With plans to become a significant producer of the magnet rare earths, Defense Metals deserves a deeper dive

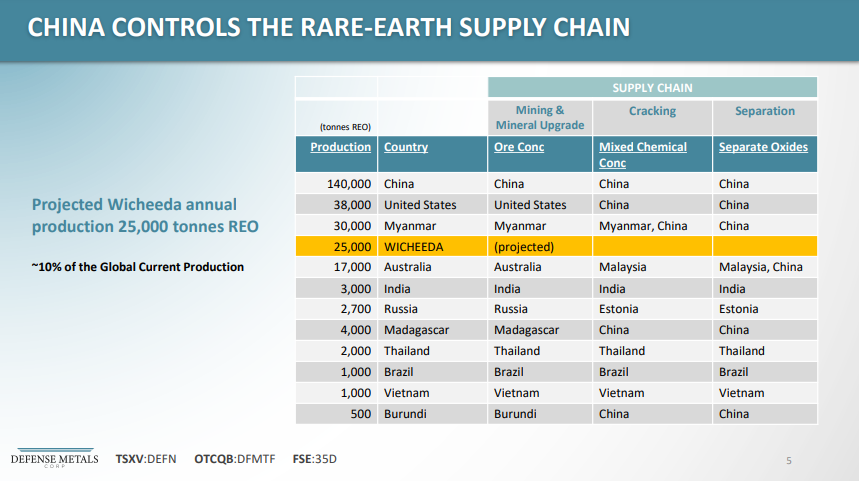

The Wicheeda Project plans to produce 25,000tpa of REO which represents ~10% of the current global production

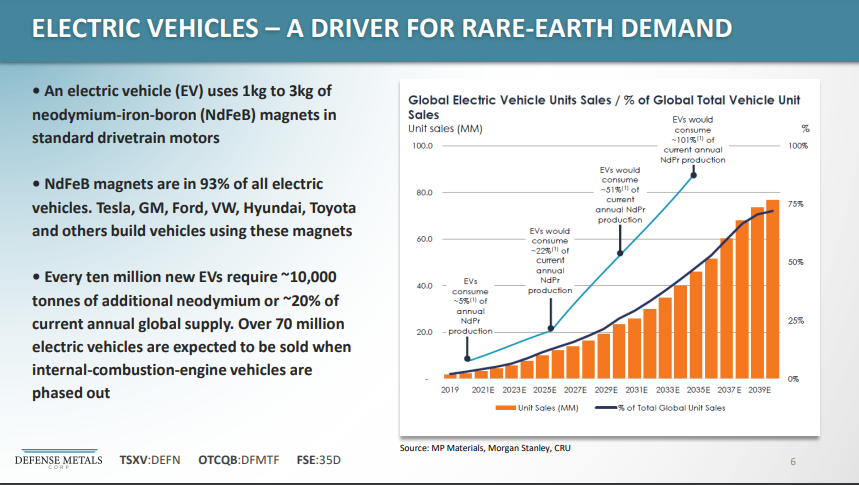

Magnet rare earths demand is forecast to surge this decade. This is because an electric vehicle (“EV”) uses 1kg to 3kg of neodymium–iron–boron (“NdFeB”) magnets in standard drivetrain electric motors. NdFeB magnets are in 93% of all EVs. Global demand for EVs is expected to grow from 6.75 million in 2021 to over 70 million by (or before) 2040. This will require huge amounts of neodymium.

Every ten million new EVs require ~10,000 tonnes of additional neodymium or ~20% of the current annual global supply

The key problem for the EV industry is where will the new magnet rare earths supply come from and can the West become independent from Chinese supply. Today’s company is working towards a solution.

