Neo’s Real Line: Breaking China’s Hold on Heavy Rare Earths

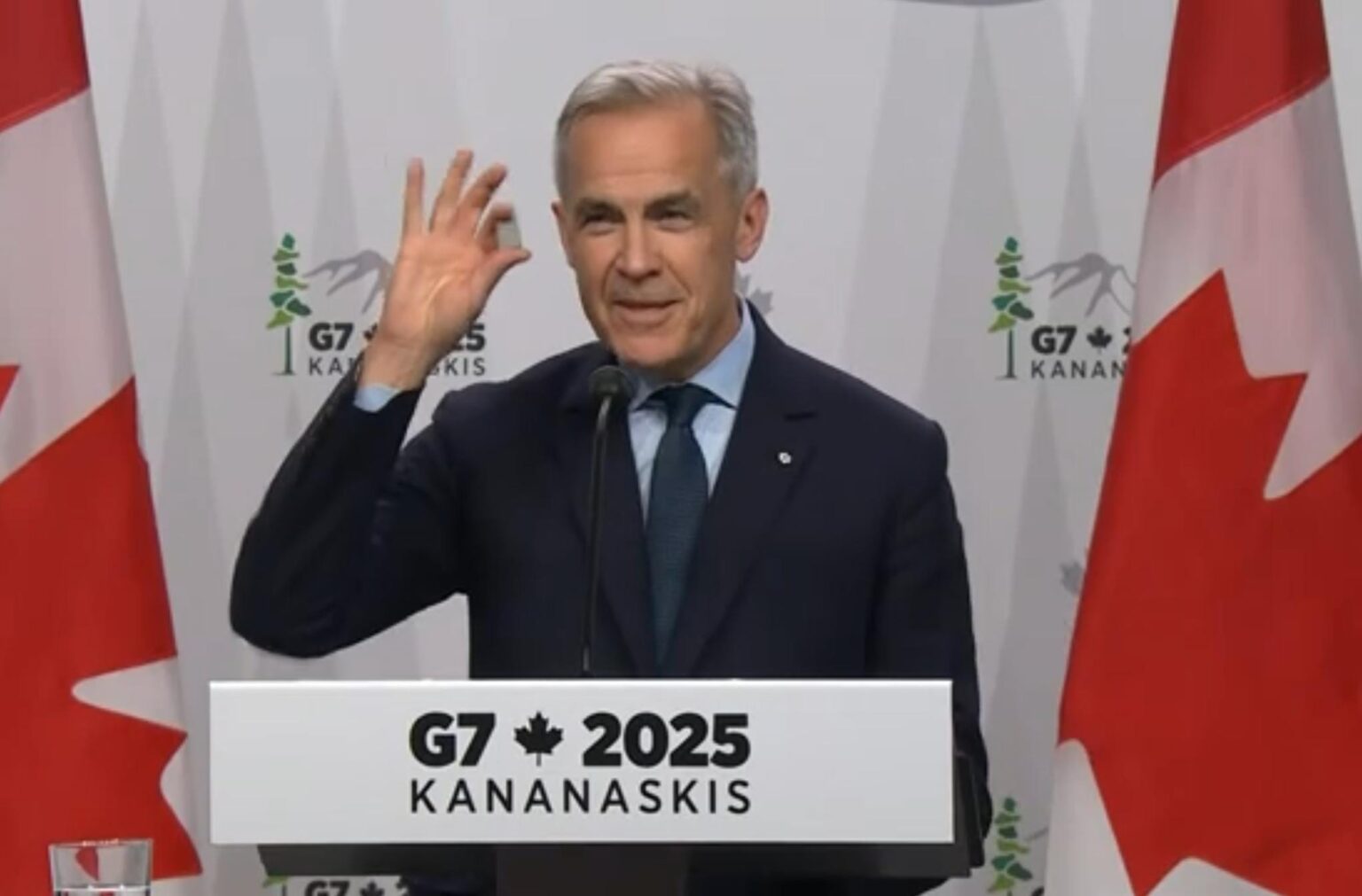

August 20, 2025 — “Neo’s had a very good run, but it’s just the beginning.” Rahim Suleman, the measured President and CEO of Neo Performance Materials Inc. (TSX: NEO | OTCQX: NOPMF), is not a man given to hyperbole. But when the leader of a 30-year-old company that has quietly supplied the building blocks of modern technology suddenly finds his magnets held aloft at the G7 Summit by Ursula von der Leyen and Canadian Prime Minister Mark Carney, even understatement takes on a charge.

Neo is not a story of sudden discovery or speculative frenzy. Headquartered in Toronto, with factories in Germany, Estonia, China, and beyond, the company makes the powders, magnets, alloys, and chemicals that hum inside wind turbines, hybrid vehicles, robotics, and server farms. Its products are both invisible and indispensable. This past year, Neo’s stock rose nearly 169%, the company raised its dividend, and quarterly profits surged 42%. Yet Suleman insists the company’s transformation is only starting. “It’s hard to say it’s just the beginning after 30 years,” he told me, “but I do feel it is really just the beginning of what rare earth magnetics in the Western world is going to look like.”

The timing is fortuitous. For decades, rare earth supply chains have been dominated by China. Neo, with its deep technical history and operating scale, now finds itself one of the only firms capable of producing rare earth magnets outside that system. In Estonia, its new sintered magnet plant has begun with capacity for 2,000 tons annually, with plans to expand to 5,000 tons and eventually 20,000 tons. “That was always the intention,” Suleman said, leaning forward. “We’re putting the pedal to the floor because we see more and more good things happening.”

