First Phosphate Reports Initial Mineral Resource Estimate on its Bégin-Lamarche Phosphate Deposit in the Saguenay-Lac-Saint-Jean Region of Québec, Canada

September 18, 2024 (Source) — First Phosphate Corp (CSE: PHOS) (OTC: FRSPF) (FSE: KD0) (“First Phosphate” or the “Company”) is pleased to announce the results of its initial Mineral Resource Estimate (“MRE”) for its Bégin-Lamarche project, located 50 km north of the City of Saguenay, Quebec, Canada. The MRE, with an effective date of September 9, 2024, was carried out by M. Antoine Yassa, P.Geo., of P&E Mining Consultants Inc., who is an Independent Qualified Person within the meaning of Canadian Securities Administrators’ National Instrument 43-101: Standards of Disclosure for Mineral Projects (“NI 43-101”). MRE Highlights include:

- Inferred pit-constrained Mineral Resource: 214.0 Mt @ 6.01% P2O5 (phosphate)

Indicated pit-constrained Mineral Resource: 41.5 Mt @ 6.49% P2O5 - Including Mountain Zone:Indicated Mineral Resource of 9.3 Mt @ 8.19% P2O5

- Inferred Mineral Resource of 6.8 Mt @ 8.57% P2O5

- Metallurgical Testwork indicates an anticipated apatite concentrate grade of 40% P2O5 at a 91% recovery.

- The Bégin-Lamarche Deposit presents the potential for recovering two additional primary mineral products: a magnetite concentrate (iron) and an ilmenite concentrate (titanium).

- Apatite (Phosphorus), titanium and high purity iron are all listed on the Quebec and Canadian critical minerals lists.

- The Bégin-Lamarche Deposit contains very low levels of potentially deleterious elements.

- The Deposit is open at depth.

- 3D deposit model : https://www.firstphosphate.com/BeginLamarche3D

“We have demonstrated that the Company benefits from a substantial strategic phosphate deposit located at only 70 km from the deep-sea port of Saguenay and Canadian Air Forces NATO Base Bagotville,” said First Phosphate CEO, John Passalacqua. “Our goal will be to bring this Mineral Resource into Preliminary Economic Assessment (“PEA”) later this year to then be able to evaluate the commencement of a Feasibility Study.”

