principal application is as a pigment found in everyday paints, plastics and coatings and 7% of global demand relates to titanium metal where it is a critical material to the defense, aerospace and medical sectors.

To put the importance of titanium to the defense sector in context, consider the F-22 air superiority fighter. Generally considered the best fighter in the world, it uses more titanium than any other US Air Force aircraft, over 9,000 lb, or approximately 42% by weight.

Ilmenite and rutile, currently the principal titanium-bearing ore minerals, are processed to remove impurities and separate the titanium dioxide (TiO₂). TiO2 is predominantly used in pigments (91% of global demand) used to provide opacity in paints, plastics, paper, etc; or converted into titanium tetrachloride (TiCl₄), which is then reduced via the energy-intensive Kroll process to produce titanium sponge. Titanium metal (7% global demand) is used across:

- aerospace: titanium is crucial to the manufacture of aircraft frames, engines (including compressor blades), landing gears, etc due to its light-weight strength and heat tolerance. Example: titanium accounts for 15% of a Boeing Dreamliner’s weight, using about 50 tons for each plane

- defense: as well as aircraft, titanium is used across a range of naval and military applications, armour and missile casings

- medical: titanium is non-toxic, making is ideal for medical implants such as orthopedic implants (eg: joint replacements), dental implants, surgical instruments, prosthetics, heart stents, and spinal rods, due to its biocompatibility and corrosion resistance

- automotive: titanium is increasingly used in high-performance components such as exhaust systems, drive shafts, steering mechanisms, valve springs, and connecting rods to improve speed, efficiency, and reduce weight

- industry and chemical processing: titanium’s corrosion resistance is deployed in reactors, heat exchangers, and piping systems, particularly when handling corrosive chemicals

Demand

The global titanium dioxide market is forecast to be worth more than US$33 billion by 2030, fueled by global industrial and GDP growth.

The main drivers of titanium metal demand include:

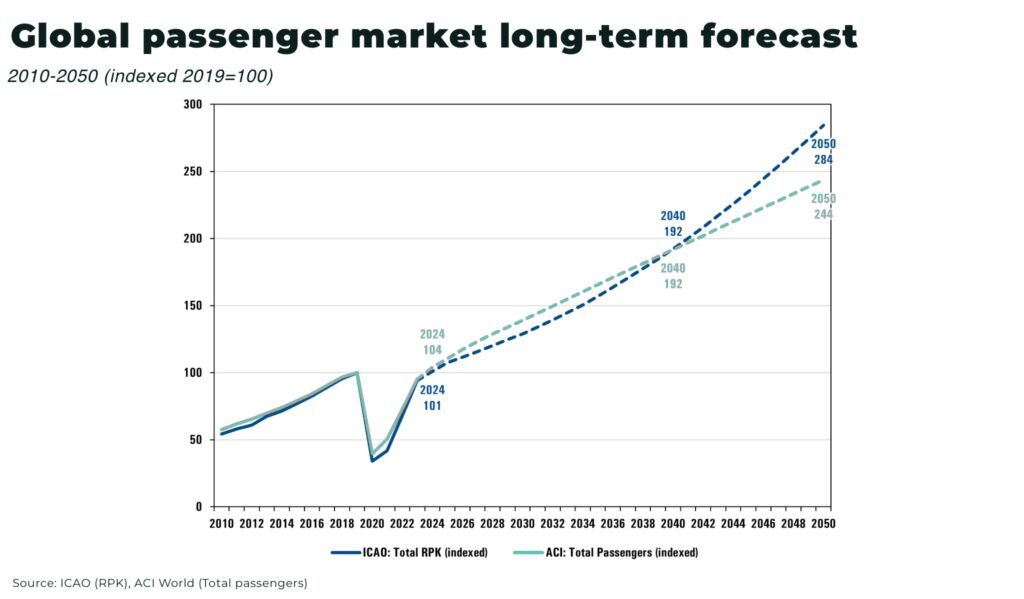

- aerospace: global passenger traffic is projected to surpass 10 billion passengers in 2025, according to electronic payments company ACI World. That figure is up 6% from 2024 and up more than 16% from 2019

