Will the magnet rare earths prices rise in 2024?

Today we take a look at the magnetic rare earths sector and two leading rare earth companies and what we can expect in 2024 and beyond.

The magnet rare earths prices have fallen in 2022 and 2023

The magnet rare earths sector was hit hard in 2023 with China’s Neodymium (Nd), Praseodymium (Pr), and Dysprosium (Dy) prices falling as the global economy and EV demand slowed.

Neodymium prices came crashing down in 2022 and 2023 as demand slowed after the 2021 growth rate boom in EV sales – Now at CNY 530,000/t

Source: Trading Economics

Global plugin electric car sales grew by 108% in 2021 causing a huge spike in EV metal prices. Then in 2022, the growth rate slowed to 56% at a time when supply of most EV metals surged. Finally in 2023, the growth rate slowed further to an estimated 28%, resulting in further price decline for the magnet metals such as neodymium.

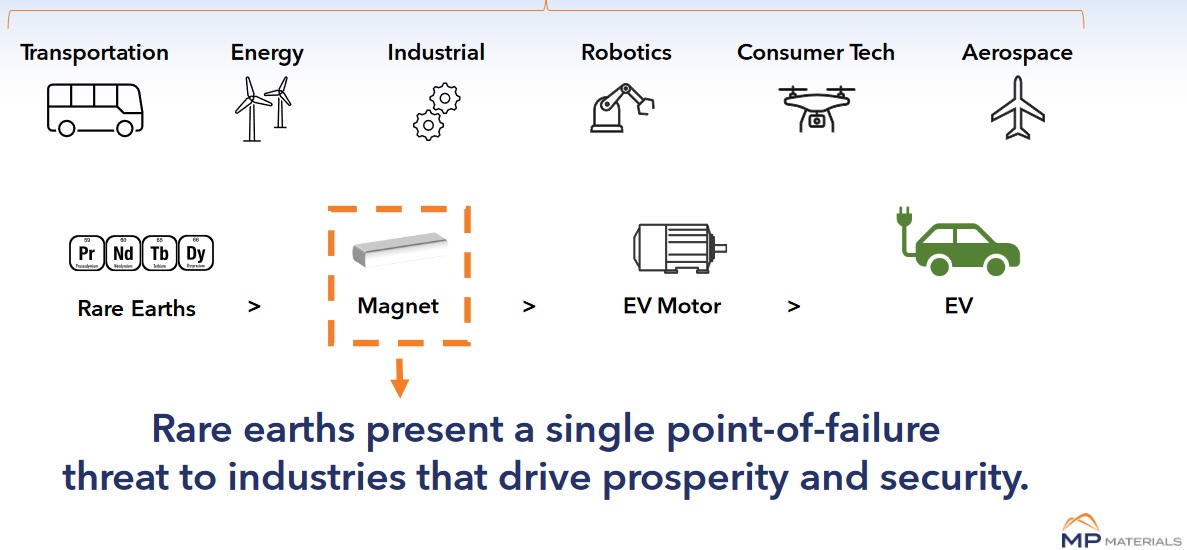

Demand for the magnet rare earths in electric motors is driven by multiple sources with electric vehicle sales being a key driver. (90% of EV motors use rare earth magnets)

Source: MP Materials company presentation

Will the magnet rare earths prices rise in 2024?

The answer to this question will largely depend on recovery in China and the global economy driving increased demand for EVs, wind turbines, and other magnets used in various industrial applications. Given the most recent trend globally has been towards future interest rate decreases (notably in the USA and China), it bodes well for a recovering consumer and hence demand. This may take a good part of 2024 to flow through with excess inventories across many sectors still needing to be worked off. If we get a strong pickup in EV demand (>40% YoY increase) in 2024, then the magnet rare earths sector woes could soon disappear.

China’s December 2023 EV sales give some hope as they jumped to a record 945,000 units, achieving a superb 47% YoY growth rate.

Lynas Rare Earths Ltd. (ASX: LYC) (“Lynas”) update

The big recent Lynas news (announced December 7, 2023) is that the first feed of material from the Mt Weld Mine has been introduced into the new Kalgoorlie Rare Earths Processing Facility in Western Australia, leading to first production and ramp-up of the Facility. A great achievement for Lynas, especially given that the Kalgoorlie Rare Earths Processing Facility is Australia’s first value-added rare earths processing facility. Lynas stated:

The Lynas Malaysia plant is currently shutdown as works to increase downstream processing capacity are completed. Production will recommence in January 2024. Mixed Rare Earth Carbonate (MREC) from the Kalgoorlie Rare Earth Processing Facility will be progressively introduced to the Lynas Malaysia plant commencing late in the March quarter and increasing as the controlled ramp up of the Kalgoorlie facility is progressed.…“