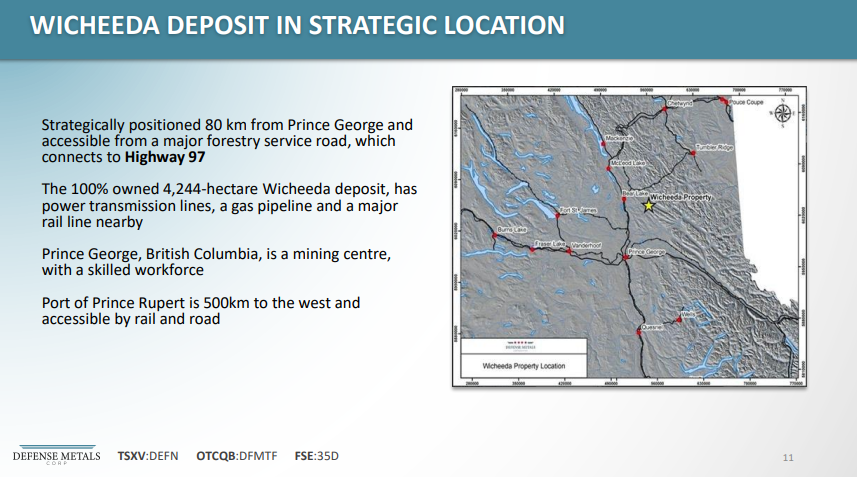

Defense Metals Corp. (TSXV: DEFN | OTCQB: DFMTF | Frankfurt: 35D) (‘Defense Metals’) plans to become a significant producer of the magnet rare earths neodymium and praseodymium from their 100% owned Wicheeda Rare Earth Element Project spread over 4,244 hectares and located 80 km northeast of Prince George, British Columbia, Canada.

Brought to my attention a few dozen times over the last 2-years, I am fond of Dr William Bird, Director – who is deemed a leader in understanding rare earths in our sector; and likewise, President & Director Luisa Moreno who has at least 10,000 professional hours in this sector by now I suspect. With a PhD in Materials Science and Mechanics, this is the theme we are stressing at the Critical Minerals Summit on Wednesday, November 9th and that is the scarcity of talented professionals with both the experience and education to tackle the formidable task of creating a decarbonized economy.

The Project has an Indicated Mineral Resource of 5 million tonnes averaging 2.95% LREO (“Light Rare Earth Oxide”), and an Inferred Mineral Resource of 29.5 million tonnes averaging 1.83% LREO. Key rare earths contained include neodymium (Nd) and praseodymium (Pd), as well as cerium (Ce) and lanthanum (La). The Resource is amenable to an open pit project and contains a mix of monazite and bastnaesite ore.

Some of the best drill results to date at the Wicheeda Rare Earth Element Project include:

- WI21-49 – 3.79% Total Rare Earth Oxide (“TREO”) over 150 Metres

- WI21-54 – 3.81% TREO over 117 metres.

- I21-58 – 3.09% TREO over 251 metres.

- WI21-59 – 2.76% TREO over 212 metres.

Strong PEA result with a NPV8% of C$517 million

The Wicheeda Project PEA (Jan. 2022) resulted in a post–tax NPV8% of C$517 million and a post-tax IRR of 18%, using a price assumption of US$100/kg NdPr. Initial CapEx is estimated at C$440 million.

Once in production Defense Metals targets to produce 25,423tpa of REO over a 16 year mine life, which would make the company a globally significant rare earths producer with ~10% of the current global production.

The Wicheeda Project plans to produce ~25,000tpa of REO which represents ~10% of the current global production

The Wicheeda Project is accessible by a major forestry road that connects to a highway, with the town of Prince George 80kms away. Power lines and a gas pipeline are <40kms away and a major rail line is nearby.

Next steps for Defense Metals include a PFS to be completed in H1 2023, a pilot plant in 2024, and a FS completed in 2025.

The Wicheeda Project location map and key points showing adequate road access and reasonable local infrastructure including access to power and gas <40kms away

Given the size and quality of the resource, safe location in Canada (with forestry road access, power & gas not too far away) and strong fundamentals supporting key magnet rare earths demand this decade; most investors would agree Defense Metals is worthy of a deeper look. Defense Metals current market cap is C$44 million.