Power Nickel Expands on High Grade Cu-Pd-Pt-Au-Ag Zone 5km northeast of its Main Nisk Deposit

Discovery hole had over 1 Oz/Tonne Combined Platinum and Palladium over 7.75 Metres

February 21, 2024 (Source) — Power Nickel Inc. (the “Company” or “Power Nickel”) (TSXV: PNPN) (OTCBB: PNPNF) (Frankfurt: IVVI) is pleased to announce that the first hole of a drill program following up on the Wildcat high grade PGM intersection, appears to have encountered a mineralized zone similar to the previously announced May 10th 2023.

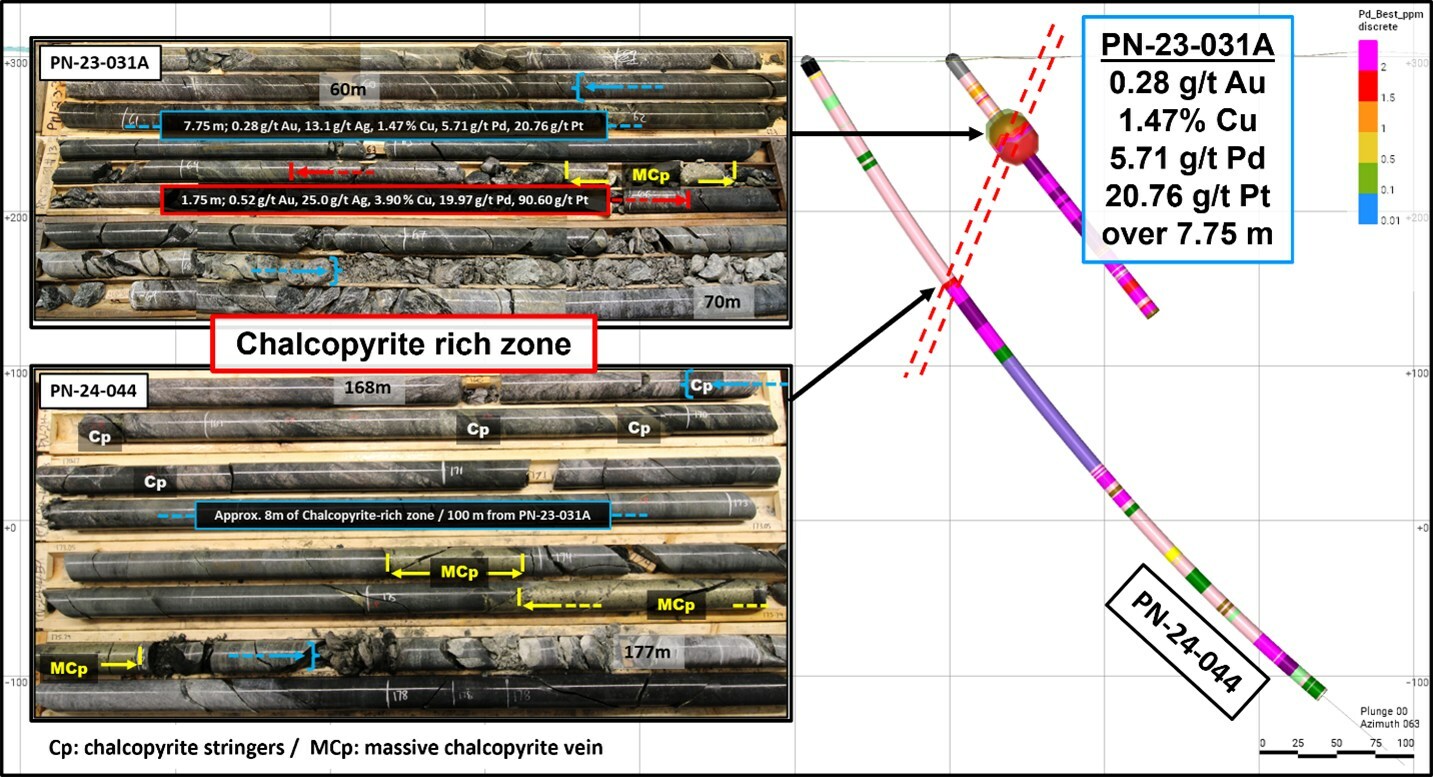

The initial Hole PN-23-031A (Figure 1) intersected multiple chalcopyrite stringers and veinlets, almost continuously in the first sixty (60) metres of the drill hole. The thickness and density of these stringers increased at 60.50 to 68.25 m down the hole. The main mineralization is characterized by a high density of chalcopyrite veinlets and local massive chalcopyrite (Figure 2).