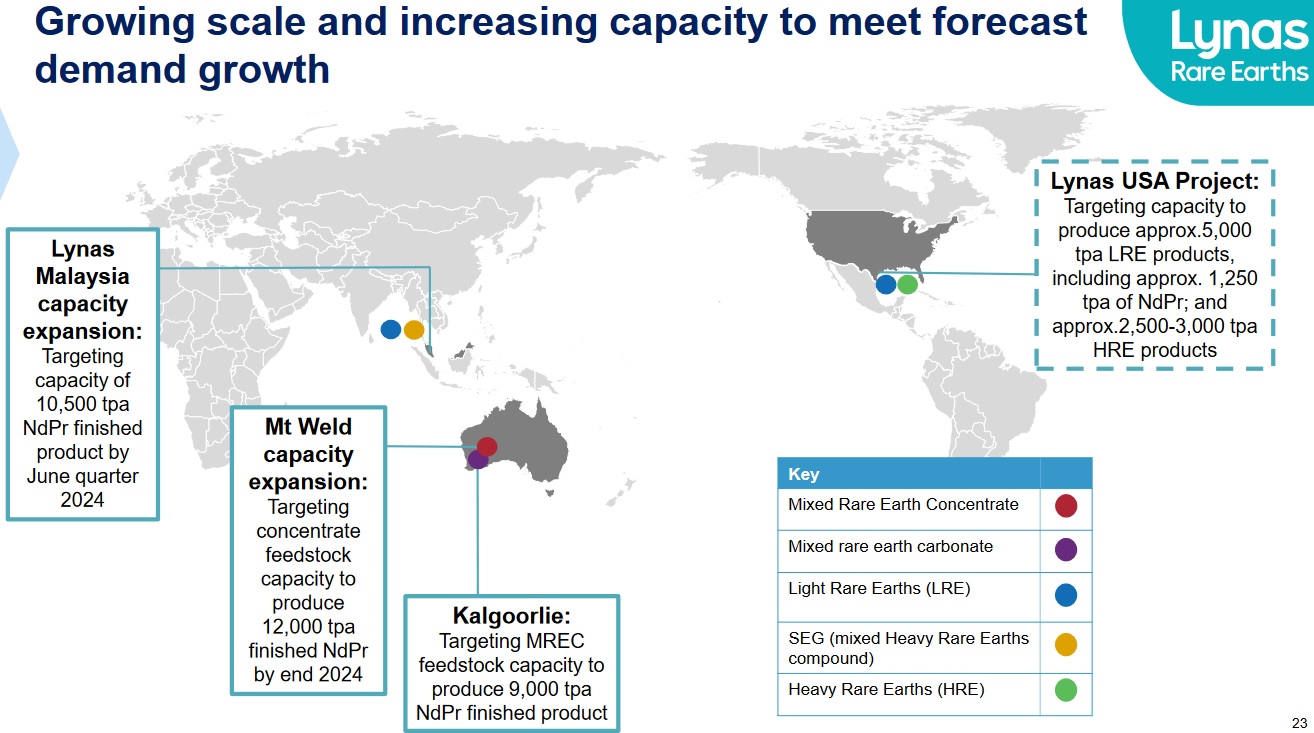

Once their expansions are completed, Lynas intend to increase their production capacity to 10,500tpa NdPr (Neodymium-Praseodymium). Lynas produced 6,142t of NdPr in FY 2023.

2024 will see the Mt Weld Mine expansion and further work on Lynas’ US Rare Earths Processing Facility Project targeted to be operational by July 2025 – June 2026.

Lynas is expanding its rare earths mining and processing capabilities through to 2025/26

Source: Lynas company presentation

MP Materials Corp. (NYSE: MP) (“MP Materials”) update

MP Materials owns and operates the Mountain Pass Rare Earth Mine and Processing Facility in California, USA. In the past MP Materials had to ship their concentrate to China for processing; however, they have a target to bring this back to the USA.

Their target is to grow their mine output by 50% over the next four years and to build separation capacity in the USA with annual production of 6,000 tpa NdPr oxide. The third stage of their plan is to build a greenfield production facility in Texas targeting ~1,000tpa of finished NdFeB (Neodymium Iron Boron) magnets. They already have General Motors (NYSE: GM) as a foundational customer.

MP Materials is working towards Stage II and Stage III of their plan to bring rare earths processing and magnets production to the USA

Source: MP Materials company presentation

Closing remarks

2024 should see a year of consolidation for the rare earths sector as some experts are telling me. Some forecasts are for NdPr supply deficit to begin as early as 2024; however, this will largely depend on China demand, the global economy, EV sales, and new NdPr supply hitting the market.

The two Western magnet rare earths leaders Lynas and MP Materials (and some other key players) are progressing their plans to further build a western supply chain and should be largely complete within the next 2-4 years if it goes to plan. This all supports the building of an end-to-end Western rare earths and magnets sector this decade. Stay tuned.