Part of what makes Neo unusual is its ability to handle heavy rare earths — the scarce, expensive cousins of the lighter elements that give magnets their staying power. “One to two percent of a magnet is heavy rare earths,” Suleman explained. “It’s small, but it is scarce and it is hard to come by. Neo has a very unique history in the ability to process and separate heavy rare earths — one of the only companies in the world that can do it outside of China.” In Estonia, Neo is constructing a pilot production line for dysprosium and terbium, which could one day become a full commercial facility. “It’s not a lab-scale line,” he added pointedly. “It’s a real line.”

Neo has also taken a contrarian path by reducing dependence on those very materials. In partnership with Daido and Honda, it developed the world’s first heavy rare earth–free traction motor for hybrid vehicles. “We are the only company in the world that has this type of technology and product actually on an automotive platform today,” Suleman said. Already in its fourth generation, the motor reflects Neo’s engineering culture: pragmatic, long-view, oriented to execution.

Execution has been the watchword of Neo’s recent quarters. In its second-quarter 2025 results, the company reported revenue of $114.7 million and Adjusted EBITDA of $19 million, up sharply from a year earlier, prompting management to raise full-year guidance to as much as $68 million. Volumes at its Magnequench division grew more than 30%, while its Chemicals & Oxides segment doubled EBITDA. The Rare Metals division delivered strong results in hafnium and gallium, niche but critical materials increasingly shaped by geopolitics. “Winning business is no longer the thing that keeps us up at night,” Suleman said. “The phones are ringing off the hook with customers looking for a localized supply chain and a rare earth magnet solution from someone experienced in this business.”

That credibility is what caught the attention of global leaders. At the G7, von der Leyen produced a Neo Performance Materials magnet as evidence that the West can still build the core technologies of the energy transition. Carney, too, brandished a Neo Performance Materials component in front of cameras. For Suleman, the recognition was humbling but also clarifying. “It was the story of the development of critical materials and the development of Neo in being able to produce a rare earth magnet in Europe,” he said. “We are honored by the highlight we got from both political leaders at incredibly high levels, but we know we have work to continue to do.”

That work is expanding rapidly. Neo’s magnet factory will officially open this September, in front of an international audience of officials, investors, and customers. More contracts with European Tier 1 suppliers have already been signed, including a new multi-year program expected to bring in $50 million in revenue. Shareholders, meanwhile, can point to $80 million in cash on the balance sheet, steady dividends, and buybacks as evidence of a company both investing for growth and rewarding capital.

Yet Suleman circles back to what matters most: execution. “Winning business is the easy part. Announcing is the easy part,” he said. “Actually developing products and executing products is where Neo’s history will matter the most.”

To access the complete interview, click here

Don’t miss other InvestorNews interviews. Subscribe to the InvestorNews YouTube channel by clicking here

About Neo Performance Materials Inc.

Neo manufactures the building blocks of many modern technologies that enhance efficiency and sustainability. Neo’s advanced industrial materials – magnetic powders, rare earth magnets, magnetic assemblies, specialty chemicals, metals, and alloys – are critical to the performance of many everyday products and emerging technologies. Neo’s products fast-forward technologies for the net-zero transition. The business of Neo is organized along three segments: Magnequench, Chemicals & Oxides and Rare Metals. Neo is headquartered in Toronto, Ontario, Canada; with corporate offices in Greenwood Village, Colorado, United States; Singapore; and Beijing, China. Neo has a global platform that includes manufacturing facilities located in China, Germany, Canada, Estonia, Thailand and the United Kingdom, as well as one dedicated research and development centre in Singapore.

To learn more about Neo Performance Materials Inc., click here

Disclaimer: Neo Performance Materials Inc. is an advertorial member of InvestorNews Inc.

This interview, which was produced by InvestorNews Inc. (“InvestorNews”), does not contain, nor does it purport to contain, a summary of all material information concerning the Company, including important disclosure and risk factors associated with the Company, its business and an investment in its securities. InvestorNews offers no representations or warranties that any of the information contained in this interview is accurate or complete.

This interview and any transcriptions or reproductions thereof (collectively, this “presentation”) does not constitute, or form part of, any offer or invitation to sell or issue, or any solicitation of any offer to subscribe for or purchase any securities in the Company. The information in this presentation is provided for informational purposes only and may be subject to updating, completion or revision, and except as may be required by applicable securities laws, the Company disclaims any intent or obligation to update any information herein. This presentation may contain “forward-looking statements” within the meaning of applicable Canadian securities legislation. Forward-looking statements are based on the opinions and assumptions of the management of the Company as of the date made. They are inherently susceptible to uncertainty and other factors that could cause actual events/results to differ materially from these forward-looking statements. Additional risks and uncertainties, including those that the Company does not know about now or that it currently deems immaterial, may also adversely affect the Company’s business or any investment therein.

Any projections given are principally intended for use as objectives and are not intended, and should not be taken, as assurances that the projected results will be obtained by the Company. The assumptions used may not prove to be accurate and a potential decline in the Company’s financial condition or results of operations may negatively impact the value of its securities. This presentation should not be considered as the giving of investment advice by the Company or any of its directors, officers, agents, employees or advisors. Each person to whom this presentation is made available must make its own independent assessment of the Company after making such investigations and taking such advice as may be deemed necessary. Prospective investors are urged to review the Company’s profile on SedarPlus.ca and to carry out independent investigations in order to determine their interest in investing in the Company.