Critical Metals PLC advances the Molulu Copper-Cobalt Project in DRC

Key Operations, Logistics, and Drilling Update

December 20, 2023 (Source) — Critical Metals plc, operator of Molulu copper/cobalt project in the Democratic Republic of Congo, provides an update on the delivery of ore to the buyer OM Metals SARL (‘OM Metals’).

Highlights

- Permits for trucks to use the public roads received

- Permission granted to transverse neighbouring property

- Further road upgrades to begin soon to handle heavier general traffic

- Ore sales expected to recommence in Q1 2024

- Areas of 29.41%, 14.59%, and 8.88% copper intercepted using XRF.

- Advancing diamond drilling campaign in Phases 1, 2, and 4 to establish JORC resource estimation for copper-cobalt mineralisation in the area.

- High-grade copper mineralisation identified in most of the drilled holes, proved to be of economic potential.

- A total of 24 holes have been drilled, logged, and sampled.

Russell Fryer, CEO of Critical Metals, remarked: “The outcomes from our 24-drill-hole campaign have been tremendously encouraging, revealing high-grade copper mineralization that underscores the remarkable promise of the Molulu project. This success not only demonstrates our operational efficiency but also highlights our strategic focus on enhancing both the logistics and infrastructure critical to our operations. Our commitment to upgrading road access, alongside our notable collaboration with OM Metals and the planned acquisition of a processing plant, are pivotal steps towards scaling our business. As we prepare for the next drilling phase in Q1 2024, extending into Phase 3, our goal is to deepen our understanding of the mineralization’s grade, mineralogy, thickness, and spread. This will be crucial in fulfilling our off-take commitments and driving sustainable growth. We eagerly anticipate sharing more updates on our progress and drilling activities with our shareholders soon.”

Operations and Logistics Update:

The recently announced proposed acquisition of a copper-cobalt processing plant and the sizeable off take agreement with OM Metals generates positive momentum for Critical Metals moving into 2024. Ensuring smooth mine logistics and delivery of ore throughout the year in extreme weather conditions of the DRC is essential. The aim of the board of the Company is to prepare now for the growth of the Company’s business to create a sustainable and scalable business, for all shareholders.

As previously reported on 15 May 2023, Critical Metals has invested in the road at Molulu, including construction of a bridge, to allow ore to be removed from the mine site and transported to the off-take purchaser. In addition, the proposed rental and acquisition of the processing copper-cobalt plant would see a significant increase in the volume of ore that will be transported from Molulu.

The ore purchase agreement with OM Metals outlines the use of ten 40-tonne trucks to transport the copper ore from Molulu to the OM Metals plant. These trucks have the capacity to deliver 10,000 tonnes of copper ore to the OM Metals plant per month.

After securing the seven necessary road permits to use the ten trucks for transportation and receiving permission of a neighbour of the Molulu lease area to pass through their adjacent property, the first 40-tonne trucks arrived at Molulu with no delays in the week of November 20th to receive ore. The trucks did have road delays on their return but arrived and delivered copper ore to the OM Metals plant.

After consulting with the management of OM Metals, Critical Metals made the strategic decision now, while the processing plant transaction is under due diligence and before significant deterioration of the road occurs, to further invest in the public road from the Molulu Project during the election and holiday season to ensure reliable ore delivery at anticipated volumes. These road improvements also benefit the local community and form a continuing part of our programme of local stakeholder engagement.

Improvements to the road include additional grading, ground compacting, with a layer of stones to be placed in the areas of water collection and heavy usage. Such improvements include rainwater drainage points.

A road contractor has already been appointed and the time to improve the road as described above is anticipated to take forty-five (45) days. Work on the road is scheduled to begin in late December and with these new improvements, the road is expected to be useable for the remainder of the rain season which normally ends in April.

Once the road is rehabilitated, ore sales to OM Metals can resume and the Company aims to fulfil its off-take contract commitment. It is anticipated that ore sales to OM Metals will restart once the road upgrade is complete. OM Metals has indicated they will purchase as much copper oxide ore as Molulu can produce once the road is ready for the 40-tonne trucks to resume deliveries.

Critical Metals is actively engaging with OM Metals and will provide additional information and updates on operations to the market as appropriate.

Drilling Update

Details

· Notable drill results from all three phases using the handheld Niton XRF include:

Phase 1 (Figure 3)

o Hole DD1-01 recorded an average of 1.01% of copper at a depth of 12.20m

Phase 2 (Figure 4)

o Hole DD2-05BIS recorded an average of 1.57% of copper at a depth of 22.65m

o Hole DD2-6BIS recorded an average of 1.39% of copper at a depth of 16.80m

o Hole DD2-07 recorded an average of 2.15% of Cu at a depth of 7.40m

Phase 4 (Figure 5)

o Hole DD4-01BIS recorded an average of 5.97% of copper at a depth of 32.85m

o Hole DD4-09BIS recorded an average of 7.35% of Cu at a depth of 36.05m

o Hole DD4-10 recorded an average of 4.53% of Cu at a depth of 49.65m

Excellent higher grade copper intercepts in Phase 4 include:

DD4-09BIS intercepted a copper zone with a grade of 29.41%,

DD4-01BIS intercepted a copper zone with a grade 14.59%,

DD4-10 intercepted a copper zone with a grade of 8.88%.

