Happy Creek Announces Closing of Oversubscribed $3.75 Million Financing to Advance the Fox Tungsten Project

August 18, 2025 (Source) — HAPPY CREEK MINERALS Ltd (TSX-V: HPY, OTC: HPYCF, FSE: 1HC) (“Happy Creek” or the “Company”), is pleased to announce that it has closed the previously announced non-brokered private placement raising total gross proceeds of C$3,750,000 (the “Placement”). The over-subscribed Placement was led by PowerOne Capital Markets Limited. (“PowerOne”) , attracting interest from institutional investors, including funds managed by Waratah Capital Advisors Ltd (“Waratah”).

Happy Creek President and CEO, Jason Bahnsen, commented “We are extremely pleased with the support shown by institutional investors participating in the Placement, with two funds managed by Waratah to hold almost 20% of Happy Creek post financing.

The financing positions Happy Creek to immediately begin the previously announced 10,000 metre drill program at the Fox Tungsten Project (“Fox” or the “Project”), focused on the expansion of the 2018 NI43-101 resource estimate. We are mobilizing contractors and equipment to site now with drilling expected to begin by the first week in September.

Fox is one of the highest-grade tungsten projects globally and is extremely well located to be a future source of high-quality tungsten for the rapidly growing North American and European industrial and defense markets.”

The Fox Tungsten Project

The Fox Tungsten Project is a district-scale (136 square kilometre licence area), high-grade critical mineral project that Happy Creek has advanced from initial discovery to maiden resource stage. Fox is located approximately 70 kilometres northeast of 100 Mile House, British Columbia.

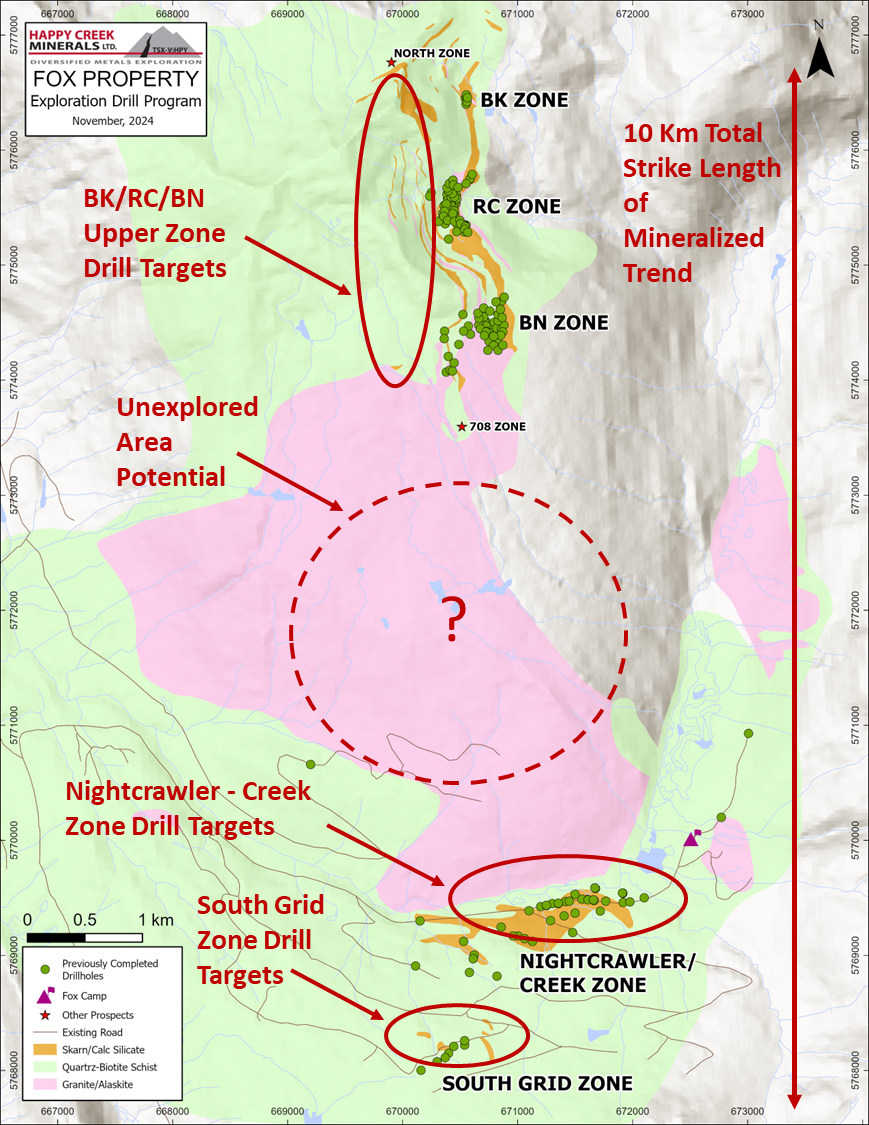

The tungsten bearing scheelite mineralization at Fox occurs in relatively flat-lying sequences of calcium silicate layers up to 20 metres in thickness. The mineralized layers appear to be stacked in groups. The Project has an overall identified mineralized trend of ten kilometres by five kilometres.

