Appia Announces Maiden Rare Earth Mineral Resource Estimate of 6.6 Million Tonnes Indicated Grading 2,513 ppm TREO and 46.2 Million Tonnes Inferred grading 2,888 ppm TREO at the PCH Ionic Adsorption Clay Project in Goias, Brazil

March 1, 2024 (Source) — Appia Rare Earths & Uranium Corp. (CSE: API) (OTCQX: APAAF) (FWB: A0I0) (MUN: A0I0) (BER: A0I0) (the “Company” or “Appia”) is pleased to announce that it has received an independent maiden Mineral Resource Estimate (MRE) for its ionic adsorption clay (IAC) project located in the State of Goiás, Brazil, known as the PCH Project. The MRE was prepared by Yann Camus, P.Eng., of SGS Canada Inc. – Geological Services (“SGS“).

Highlights:

- The maiden MRE for the PCH Project is estimated at 52.8 million tonnes (Mt) comprising:

- 6.6 Mt Indicated resource with a grade of 2,513 parts per million (ppm) total rare earth oxide (TREO).

- 46.2 Mt Inferred resource with a grade of 2,888 ppm TREO.

- The deposit contains significant concentrations of Neodymium (Nd), Praseodymium (Pr), Dysprosium (Dy), and Terbium (Tb) which are the rare earth elements used in the production of permanent magnets and currently under high demand.

- The Company is currently undertaking a significant evaluation of the potential desorbed rare earth oxide (DREO), and results are pending.

- Significant anomalies of Scandium and Cobalt have been identified in the Buriti Zone, adding additional potential resource value to the project.

Tom Drivas stated, “Appia’s team has done a tremendous amount of work over the past 8 months leading to the commissioning of this maiden MRE on our two (2) initial project areas, Target IV and the Buriti Zone. I couldn’t be more pleased to confirm that our conviction was well placed as there is immense potential at our PCH project in Brazil. With an estimated 6.6 million tonnes of high-grade mineralization in the indicated category and 46.2 million tonnes of high-grade mineralization in the inferred category, and with some of the highest TREO grades in the world, we are well on our way to establishing the Company as a leader not only in Brazil, but the around the globe.”

Stephen Burega, President, commented, “Today’s announcement is very important to the Company and our shareholders, and this is only the beginning for this amazing project. We have delineated a combined resource of 52.8 million tonnes of high-grade mineralization in an area of only 483 hectares across both target zones. Appia is continuing its exploratory auger drilling program to test multiple new target areas across the PCH project which covers over 40,000 hectares. We will continue to evaluate future targets for TREO as well as for Scandium and Cobalt potential.”

Mineral Resource Statement

The block model representing the Current Resource of the PCH deposit is based on a total of 138 RC drillholes and 1 Diamond drillhole, which produced 1,869 samples in the 3 layers (Top Soil, Clay and Saprolite) above the rock. The 3 softer material layers were interpreted and modelled from this data. The mineral resource statement prepared by SGS is reported in accordance with the requirements of National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”).

| Mineralized Zone |

Classification | Volume | SG | Tonnes | TREO | MREO | HREO | Sm2O3 | Tb4O7 | Dy2O3 | Pr6O11 | Nd2O3 | Sc2O3 | Co |

| Mm3 | Mt | ppm | ppm | ppm | ppm | ppm | ppm | ppm | ppm | ppm | ppm | |||

| Target IV | Indicated | 3.3 | 1.97 | 6.6 | 2513 | 562 | 186 | 58.3 | 5.8 | 31.1 | 109 | 358 | 15.9 | 22 |

| Inferred | 6.9 | 1.96 | 13.5 | 7307 | 1391 | 331 | 114.4 | 9.6 | 49.4 | 311 | 907 | 24.6 | 74 | |

| Buriti | Inferred | 16.7 | 1.96 | 32.7 | 1059 | 259 | 101 | 29.0 | 3.1 | 17.8 | 45 | 164 | 68.6 | 127 |

| TOTAL | Indicated | 3.3 | 1.97 | 6.6 | 2513 | 562 | 186 | 58.3 | 5.8 | 31.1 | 109 | 358 | 15.9 | 22 |

| Inferred | 23.6 | 1.96 | 46.2 | 2888 | 591 | 168 | 54.0 | 5.0 | 27.0 | 123 | 381 | 55.7 | 111 |

Table 1: PCH Mineral Resource Estimate.