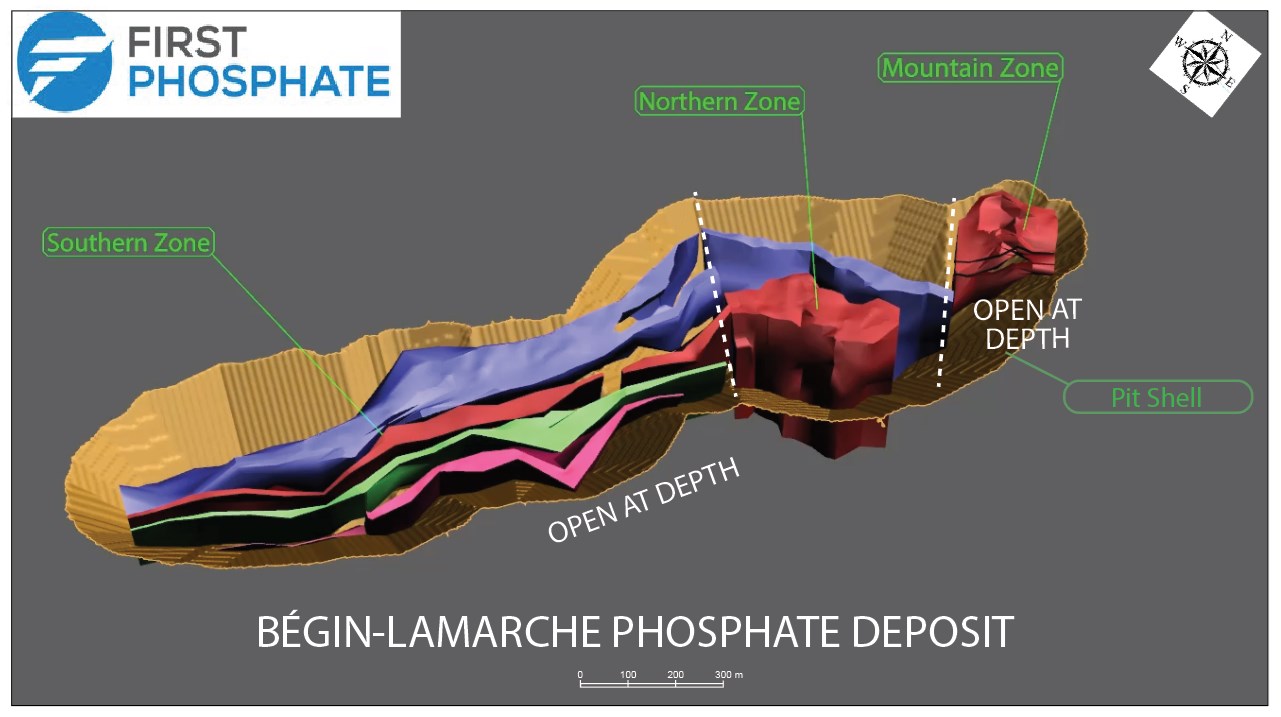

The Bégin-Lamarche Phosphate Deposit contains a significant phosphate Mineral Resource that is associated with well-defined oxide-apatite peridotite (OAP) intrusions within the large Lac-Saint-Jean anorthosite suite (LSJAS). The LSJAS is the largest anorthosite phosphate mineralized anorthosite worldwide. The phosphate deposit is comprised of three mineralized zones within the deposit. The three zones are continuous, only separated by faults within the deposit and extend to a length of 2,500 m (Figure 1). The Mountain Zone is a single phosphate-bearing mass having a diameter of up to 200 m and a length of 250 m. Drilling at the Mountain Zone intersected massive apatite (phosphate-bearing mineral) veins of up to 2 m. The Northern zone is comprised of two phosphate layers ranging from 100 to 200 m in thickness and a length of 600 m. The Southern Zone bears four phosphate layers, one of them having up to 200 m in thickness and extending to 1,700 m.

Figure 1 – The Bégin-Lamarche Deposit Pit-Shell

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/8917/223677_10eaf81724b92a56_001full.jpg

The above diagram can be viewed as a 3D deposit model by visiting https://www.firstphosphate.com/BeginLamarche3D

The Bégin-Lamarche Deposit mineralized wireframes boundaries were determined from lithology, structure, and grade boundary interpretation from visual inspection of drillhole cross-sections. Three mineralized wireframes were developed and referred to as Mountain, Northern and Southern Zones. The mineralized wireframes were constructed on 50 m spaced vertical cross-sections for the Mountain and Northern Zones and 100 m spacing for the Southern Zone, with computer screen digitizing polylines on drillhole cross-sections in GEMS™. The mineralized wireframe outlines were influenced by the selection of mineralized material above 2.5% P2O5 that demonstrated a lithological and structural zonal continuity along strike and down dip. In some cases, mineralization <2.5% P2O5 was included for the purpose of maintaining mineralized zone continuity. The minimum constrained width for mineralized wireframe interpretation was 3 m of drill core length.

The Bégin-Lamarche Mineral Resource Estimate is based on 120 drill holes totalling 29,762 m. The database contained 7,968 assays for percentage of P2O5, Fe2O3 and TiO2.The Mineral Resource Estimate is presented in Table 1.

| Table1 Pit-Constrained Mineral Resource Estimate(1-4) at 2.5% P2O5 Cut-Off |

||||

| Classification | Zone | Tonnes (Mt) | P2O5 (%) | P2O5 (kt) |

| Indicated | Mountain | 9.3 | 8.19 | 758 |

| Northern | 32.2 | 6.00 | 1,934 | |

| Total | 41.5 | 6.49 | 2,692 | |

| Inferred | Mountain | 6.8 | 8.57 | 584 |

| Northern | 44.3 | 6.98 | 3,090 | |

| Southern | 162.9 | 5.63 | 9,177 | |

| Total | 214.0 | 6.01 | 12,851 | |

Note: P2O5 = phosphorus pentoxide.