· Extension of the drilling plan into Phase 3 is set to commence in Q1 2024

Drilling Overview

Molulu Project has undertaken diamond drilling in Phases 1, 2, and 4, for resource estimation of the copper-cobalt mineralisation in the area in order to update a JORC compliant report.

The planned drill holes were placed in high signature zones shown by magnetics and IP surveys done within the project area. A total of 24 holes have been drilled, logged, and sampled at the Molulu Mine in the Democratic Republic of Congo (‘DRC’).

The Molulu Project

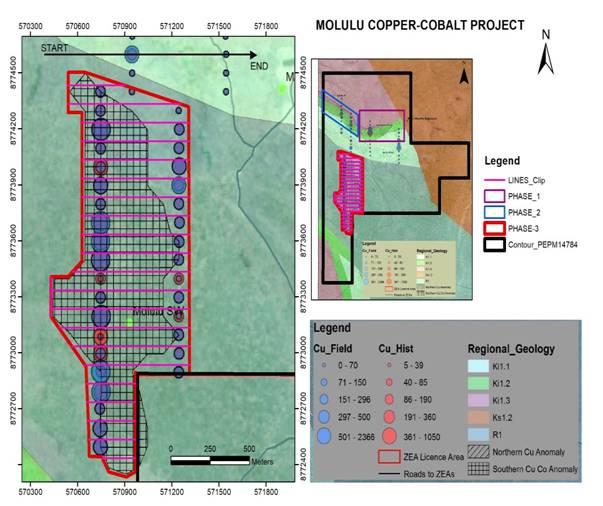

The Molulu project area is approximately 100 km north of Lubumbashi City, within the Kasenga Administrative District (Figure 1 below).

Figure 1: Molulu copper-cobalt project location showing the scale of the northern copper-anomaly and drilled holes in each Phase. The copper ore body is believed to be at least 3 kilometers long.

Diamond Core Drilling Update

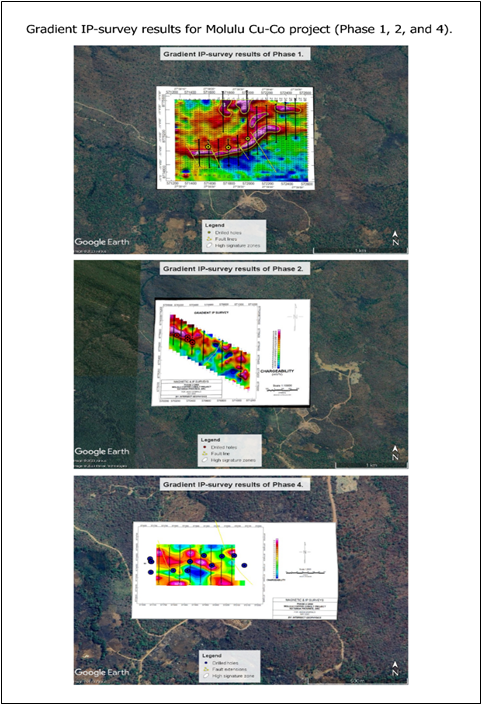

The diamond core drilling exploration program for Phases 1, 2, and 4 (announced 23 July 2023) focused on areas where highly chargeable-highly resistive anomalies from an Induced Polarisation (IP) gradient ground geophysical survey were previously identified. These anomalies were sourced to a stratabound copper-mineralisation hosted within a structurally controlled, bedded succession of metasedimentary rocks, composed of interbedded siltstone and shale (Figure 2).

A total of 24 drill holes have been drilled, logged, and scanned using a handheld XRF analyser to identify mineralised zones within the core. Logging the core has indicated two types of mineralisation; rock-type-specific mineralisation hosted with the siltstone and shale, and structurally controlled mineralisation. The identified mineralised zones are associated with traces of malachite within fracture zones.

The handheld XRF analyser has aided in identifying high-grade mineralised zones and low-grade mineralised zones within each Phase. The high-grade copper-mineralisation, identified in most of the drilled holes, proved to be of economic potential. However, sampling the core and taking the samples to an accredited laboratory will increase the level of confidence in the results given by the XRF analyser.

A senior geologist at the Molulu mine has also carried out a Quality Assurance/Quality Control (“QA/QC”) oversite, including re-logging of the core to quantify data provided throughout the drilling program. A sampling protocol was implemented on 20th November 2023, alongside drilling, logging, and scanning using the handheld XRF analyser, of the drilled holes in Phases 1, 2, and 4.