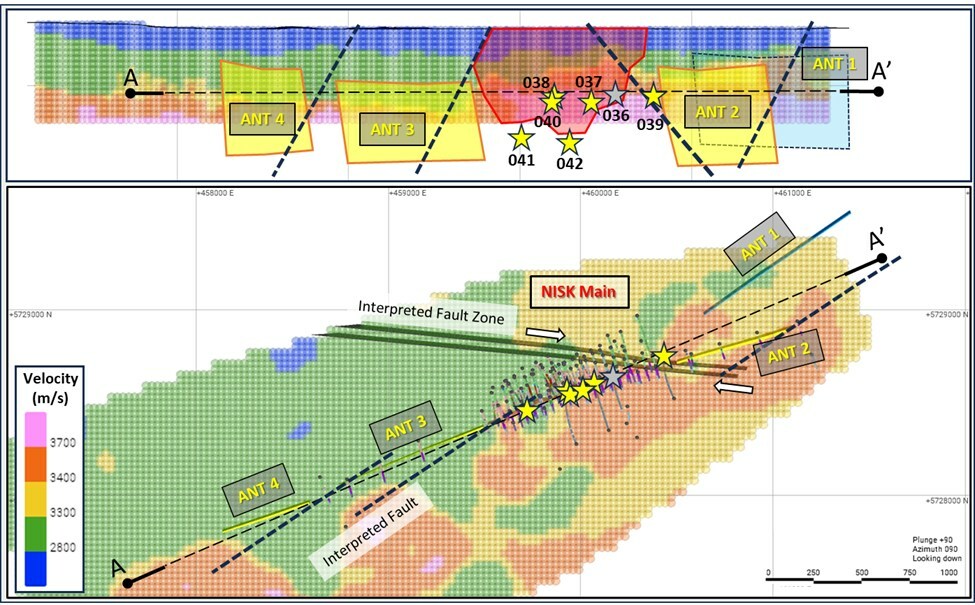

The current hole encountered the zone at a depth of 168.5 m. Wildcat area represents an entirely new target to explore and is wide open laterally along strike and at depth (Figure 3). This new discovery is very significant with high-grade platinum and palladium associated with the copper. It is probable that the high-grade platinum and palladium originated in the underlying ultramafic unit and remobilized to the tonalite unit where the mineralization occurs. As the mineralization is remobilized, there is potential for discovery in a broader target area in vicinity of the ultramafic source rocks. Follow-up drilling will consider all other lithological units in addition to identifying the source mineralization in the ultramafic unit.

“We are very encouraged to extend this, what appears to be, a very high grade PGM rich zone another 100 metres downdip from initial discovery. Will need assay results to confirm, but it certainly looks very good. Subsequent holes will test the horizontal width of this zone while also testing east and west extensions. The PGM discovery adds an exciting and valuable dimension to the Nisk Project. High value PGM zones can add significant value to the overall discovery. We are also excited to learn about our test of the deeper Ultramafic units where we are searching for massive sulfides containing Nickel.” – Commented Power Nickel CEO Terry Lynch

“We are currently drilling this area to discover a significant volume of Copper-PGM rich mineralization, but our primary goal at Nisk is to identify and explore for ultramafic rocks hosting nickel; so, we have pushed PN-24-044 further down and intersected and untested ultramafic unit observed to the south, in the footwall of the current target. As illustrated in Figure 4, we wanted to test the Fleet ANT velocity model that was suggesting a shallower dip for the footwall ultramafic unit, and we did obtain the anticipated result confirming our interpretation. Having in hands a predictive model certainly indicates that we are having a good grasp on the geology of the system. I’m a very strong believer that a better understanding of the overall geology is the key that will lead to additional discoveries across the property.” – commented Kenneth Williamson, Power Nickel VP Exploration.