- Mineral Resources, which are not Mineral Reserves, do not have demonstrated economic viability.

- The estimate of Mineral Resources may be materially affected by environmental, permitting, legal, title, taxation, socio-political, marketing, or other relevant issues.

- The Inferred Mineral Resource in this estimate has a lower level of confidence than that applied to an Indicated Mineral Resource and must not be converted to a Mineral Reserve. It is reasonably expected that the majority of the Inferred Mineral Resource could be upgraded to an Indicated Mineral Resource with continued exploration.

- The Mineral Resources in this press release were estimated using the Canadian Institute of Mining, Metallurgy and Petroleum (CIM), CIM Standards on Mineral Resources and Reserves, Definitions (2014) and Best Practices Guidelines (2019) prepared by the CIM Standing Committee on Reserve Definitions and adopted by the CIM Council.

The Bégin-Lamarche Mineral Resource Estimate was derived from applying a 2.5% P2O5 cut-off value to the pit-constrained block model and reporting the resulting tonnes and grades for potentially mineable areas. The following parameters were used to calculate the Cut-off value that determines the open pit potentially economic portions of the constrained mineralization (Table 2).

The P2O5 cut-off value is calculated with parameters below:

| US$:C$ Exchange Rate: | $0.75 |

| P2O5 Price (32%): | US$180/t (approximate two-year trailing average) |

| P2O5 Price (40%): | US$225/t |

| P2O5 Process Recovery: | 91% |

| Processing Cost: | C$14.00/t |

| G&A: | C$3.00/t |

| Mining Cost: | C$2.75/t (mineralized material and waste) |

| Pit Slopes: | 45° |

Accordingly, the P2O5 cut-off of potential open pit mining is calculated to be = 2.5%.

The optimized pit-constrained Mineral Resource Estimate is moderately sensitive to the selection of reporting P2O5 cut-off values, as demonstrated in Table 2.

| Table 2 Pit-Constrained Mineral Resource Estimate Sensitivity to P2O5 Cut-off |

||||

| Class | Cut-off | Tonnage | P2O5 | P2O5 |

| P2O5 % | (Mt) | (%) | (kt) | |

| Indicated | 5.0 | 27.2 | 7.86 | 2,143 |

| 4.5 | 30.5 | 7.53 | 2,298 | |

| 4.0 | 33.8 | 7.22 | 2,436 | |

| 3.5 | 36.7 | 6.94 | 2,547 | |

| 3.0 | 39.3 | 6.69 | 2,632 | |

| 2.5 | 41.5 | 6.49 | 2,692 | |

| 2.0 | 43.3 | 6.31 | 2,732 | |

| 1.5 | 44.8 | 6.16 | 2,759 | |

| 1.0 | 46.0 | 6.03 | 2,774 | |

| Inferred | 5.0 | 135.8 | 7.16 | 9,732 |

| 4.5 | 157.2 | 6.84 | 10,748 | |

| 4.0 | 178.1 | 6.53 | 11,639 | |

| 3.5 | 194.2 | 6.31 | 12,242 | |

| 3.0 | 206.1 | 6.13 | 12,633 | |

| 2.5 | 214.0 | 6.01 | 12,851 | |

| 2.0 | 218.7 | 5.92 | 12,959 | |

| 1.5 | 222.5 | 5.85 | 13,025 | |

| 1.0 | 225.6 | 5.79 | 13,064 | |

| Mt: million tonnes kt: thousand tonnes | ||||

Metallurgical Testwork has been successfully conducted by SGS at their Quebec City facility with additional support by SGS Lakefield Ontario. Recent test results have confirmed that an apatite concentrate can be obtained assaying 40% P2O5 and at 91% recovery. Additional metallurgical test results indicate that the Bégin-Lamarche Deposit may have the potential to produce two additional, potentially marketable concentrates – an iron oxide (magnetite) concentrate and a titanium oxide (ilmenite) concentrate. Tests are continuing on this aspect.