- The MRE has an effective date of the 1st of February 2024.

- The Qualified Person for the MRE is Mr. Yann Camus, P.Eng., an employee of SGS.

- The MRE provided in this table were estimated using current Canadian Institute of Mining, Metallurgy and Petroleum (“CIM”) Standards on Mineral Resources and Reserves, Definitions and Guidelines.

- Mineral Resources that are not Mineral Reserves have not demonstrated economic viability. Additional drilling will be required to convert Inferred and Indicated Mineral Resources to Measured Mineral Resources. There is no certainty that any part of a Mineral Resource will ever be converted into Reserves.

- All analyses used for the MRE were performed by SGS GEOSOL by ICM40B: Multi Acid Digestion / ICP OES – ICP MS and by IMS95R: Lithium Metaborate Fusion / ICP-MS.

- MRE are stated at a cut-off total NSR value of 10 US$/t. The full price list and recovery used to estimate the NSR is in Table 2. The estimated basket price of TREO is US$26.98.

- GEOVIA’s WhittleTM software was used to provide an optimized pit envelope to demonstrate reasonable prospection for economic extraction. Preliminary pit optimization parameters included overall pit slope of 30 degrees, in-pit mining costs of $2.10, processing and G/A costs of $9/t, and overall mining loss and dilution of 5%. Full details of the preliminary pit-optimization parameters can be found in Table 2. The basket price and oxides price list in Table 2 are based on forward-looking pricing. These future prices are predicted based on market trends, economic forecasts, and other relevant factors. The actual prices may vary depending on changes in these factors.

- Figures are rounded to reflect the relative accuracy of the estimate and numbers may not add due to rounding.

- Resources are presented undiluted and in situ, constrained within a 3D model, and are considered to have reasonable prospects for eventual economic extraction.

- Bulk density values were determined based on physical test work and assumed porosities for each type of material.

- Total Rare Earth Oxides: TREO = Y2O3 + Eu2O3 + Gd2O3 + Tb2O3 + Dy2O3 + Ho2O3 + Er2O3 + Tm2O3 + Yb2O3 + Lu2O3 + La2O3 + Ce2O3 + Pr2O3 + Nd2O3 + Sm2O3

- Magnetic Rare Earth Oxides: MREO = Sm2O3 + Tb4O7 + Dy2O3 + Pr6O11 + Nd2O3

- Heavy Rare Earth Oxides: HREO = Sm2O3 + Eu2O3 + Gd2O3 + Tb4O7 + Dy2O3 + Ho2O3 + Er2O3 + Tm2O3 + Yb2O3 + Lu2O3

- The MRE may be materially affected by environmental, permitting, legal, title, taxation, socio-political, marketing, or other relevant issues.

The MRE is constrained within an optimized pit envelope using assumptions found in Table 2. A map displaying the plan view of the MRE, and Scandium grade block model and cross section is available by clicking on this LINK.