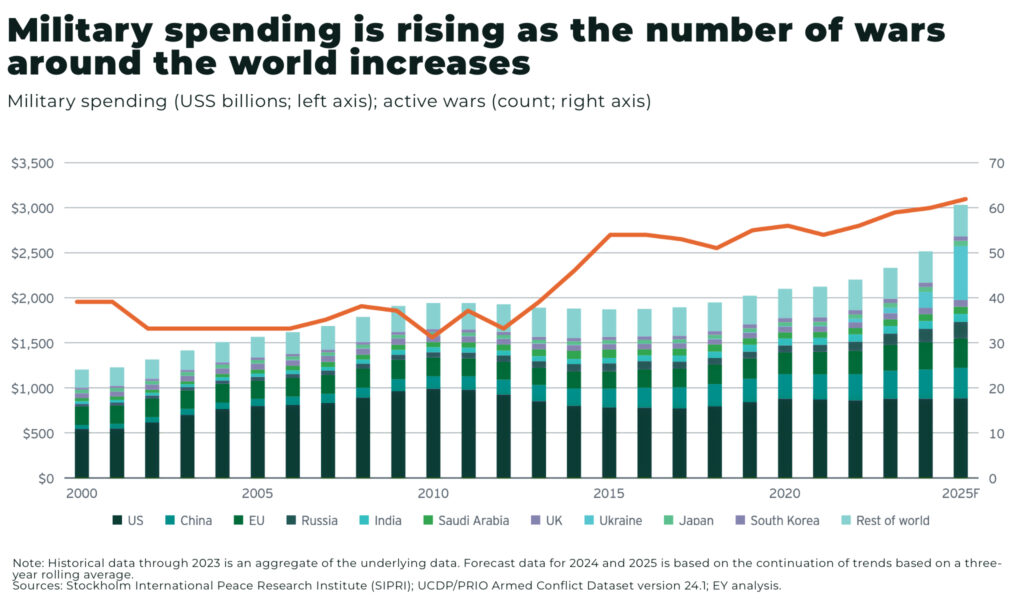

- defense: global defense spending hit US$2.46 trillion in 2024 — with the 7.4% real-terms increase outpacing increases of 6.5% in 2023 and 3.5% in 2022 — and is expected to increase further in 2025 as geopolitical tensions continue to rise

New technological breakthroughs, such as Japanese solar panel technology that promises to boost efficiency by x1000 by layering titanium and selenium in photovoltaic cells, may also drive up demand over the next decade.

China and titanium supply

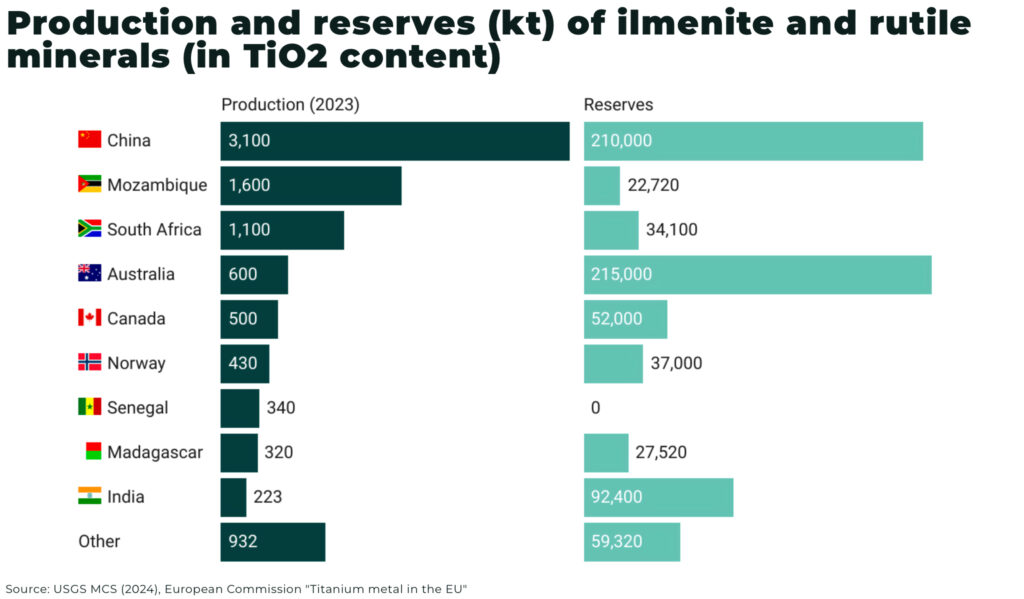

The countries with the highest production of primary titanium minerals, ilmenite and rutile, are China (34%), Mozambique (17.5%) and South Africa, while the most abundant reserves are found in Australia, China, and India.