First Phosphate’s Bégin-Lamarche Deposit is located approximately 50 km driving-distance north of the City of Saguenay, Québec’s sixth largest city, which hosts daily flights to Montréal, a skilled industrial workforce, strong local infrastructure, and which is 30 km driving distance from the deep-sea Port of Saguenay.

The geological and drilling work was planned, carried out and supervised by Laurentia Exploration Inc. Drill core was described at Lamarche near the deposit and at Laurentia Exploration’s offices. The drill core was sawn and sampled at Laurentia Exploration’s offices in Jonquière.

Qualified Persons

The scientific and technical disclosure for First Phosphate included in this News Release have been reviewed and approved by Gilles Laverdière, P.Geo. Mr. Laverdière is Chief Geologist of the Company and a Qualified Person under National Instrument 43-101 Standards of Disclosure of Mineral Projects (“NI 43-101”).

The Qualified Person independent of the issuer, responsible for estimating the Mineral Resources of the Begin-Lamarche Property, within the meaning of NI 43-101, is Mr. Antoine Yassa, P.Geo., of the firm P&E Mining Consultants Inc. Mr. Yassa has read this press release and confirms that the scientific and technical information in this press release for accuracy and compliance with NI 43-101.

An NI 43-101 compliant Technical Report will be filed on SEDAR+ within forty-five (45) days of this press release.

P&E Mining Consultants Inc., an associate group of twenty (20) geological and mine engineering professionals established in 2004, provides geological and mine engineering consulting reports, Mineral Resource and Mineral Reserve Estimates, NI 43-101 Technical Reports, Preliminary Economic Assessments, Pre-Feasibility and Feasibility Studies.

Laurentia Exploration inc. is a firm of consulting geologists based in Jonquière, Saguenay Lac-St-Jean. It has 80 employees, mainly geology professionals who are members in good standing of a professional order. The firm was founded in 2017 and carries out projects throughout Quebec and Ontario.

About First Phosphate Corp

First Phosphate is a mineral development company fully dedicated to extracting and purifying phosphate for the production of cathode active material for the lithium iron phosphate (“LFP”) battery industry. First Phosphate is committed to producing at high purity level, in responsible manner and with low anticipated carbon footprint. First Phosphate plans to vertically integrate from mine source directly into the supply chains of major North American LFP battery producers that require battery grade LFP cathode active material emanating from a consistent and secure supply source. First Phosphate holds over 1,500 sq. km of royalty-free district-scale land claims in the Saguenay-Lac-St-Jean Region of Quebec, Canada that it is actively developing. First Phosphate properties consist of rare anorthosite igneous phosphate rock that generally yields high purity phosphate material devoid of high concentrations of harmful elements.

-30-

For additional information, please contact:

Bennett Kurtz

Chief Financial Officer

[email protected]

Tel: +1 (416) 200-0657

Investor Relations: [email protected]

Media Relations: [email protected]

Website: www.FirstPhosphate.com

Follow First Phosphate:

Twitter: https://twitter.com/FirstPhosphate

LinkedIn: https://www.linkedin.com/company/first-phosphate/

Forward-Looking Information and Cautionary Statements

This news release contains certain statements and information that may be considered “forward-looking statements” and “forward looking information” within the meaning of applicable securities laws. In some cases, but not necessarily in all cases, forward-looking statements and forward-looking information can be identified by the use of forward-looking terminology such as “plans”, “targets”, “expects” or “does not expect”, “is expected”, “an opportunity exists”, “is positioned”, “estimates”, “intends”, “assumes”, “anticipates” or “does not anticipate” or “believes”, or variations of such words and phrases or statements that certain actions, events or results “may”, “could”, “would”, “might”, “will” or “will be taken”, “occur” or “be achieved” and other similar expressions. In addition, statements in this news release that are not historical facts are forward looking statements, including, among other things, the Company’s planned exploration and production activities, the properties and composition of any extracted phosphate, the Company’s plans for vertical integration into North American supply chains, the Company’s ability to prepare and the timing of the preparation of an NI 43-101 compliant technical report, to bring the Mineral Resource into Preliminary Economic Assessment later this year and to then be able to evaluate the commencement of a Feasibility Study.”

These statements and other forward-looking information are based on assumptions and estimates that the Company believes are appropriate and reasonable in the circumstances, including, without limitation, expectations of the Company’s long term business outcomes given its short operating history; expectations regarding revenue, expenses and operations; the Company having sufficient working capital and ability to secure additional funding necessary for the exploration of the Company’s property interests; expectations regarding the potential mineralization, geological merit and economic feasibility of the Company’s projects; expectations regarding drill programs and the potential impacts successful drill programs could have on the life of the mine and the Company; mineral exploration and exploration program cost estimates; expectations regarding any environmental issues that may affect planned or future exploration programs and the potential impact of complying with existing and proposed environmental laws and regulations; receipt and timing of exploration and exploitation permits and other third-party approvals; government regulation of mineral exploration and development operations; expectations regarding any social or local community issues that may affect planned or future exploration and development programs; expectations surrounding global economic trends and technological advancements; and key personnel continuing their employment with the Company, as well as the Company’s ability to prepare an NI 43-101 compliant technical report, to bring the Mineral Resource into Preliminary Economic Assessment on the timeline provided and that the results will be consistent with the results referenced herein.”

There can be no assurance that such statements will prove to be accurate, and actual results and future events could differ materially from those anticipated in such statements. Important factors that could cause actual results to differ materially from the Company’s expectations include: limited operating history; high risk of business failure; no profits or significant revenues; limited resources; negative cash flow from operations and dependence on third-party financing; the uncertainty of additional funding; no dividends; risks related to possible fluctuations in revenues and results; insurance and uninsured risks; litigation; reliance on management and key personnel; conflicts of interest; access to supplies and materials; dangers of mineral exploration and related liability and damages; risks relating to health and safety; government regulation and legal uncertainties; the company’s exploration and development properties may not be successful and are highly speculative in nature; dependence on outside parties; title to some of the Company’s mineral properties may be challenged or defective; Aboriginal title and land claims; obtaining and renewing licenses and permits; environmental and other regulatory risks may adversely affect the company; risks relating to climate change; risks related to infrastructure; land reclamation requirements may be burdensome; current global financial conditions; fluctuation in commodity prices; dilution; future sales by existing shareholders could cause the Company’s share price to fall; fluctuation and volatility in stock exchange prices; and risks related to market demands. There can be no assurance that any opportunity will be successful, commercially viable, completed on time or on budget, or will generate any meaningful revenues, savings or earnings, as the case may be, for the Company. In addition, the Company will incur costs in pursuing any particular opportunity, which may be significant.

These factors and assumptions are not intended to represent a complete list of the factors and assumptions that could affect the Company and, though they should be considered carefully, should be considered in conjunction with the risk factors described in the Company’s other documents filed with the Canadian and United States securities authorities, including without limitation the “Risk Factors” section of the Company’s Annual Information Form dated November 29, 2023 which is available on SEDAR at www.sedarplus.ca. Although the Company has attempted to identify factors that would cause actual actions, events or results to differ materially from those disclosed in the forward-looking information or information, there may be other factors that cause actions, events or results not to be as anticipated, estimated or intended. The Company does not undertake to update any forward-looking information, except in accordance with applicable securities laws.

NOT INTENDED FOR DISTRIBUTION TO UNITED STATES NEWSWIRE SERVICES OR THE UNITED STATES