The drill holes in Phases 1, 2, and 4 were strategically positioned at an incline to intercept the mineralised layer. Adjustments to a vertical position have been made to a few drill holes where the mineralized layer was not intercepted at an inclined angle.

Figure 2: Magnetics map overlain by gradient IP survey results with indicative highest density zones (solid purple outlines) and locations of diamond core drill holes.

PHASE 1 Highlights

· Notable 2023 positive results of copper from the handheld XRF analyser recordings in the following drilled holes of Phase 1, 2 and 4:

o Phase 1 (Figure 3 below)

– Hole DD1-01 recorded an average of 1.01% of copper at a depth of 12.20m.

Figure 3: Phase 1 Diamond Drill Hole Positions with Copper Intersection Weight Percentage.

PHASE 2 Highlights

o Phase 2 (Figure 4 below)

– Hole DD2-05BIS recorded an average of 1.57% of copper at a depth of 22.65m.

– Hole DD2-6BIS recorded an average of 1.39% of copper at a depth of 16.80m.

– Hole DD2-07 recorded an average of 2.15% of copper at a depth of 7.40m.

Figure 4: Phase 2 Diamond Drill Hole Positions with Copper Intersections Weight Percentage and planned drill holes at the white pins.

PHASE 4 Highlights

o Phase 4 (Figure 5 below)

– Hole DD4-01BIS recorded an average of 5.97% copper at a depth of 32.85m.

– Hole DD4-09BIS recorded an average of 7.35% copper at a depth of 36.05m.

– Hole DD4-10 recorded an average of 4.53% copper at a depth of 49.65m.

Although the above Phase 4 grades are averages, the XRF has recorded copper grades well in excess of the averages over multiple meters.

Examples of the excellent copper intercepts in Phase 4 include:

– DD4-09BIS intercepted a copper zone with a grade of 29.41%,

– DD4-01BIS intercepted a copper zone with a grade 14.59%,

– DD4-10 intercepted a copper zone with a grade of 8.88%.

These copper intercepts in Phase 4 are outstanding and support the July 2023 decision by management to pivot to the Phase 4 sulphide pit area and deemphasize drilling on the Phase 1 area.

Figure 5: Phase 4 Diamond Drill Hole Positions with Copper Intersections Weight Percentage and planned drill holes at the white pins.

Future Activities

Drilling is anticipated to restart in January 2024 with core logging, scanning XRF analysis, QA/QC, and sampling to begin soon after. An extension of the drilling plan into Phase 2 and 3 is set to also commence in the first quarter of 2024. The key factors to this drilling program are to scale out the mineralised zones in all the Phases, and to get the grade, mineralogy, thickness, and extent of the mineralised beds in each Phase.

The drilling data and information is planned to be inserted into the JORC report which is expected to be released in Q1 2024.

Once the further drilling of the Phase 4 area is completed, the next phase is for a new drill programme be designed in the cobalt area that is located south of the current drilling areas. See Figure 6 below.

Figure 6: Copper Anomalies found in the Cobalt area are the blue dots.

Processing Plant Update

Due diligence of the Kastro SARL plant assets (announced 10 October 2023) continues with both parties committed to working to a positive outcome. These complex discussions not only encapsulate the plant assets, but also the tailings waste facility and property where the Kastro SARL assets reside. The Company will update the market on developments when appropriate.

**ENDS**

For further information on the Company please visit www.criticalmetals.co.uk or contact:

| Critical Metals plcRussell Fryer, CEO | Tel: +44 (0)20 7236 1177 |

| Peterhouse Capital LimitedCorporate BrokerLucy William / Charles Goodfellow | Tel: +44 (0)20 7469 0936 / +44 (0)20 7220 9797 |

| St Brides Partners LtdFinancial PRCatherine Leftley /Ana Ribeiro/Isabelle Morris | Tel: +44 (0)20 7236 1177 |

About Critical Metals

Critical Metals PLC has acquired a controlling 100% stake in Madini Occidental Limited, which holds an indirect 70% interest in the Molulu copper/cobalt project, a producing asset in the Katangan Copperbelt in the Democratic Republic of Congo.

The Company will continue to identify future assets that are in line with its stated acquisition objective of low CAPEX and OPEX brown-field projects with near-term production and cash-flow, whilst concentrating on minerals that have strategic importance to future economic growth thereby generating significant value for shareholders.

This information is provided by RNS, the news service of the London Stock Exchange

. RNS is approved by the Financial Conduct Authority to act as a Primary Information Provider in the United Kingdom

. Terms and conditions relating to the use and distribution of this information may apply. For further information, please contact [email protected] or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms and conditions, to analyse how you engage with the information contained in this communication, and to share such analysis on an anonymised basis with others as part of our commercial services. For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy Policy.