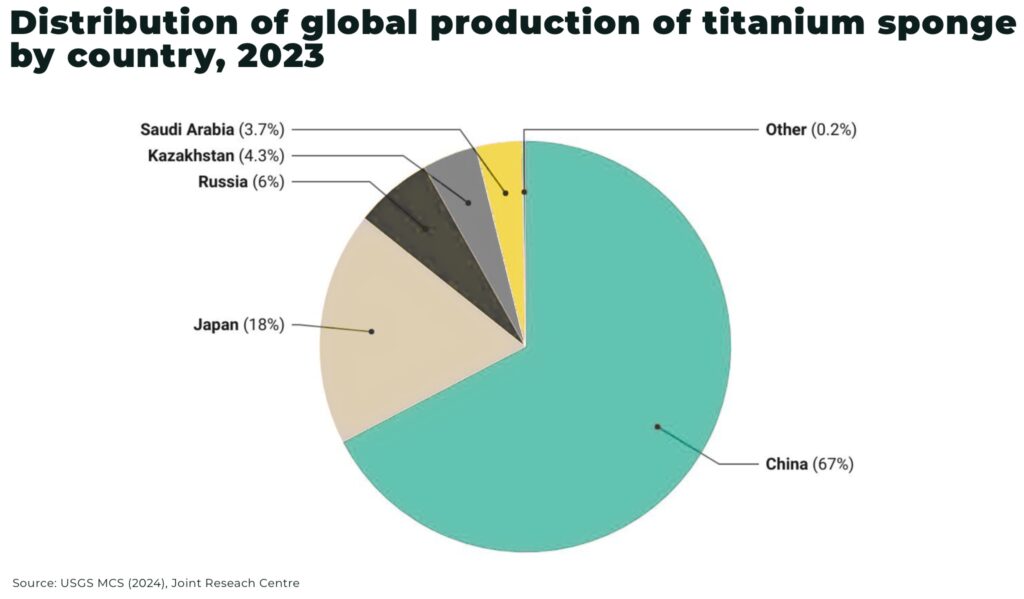

China has come to dominate the global titanium sponge industry with a remarkable expansion of its production capacity since 2018, increasing x3 between 2018-2023, from a 37% share of global output in 2018 to 66% in 2023. China also has the second largest titanium ore resources in the world — although, it should be noted, the majority of titanium sponge from China is not qualified for aerospace.

China is increasingly dominant as a TiO₂ pigment producer, putting pressure on global TiO₂ supply chains.

China primarily produces sulphate-process TiO₂ pigment, while Western manufacturers favor the chloride process, which requires higher-purity feedstocks like natural rutile and high-grade chloride ilmenite. This shift has sparked a surge in global demand for these premium raw materials — but supply is struggling to keep pace and reserves are depleting. As a result, feedstock costs are rising, putting pressure on chloride pigment producers and creating a significant opportunity for innovative, high-grade TiO₂ feedstock suppliers to disrupt the market.

Titanium supply crisis for the West

As demand for titanium metal surges, so too has the US and EU’s exposure to supply vulnerabilities, for example:

- there is only one titanium sponge producer in the US, a facility in Utah with an estimated production capacity of 500 tons per year (although actual production data is withheld to avoid disclosing company proprietary data)

- the EU does not produce titanium sponge and is 100% reliant on imports

Highlighting the importance and vulnerability of the West’s titanium supply, Western sanctions have not targeted titanium exports from Russia (since the invasion of Ukraine), worth an estimated US$345 million worth of titanium exported in 2023 alone.

China’s increasing implementation of export restrictions across a range of critical minerals, from tungsten to antimony, gallium to germanium, has raised alarms about potential future restrictions on titanium.

Bob Wetherbee, president of Dallas-based ATI Inc. (NYSE: ATI), one of the three big producers of US titanium metal, recently told the Washington Post that he believed all of the American titanium producers had seen demand double, but that “the lack of action is having an impact on national security.”

The EU has no domestic production capacity of titanium sponge and is therefore a net importer of titanium metal, with an import-to-export ratio of 10:1. In particular, supply from high-quality deposits in Ukraine have been disrupted due to the war.

Mining opportunities

In 2025, the US Department of Defense (DoD) awarded IperionX (NASDAQ: IPX | ASX: IPX) US$47.1 million in funding to develop a fully-integrated domestic mineral-to-metal titanium supply chain. This is further to a previous DoD award in 2023 of US$12.7 million to increase titanium powder production for defense supply chains.