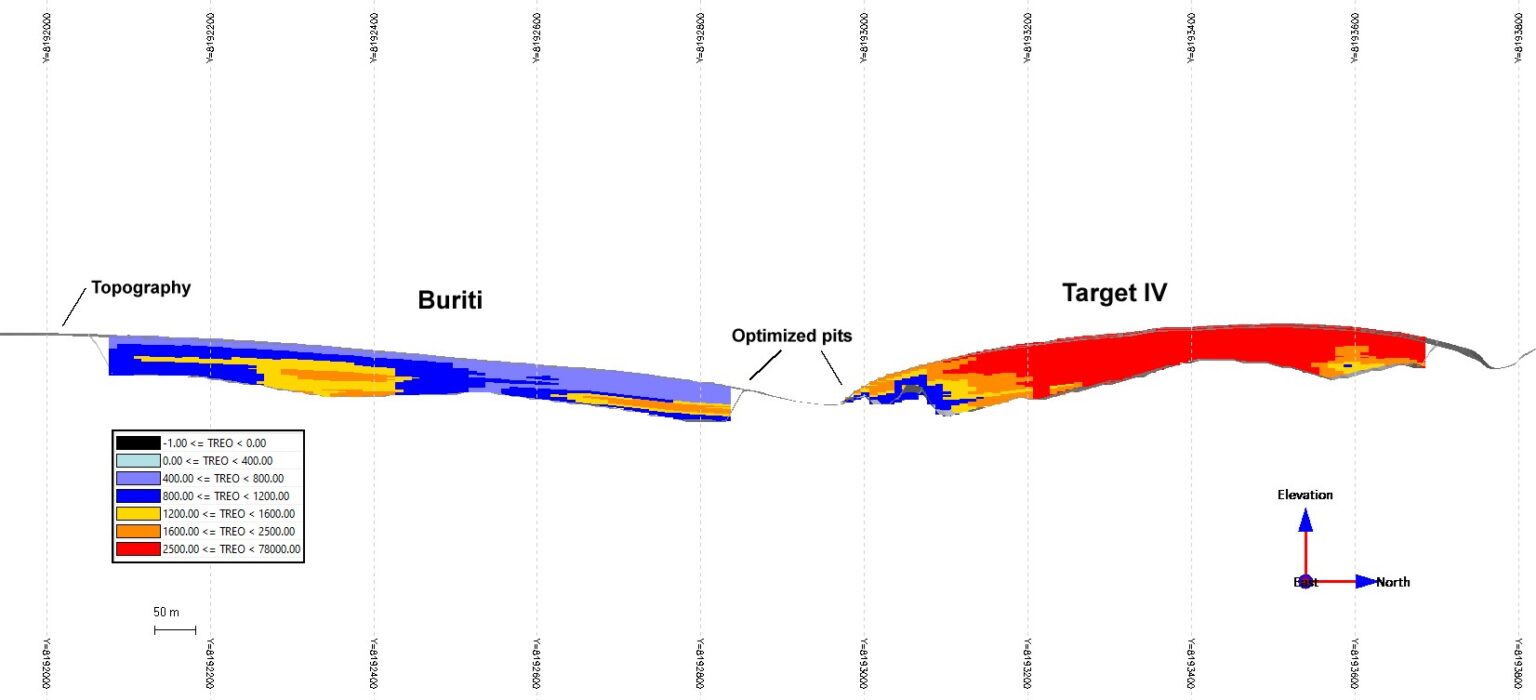

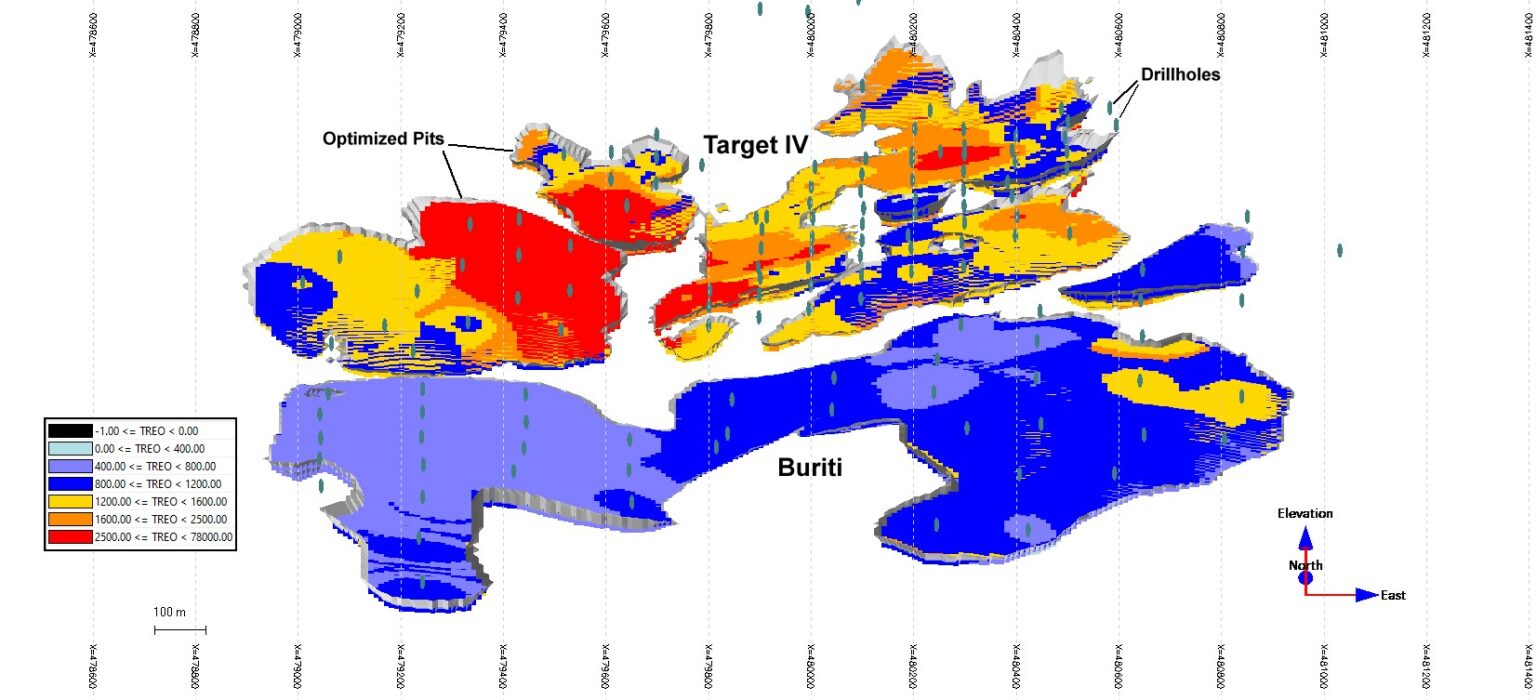

The overall MRE indicates that, at shallower depths, the N and NW portions are more enriched in TREO in Target IV when compared to Buriti Target (Figure 2). Buriti target presents TREO enrichment at deeper depths (Figure 3) and presents anomalous grades of Scandium and Cobalt.

| Parameter | Value | Unit |

| Sm2O3 | $2.2 | US$ per kg oxide |

| Eu2O3 | $35 | US$ per kg oxide |

| Gd2O3 | $45 | US$ per kg oxide |

| Tb4O7 | $1,450 | US$ per kg oxide |

| Dy2O3 | $450 | US$ per kg oxide |

| Ho2O3 | $130 | US$ per kg oxide |

| Er2O3 | $37 | US$ per kg oxide |

| Tm2O3 | $5.0 | US$ per kg oxide |

| Yb2O3 | $16 | US$ per kg oxide |

| Lu2O3 | $750 | US$ per kg oxide |

| La2O3 | $2.0 | US$ per kg oxide |

| CeO2 | $1.5 | US$ per kg oxide |

| Pr6O11 | $100 | US$ per kg oxide |

| Nd2O3 | $95 | US$ per kg oxide |

| Scandium | $700 | US$ per kg oxide |

| Cobalt | $35 | US$ per kg oxide |

| Y2O3 | $5.0 | US$ per kg oxide |

| Overall Pit Slope | 30 | Degrees |

| In-Pit Mining Cost | $2.1 | US$ per tonne mined |

| Processing Cost and G&A | $9.0 | US$ per tonne milled |

| Metallurgical Recovery (overall) |

25 | Percent (%) |

| Mining loss / Dilution (open pit) |

5/5 | Percent (%) / Percent (%) |

| Densities | Value | Unit |

| Top Sol | 2.00 | t/m3 |

| Sol | 1.80 | t/m3 |

| SAP | 2.10 | t/m3 |

| Rock | 2.50 | t/m3 |

| Waste in pit | 2.00 | t/m3 |

| Cut-off Grade | Value | Unit |

| Total NSR | 10$ | US$ per tonne |

Table 2: Assumed Current Resource Cut-Off and Pit Optimization Parameters in US$.