Happy Creek acquired Fox in 2006. From 2010 to 2017, Happy Creek completed diamond drilling and trenching programs at Fox resulting in the 2018 maiden NI43-101 resource estimate in the lower BK/RC/BN zones of 582.4 kt grading 0.83% WO3 Indicated plus 565.4 kt grading 1.23% WO3 Inferred. (For full details of the 2018 Fox Project Mineral Resource see the report by Pierre Desautels, P. Geo, AGP Mining Consultants Inc. and Paul Berndt, FAusIMM, dated April 9, 2018 and titled “NI 43-101 Resource Update for the RC and BN Zones and Maiden Resource Estimate for the BK Zone of the Fox Tungsten Project British Columbia” available on the Company’s website at www.happycreekminerals.com and www.sedarplus.ca.)

The upcoming drill program will focus on expanding the NI43-101 resource estimate by completing “step-out” drilling on the current resource area (lower BK/RC/BN zones) as well as targeting new areas identified through geological mapping, prospecting, and previous drilling. The new target zones include above and between the BK/RC/BN zones (see Figure 1).

Geological mapping completed by Happy Creek in 2017 through 2023 identified numerous mineralized outcrops between the BN and RC zones as well as at least three additional calcium silicate horizons that are approximately 50 to 150 metres in elevation above BK/RC/BN resource horizon. Mapping indicates that the upper horizons extend over two kilometres in strike length with an observed lateral extent of at least 500 metres west and beyond the area previously tested by drilling.

There is excellent potential to expand the resource horizon between deposits and to the west, and additional potential in the upper horizons. Drilling completed at the RC Zone in 2017, include two drill holes directly beneath Deception Mountain returned intervals of 19.4m of 0.93% WO3 and 26m of 1.19% WO3. (see announcement dated November 21, 2017).

Additional drill targets in the Nightcrawler and South Grid Zones may also be included in the drill program. Up to 100 diamond drill holes, totaling approximately 10,000 metres are planned across multiple zones over the two-year program.

Happy Creek is currently mobilizing contractors and equipment to begin drilling by the first week of September.

Figure 1 – Fox Project 2025/2026 Drill Target Zones

Placement Detail

The Placement consists of 34,625,000 flow-through units (the “FT Units”) at a price of C$0.07 for proceeds of $2,423,750 and 26,525,000 non-flow through units (the “NFT Units”) at a price of C$0.05 for gross proceeds of $1,326,250 (the “Placement”).

Each FT Unit will be comprised of one flow-through common share (a “FT Share”) and one half of one common share purchase warrant ( “Warrant”) and each NFT Unit will be comprised of one common share (a “Share”) and one half of one common share purchase warrant. Each Warrant will be exercisable into one common share of the Company at an exercise price of C$0.07 for a period of 60 months from the date of issue.

The gross proceeds of the Offering will be applied to the drilling, exploration and development of the Company’s Fox Tungsten Project and at other exploration projects located within the Cariboo district of British Columbia, Canada and for general working capital.

The FT Shares will qualify as “flow-through shares” (within the meaning of subsection 66(15) of the Income Tax Act (Canada) (the “Tax Act”)). An amount equal to the gross proceeds from the issuance of the FT Shares will be used to incur eligible resource exploration expenses which will qualify as (i) “Canadian exploration expenses” (as defined in the Tax Act), and (ii) as “flow-through mineral mining expenditures” (as defined in subsection 127(9) of the Tax Act) (collectively, the “Qualifying Expenditures”). Qualifying Expenditures in an aggregate amount not less than the gross proceeds raised from the issue of the FT Shares will be incurred (or deemed to be incurred) by the Company on or before December 31, 2026 and will be renounced by the Company to the initial purchasers of the FT Shares with an effective date no later than December 31, 2025.