The renewed interest comes as President Donald Trump signed an executive order invoking cold war era powers to ramp up critical mineral production across the US — and it’s expected titanium will be prioritized.

However, it’s unlikely that any new supply from the US will be enough by itself in the short-term, providing opportunities for potential supply from mines in jurisdictions with free trade agreements and strong historical alliances with America.

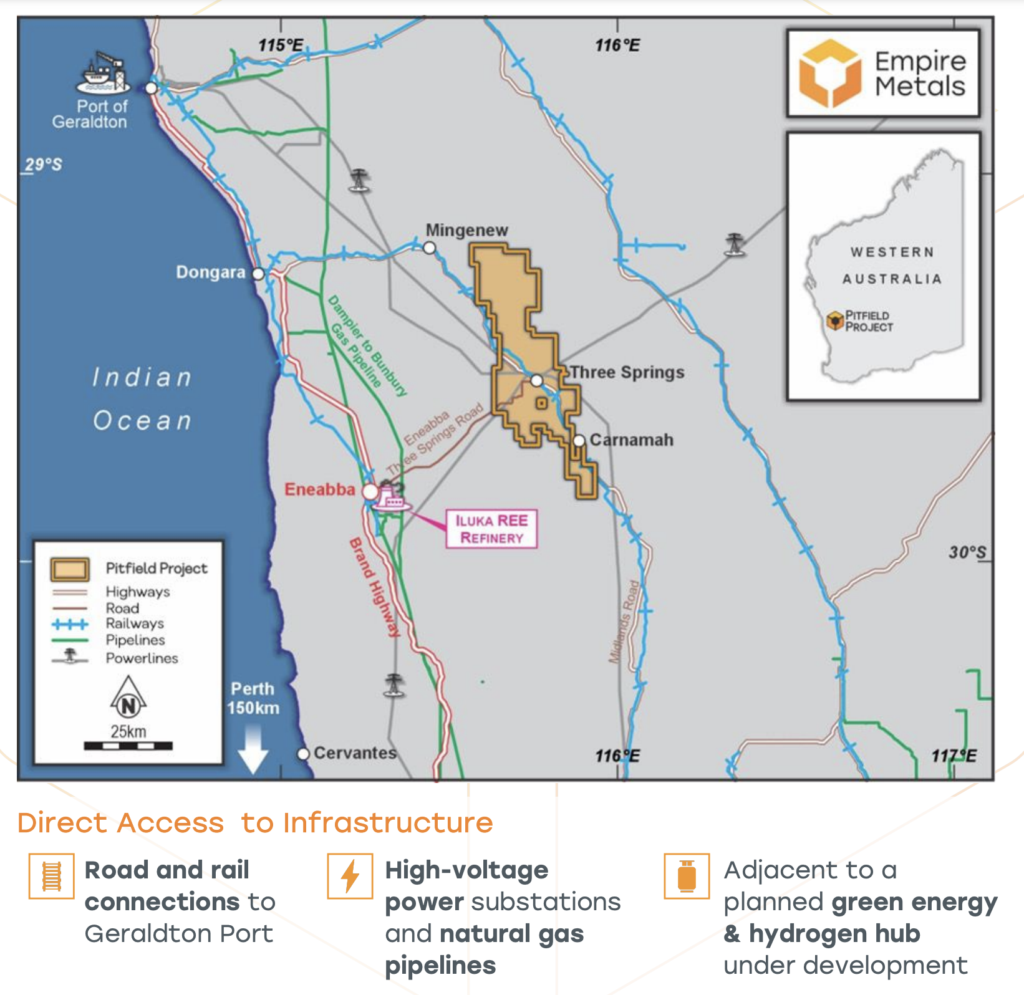

Empire Metals Limited (LON: EEE | OTCQB: EPMLF) is accelerating the economic development of its flagship Pitfield project, a world-class, district-scale titanium mineral system in Western Australia, which extends over 40km x 8km x 5km deep making it the largest known titanium discovery in the world.

The company’s initial focus is on two key prospects, Cosgrove and Thomas, which have been identified as having thick, high-grade, near-surface, bedded TiO₂ mineralisation, each being over 7km in strike length.