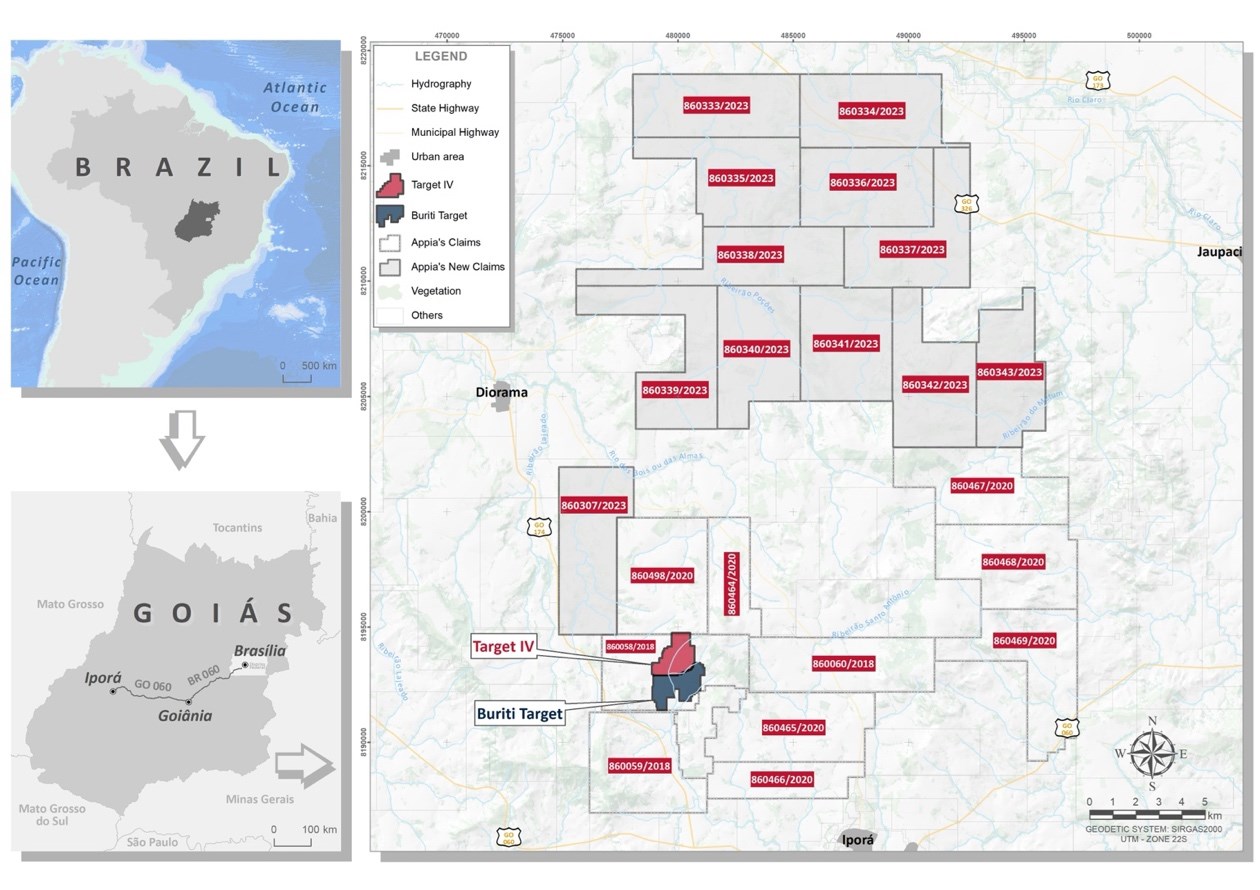

Figure 1 – Map showing the total area of the PCH Project and locations of the Target IV and Buriti Zone.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/5416/200153_daf4fa3dc4ef2988_003full.jpg