Insiders of Happy Creek purchased 800,000 NFT Units. The participation of these insiders in the constitutes a related party transaction within the meaning of TSX-V Policy 5.9 and Multilateral Instrument 61-101 – “Protection of Minority Security Holders in Special Transactions” (“MI 61-101”). HPY has relied on exemptions from the formal valuation and minority shareholder approval requirements provided under sections 5.5(a) and 5.7(a) of MI 61-101 on the basis that the fair market value (as determined under MI 61-101) of insider participation in the private placement does not exceed 25% of HPY’s market capitalization.

The Company will pay finders fees under the Placement of $201,600 cash plus 4,032,000 broker warrants. Each broker warrant will be exercisable at a price of C$0.05 into one Finders Commission Unit. Each Finders Commission Unit will be comprised of one common share (a “Share”) and one half of one common share purchase finders commission warrant (a” Finders Commission Warrant”). Each Finders Commission Warrant will be exercisable at a price of C$0.05 into one common share for a period of 60 months from the date of issue.

The securities issued under the Placement will be subject to a hold period under applicable securities laws in Canada expiring four months and one day from the closing date of the Placement. The Company has received conditional approval of the TSX Venture Exchange for the Placement.

Qualified Person Statement

The technical and scientific contents of this release have been prepared, verified and approved by David Blann, P.Eng., a director of the Company, and a qualified person pursuant to National Instrument 43-101, Standards of Disclosure for Mineral Projects.

On behalf of the Board of Directors,

“Jason Bahnsen”

President and Chief Executive Officer

FOR FURTHER INFORMATION, PLEASE CONTACT:

Jason Bahnsen

Email: [email protected]

About Happy Creek Minerals Ltd.

Happy Creek is focused on making new discoveries and building resources in proximity to infrastructure on the Company’s 100-percent-owned portfolio of diversified metals projects in British Columbia.

Projects include the high-grade Fox Tungsten deposit, the Silverboss molybdenum-copper-gold-silver project adjacent to Glencore’s closed Boss Mountain molybdenum mine and the adjacent Hen-Art-DL gold and silver project.

On November 7, 2024, Happy Creek announced the closing of the sale of the Highland Valley Copper Project to Metal Energy Corp. (TSX:V MERG) (“Metal Energy”). Happy Creek holds 9.9% of Metal Energy issued capital and up to a 2.5% Net Smelter Return royalty on the Highland Valley mineral claims.

Happy Creek is committed to responsible mineral resource development. The Company’s priority is to build and sustain mutually beneficial relationships with Indigenous Communities in the territories in which the Company explores.

Additional information relating to Happy Creek Minerals Ltd. may be obtained or viewed on the SEDAR+ website at www.sedarplus.ca or on the Company’s website at www.happycreekminerals.com.

Forward Looking Statement

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

This press release contains “forward-looking information” within the meaning of applicable securities laws, including statements that address capital costs, recovery, grade, and timing of work or plans at the Company’s mineral projects and statements relating to the use of proceeds and completion of the Offering. Forward-looking information may be, but not always, identified by the use of words such as “seek”, “anticipate”, “foresee”, “plan”, “planned”, “continue”, “expect”, “thought to”, “project”, “predict”, “potential”, “targeting”, “intends”, “believe”, “opportunity”, “further” and others, or which describes a goal or action, event or result such as “may”, “should”, “could”, “would”, “might” or “will” be undertaken, occur or achieved. Statements also include those that address future mineral production, reserve potential, potential size or scale of a mineralized zone, potential expansion of mineralization, potential type(s) of mining, potential grades as well as to Happy Creek’s ability to fund ongoing expenditure, or assumptions about future metal or mineral prices, currency exchange rates, metallurgical recoveries and grades, favourable operating conditions, access, political stability, obtaining or renewal of existing or required mineral titles, licenses and permits, labour stability, market conditions, availability of equipment, accuracy of any mineral resources, anticipated costs and expenditures. Assumptions may be based on factors and events that are not within the control of Happy Creek and there is no assurance they will prove to be correct. Such forward-looking information involves known and unknown risks, which may cause the actual results to materially differ, and/or any future results expressed or implied by such forward-looking information. Additional information on risks and uncertainties can be found within Financial Statements and other materials found on the Company’s SEDAR+ profile at www.sedarplus.ca. Although Happy Creek has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking information, there can be no assurance that such information will prove to be accurate as actual results and future events could differ materially from those anticipated in such statements. Happy Creek withholds any obligation to update or revise any forward-looking information, whether as a result of new information, future events or otherwise, unless required by law.