A JORC Exploration Target* for Pitfield was declared in 2024, covering the two initial prospects, and was estimated to contain between 26.4 to 32.2 billion tonnes with a grade range of 4.5 to 5.5% TiO2. Included within the total Exploration Target* is a subset that covers the weathered sandstone zone, which extends from surface to an average vertical depth of 30m to 40m and is estimated to contain between 4.0 to 4.9 billion tonnes with a grade range of 4.8 to 5.9% TiO2.

*The potential quantity and grade of the Exploration Target is conceptual in nature. There has been insufficient exploration to estimate a Mineral Resource and it is uncertain if further exploration will result in the estimation of a Mineral Resource.

The Exploration Target* covers an area less than 20% of the overall mineral system at Pitfield which demonstrates the potential for significant further upside.

Preliminary testwork has delivered a high-purity TiO2 product, which assayed at 91.6% TiO2 and was entirely free of any deleterious impurities, providing strong potential for its use in high-quality titanium sponge metal or high-grade titanium dioxide pigment production.

The project is located in Australia’s mid-West, a Tier One mining jurisdiction with direct access to critical infrastructure:

- existing road/rail network

- proximity to Geraldton Port (150km)

- low-energy processing advantages from weathered cap mineralization (30–40m depth)

Metallurgical bulk sampling has been completed and up-scaled metallurgical testing is underway ahead of the design of a larger metallurgical test facility, slated for 2025. Empire is focused on accelerating the economic development of Pitfield, with a vision to produce a high-value titanium metal or pigment quality product at Pitfield, to realise the full value potential of this exceptional deposit.

Toho Titanium Co (TYO: 5727): a leading Japanese titanium producer, Toho Titanium has been at the forefront of innovation since 1948. With a production capacity of 12,000 tons/year of titanium sponge and 7,800 tons/year of titanium ingots, Toho is well-positioned to meet growing global demand. Their recent expansion into Saudi Arabia and continuous technological advancements make them a key player in the titanium market.

Osaka Titanium Technologies Co (TYO: 5726): the world’s second-largest producer of titanium sponge, Osaka Titanium Technologies is a crucial supplier to the global aerospace industry. Their diversified product portfolio, including high-purity titanium and innovative materials like TILOP (Gas-atomized titanium powder), demonstrates their commitment to meeting evolving market needs. With a strong foundation in the Sumitomo Group, Osaka Titanium is poised for continued growth in the titanium sector.

IperionX (NASDAQ: IPX | ASX: IPX): this innovative company is revolutionizing the titanium industry with its breakthrough technologies. IperionX’s proprietary processes eliminate the need for titanium metal sponge and ingot, enabling direct manufacturing of titanium products. With recent funding from the US Department of Defense totaling US$59.8 million, IperionX is set to develop a fully integrated domestic mineral-to-metal titanium supply chain, addressing critical supply vulnerabilities in the West.

Tronox (NYSE: TROX): a leading integrated manufacturer of titanium dioxide pigment, Tronox offers a vertically integrated platform spanning from mine to pigment. Their global operations and focus on sustainability position them as a reliable supplier in the TiO2 market.

Iluka Resources (ASX: ILU): with a strong presence in mineral sands and rare earths, Iluka is a key player in the titanium feedstock industry. Their recent strategic shifts and investments in high-grade deposits underscore their commitment to meeting growing titanium demand.

Kenmare Resources (LON: KMR): is one of the world’s largest producers of titanium minerals with its world-class Moma Titanium Minerals Mine in Mozambique and, in March 2025, rejected a €565m takeover bid from a consortium led by its former MD Michael Carvill. Their strategic position and high-quality mineral deposits make them an attractive investment in the titanium sector.

Sovereign Metals (LON: SVML): with its Kasiya rutile project in Malawi, touted as the world’s largest undeveloped rutile deposit (17.9Mt contained rutile), which is the purest, highest-grade form of titanium feedstock found in nature, Sovereign Metals has the potential to become a significant player in the titanium feedstock market. Their focus on sustainable, low-cost production methods adds to their appeal.

Conclusion

The global titanium market faces intensifying supply-demand tensions as structural deficits emerge across aerospace, defense, and green technology sectors.

These strategic vulnerabilities are accelerating industry realignments at an unprecedented pace. Trump’s latest tariffs underscore how swiftly geopolitical tensions are reshaping markets and supply chains — and when military capabilities are jeopardized by weaknesses in critical mineral supplies, investment inevitably follows.