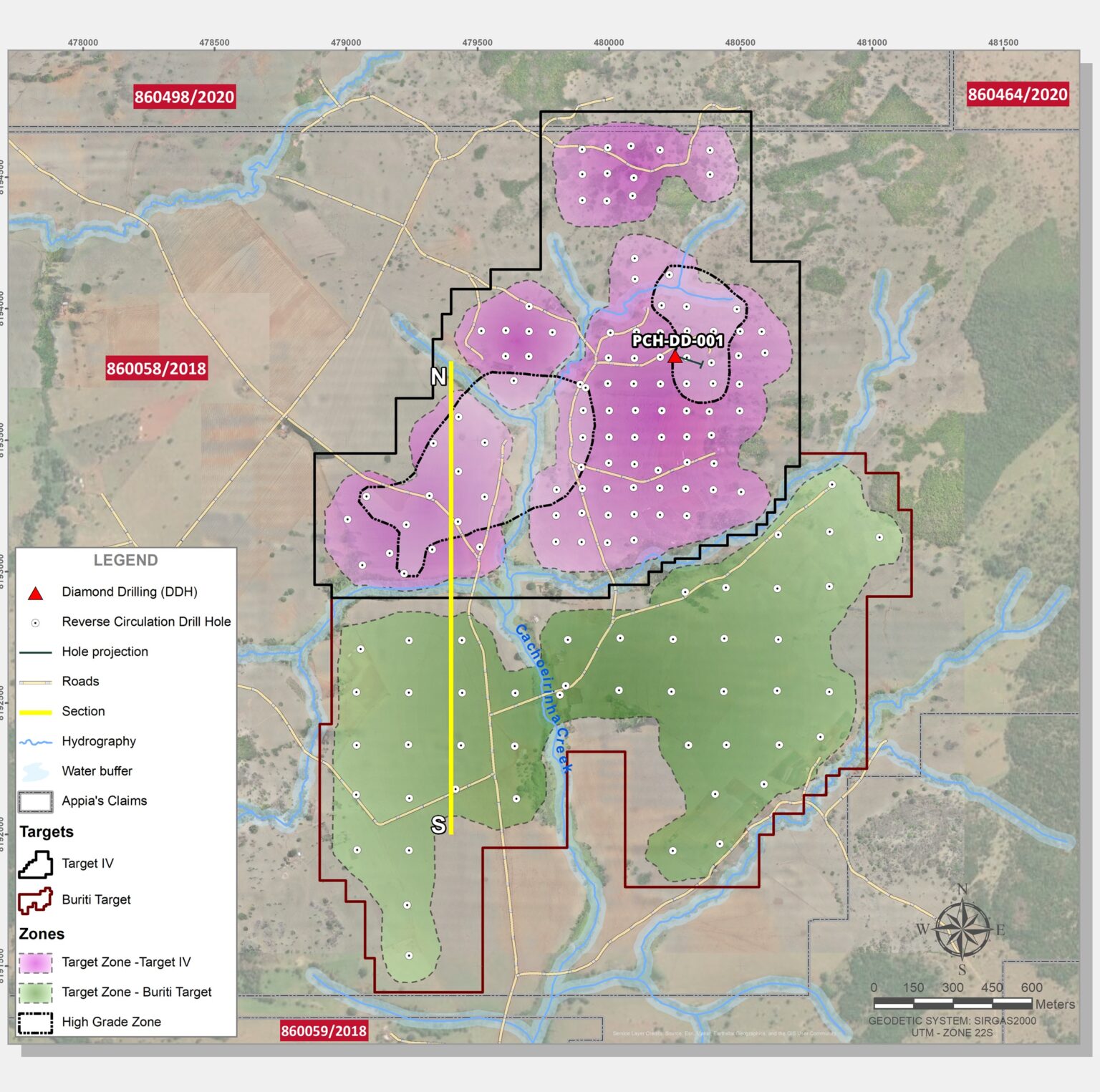

Figure 2 – Map showing the Target IV and Buriti Zone resource extension and South-North cross section location shown in Figure 3.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/5416/200153_fig2.jpg

Figure 3 – South-North cross section showing the TREO grade block model. With a 3x vertical exaggeration factor.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/5416/200153_daf4fa3dc4ef2988_005full.jpg

Figure 4 – 3D view from south showing the TREO grade block model. With a 3x vertical exaggeration factor.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/5416/200153_daf4fa3dc4ef2988_006full.jpg

More Details on Data Sources and Current Resource Estimation Methods

Some exploration Auger data is also available but have no impact on the MRE. Therefore, only the RC and Diamond drillholes were used for the MRE estimation. The hard rock, while mineralized, was not included in the MRE because the required process would be different and is not currently part of the development strategy. Also, data from the hard rock is currently limited. Blocks of 10 x 10 x 0.2 m were used to fill the 3 layers volumes. The composites used are the original assays given that 1867 of the 1868 assay in the 3 layers have lengths between 0.5 m and 1.05 m. Capping was studied but was deemed unnecessary because no significant extreme grades are present in the database. It is estimated that capping of highest grades could potentially reduce the MRE by around 1%. Estimation of the block model was prepared by Yann Camus, P.Eng., of SGS Canada Inc. – Geological Services (“SGS”) from Blainville, Quebec, using the SGS Genesis© mining software. Interpolation was performed using inverse square distance (ID2) as well as different search ellipses which were adapted for the geology of the deposit with variable orientations to conform to the geometry of the 3 layers. Estimation was done in 3 passes. The composites used pertain to each layer as hard boundaries. Mineralized material classification was outlined by hand as Indicated in areas with at least 3 drillholes with a drilling grid of around 100 m. Inferred resources are in areas with a drill grid of up to 200 m. At this point, there are no measured resources in the project. The block model was then fed to GEOVIA’s WhittleTM software to provide an optimized pit envelope constraining the Current Resource. The TREO basket price found for the MRE is 26.98 US$/kg TREO as detailed in Table 2. The base case MRE is detailed in Table 1.

QA/QC

Reverse circulation (RC) drill holes are vertical and reported intervals are true thickness. The material produced from drill holes are sampled at one metre intervals, resulting in average sample sizes of 5-25 kg. A small representative specimen was taken from each sample bag and placed into a chip tray for visual inspection and logging by the geologist. Quartering of the material was performed at Appia’s logging facility using a riffle splitter and continued splitting until a representative sample weighing approximately 500g each was obtained, bagged in a resistant plastic bag, labeled, photographed, and stored for shipment.

The bagged samples are sent to the SGS laboratory in Vespasiano, Minas Gerais. In addition to the internal QA/QC of the SGS Lab, Appia includes its own control samples in each batch of samples sent to the laboratory.

Quality control samples, such as blanks, duplicates, and standards (CRM) were inserted into each analytical run. For all analysis methods, the minimum number of QA/QC samples is one standard, one duplicate and one blank, introduced in each batch which comprise a full-length hole. The rigorous procedures are implemented during the sample collection, preparation, and analytical stages to insure the robustness and reliability of the analytical results.

All analytical results reported herein have passed internal QA/QC review and compilation. All assay results of RC samples were provided by SGS Geosol, an ISO/IEC 17025:2005 Certified Laboratory, which performed their measure of the concentration of rare earth elements (REE) analyses by Inductively Coupled Plasma Mass Spectrometry (ICP-MS) analytical methods.

Qualified Person

The technical content in this news release was reviewed and approved by Mr. Don Hains, P.Geo, Consulting Geologist, and a Qualified Person as defined by National Instrument 43-101.

The MRE has been prepared by Yann Camus, P.Eng., of SGS Canada Inc. – Geological Services (“SGS”) from Blainville, Quebec and is a Qualified Person (QP) as defined under NI 43-101. He is responsible for the MRE and has reviewed and approved the scientific and technical information related to the MRE contained in this news release.

NI 43-101 Technical Report

A technical report in conformance with the requirements of NI-43-101 will be filed on www.sedarplus.com within 45 days of the issuance of this press release..

About Appia Rare Earths & Uranium Corp. (Appia)

Appia is a publicly traded Canadian company in the rare earth element and uranium sectors. The Company is currently focusing on delineating high-grade critical rare earth elements and gallium on the Alces Lake property, as well as exploring for high-grade uranium in the prolific Athabasca Basin on its Otherside, Loranger, North Wollaston, and Eastside properties. The Company holds the surface rights to exploration for 94,982.39 hectares (234,706.59 acres) in Saskatchewan. The Company also has a 100% interest in 13,008 hectares (32,143 acres), with rare earth elements and uranium deposits over five mineralized zones in the Elliot Lake Camp, Ontario. Lastly, the Company holds the right to acquire up to a 70% interest in the PCH Project (See June 9th, 2023 Press Release – Click HERE) which is 40,963.18 ha. in size and located within the Goiás State of Brazil. (See January 11th, 2024 Press Release – Click HERE)

Appia has 136.3 million common shares outstanding, 144.5 million shares fully diluted.

Cautionary note regarding forward-looking statements: This News Release contains forward-looking statements which are typically preceded by, followed by or including the words “believes”, “expects”, “anticipates”, “estimates”, “intends”, “plans” or similar expressions. Forward-looking statements are not a guarantee of future performance as they involve risks, uncertainties and assumptions. We do not intend and do not assume any obligation to update these forward-looking statements and shareholders are cautioned not to put undue reliance on such statements.

Neither the Canadian Securities Exchange nor its Market Regulator (as that term is defined in the policies of the CSE) accepts responsibility for the adequacy or accuracy of this release.

For more information, visit www.appiareu.com

As part of our ongoing effort to keep investors, interested parties and stakeholders updated, we have several communication portals. If you have any questions online (X, Facebook, LinkedIn) please feel free to send direct messages.

To book a one-on-one 30-minute Zoom video call, please click here.

Contact:

Tom Drivas, CEO and Director

(c) (416) 876-3957

(e) [email protected]

Stephen Burega, President

(c) (647) 515-3734

(e) [email protected]