Qualified Person

Kenneth Williamson, Géo, M.Sc., VP Exploration at Power Nickel, is the qualified person who has reviewed and approved the technical disclosure contained in this news release.

About Power Nickel Inc.

Power Nickel is a Canadian junior exploration company focusing on developing the High-Grade Nisk project into Canada’s first Carbon Neutral Nickel mine.

On February 1, 2021, Power Nickel (then called Chilean Metals) completed the acquisition of its option to acquire up to 80% of the Nisk project from Critical Elements Lithium Corp. (CRE: TSXV). Subsequently, Power Nickel has exercised its option to acquire 50% of the Nisk Project and delivered notice to Critical Elements that it intends to exercise its second option to bring its ownership to 80%. The last remaining commitment to exercise the option was the delivery of a NI-43-101 Technical report which has now occurred. Power Nickel expects to complete the acquisition in Q1.

The figure below presents a longitudinal view of the current 2023 Mineral Resource Estimate

About Us Figure 1

The NISK property comprises a significant land position (20 kilometers of strike length) with numerous high-grade intercepts. Power Nickel is focused on expanding the historical high-grade nickel-copper PGE mineralization with a series of drill programs designed to test the initial Nisk discovery zone and to explore the land package for adjacent potential Nickel deposits.

About Us Figure 2

In addition to the Nisk project, Power Nickel owns significant land packages in British Colombia and Chile. Power Nickel is expected to reorganize these assets in a related vehicle through a plan of arrangement.

Power Nickel announced on June 8, 2021, that an agreement had been made to complete the 100% acquisition of its Golden Ivan project in the heart of the Golden Triangle. The Golden Triangle has reported mineral resources (past production and current resources) in 130 million ounces of gold, 800 million ounces of silver, and 40 billion pounds of copper (Resource World). This property hosts two known mineral showings (gold ore and Magee) and a portion of the past-producing Silverado mine, reportedly exploited between 1921 and 1939. These mineral showings are Polymetallic veins containing quantities of silver, lead, zinc, plus/minus gold, and plus/minus copper.

Power Nickel is also 100 percent owner of five properties comprising over 50,000 acres strategically located in the prolific iron-oxide-copper-gold belt of northern Chile. It also owns a 3-per-cent NSR royalty interest on any future production from the Copaquire copper-molybdenum deposit sold to a subsidiary of Teck Resources Inc. Under the terms of the sale agreement, Teck has the right to acquire one-third of the 3-per-cent NSR for $3 million at any time. The Copaquire property borders Teck’s producing Quebrada Blanca copper mine in Chile’s first region.

To obtain Power Nickel’s Corporate Presentation, please use the link below:

http://powernickel.com/corporate_presentation.pdf

Power Nickel Inc.

The Canadian Venture Building

82 Richmond St East, Suite 202

Toronto, ON

Neither the TSX Venture Exchange nor it’s Regulation Services Provider accepts responsibility for the adequacy or accuracy of this release.

Cautionary Note Regarding Forward-Looking Statements

This message contains certain statements that may be deemed “forward-looking statements” concerning the Company within the meaning of applicable securities laws. Forward-looking statements are statements that are not historical facts and are generally, but not always, identified by the words “expects,” “plans,” “anticipates,” “believes,” “intends,” “estimates,” “projects,” “potential,” “indicates,” “opportunity,” “possible” and similar expressions, or that events or conditions “will,” “would,” “may,” “could” or “should” occur. Although the Company believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guarantees of future performance, are subject to risks and uncertainties, and actual results or realities may differ materially from those in the forward-looking statements. Such material risks and uncertainties include, but are not limited to, among others, the timing for the Company to close the private placement or the second Nisk option or risk that such transactions do not close at all; raise sufficient capital to fund its obligations under its property agreements going forward; to maintain its mineral tenures and concessions in good standing; to explore and develop its projects; changes in economic conditions or financial markets; the inherent hazards associates with mineral exploration and mining operations; future prices of nickel and other metals; changes in general economic conditions; accuracy of mineral resource and reserve estimates; the potential for new discoveries; the ability of the Company to obtain the necessary permits and consents required to explore, drill and develop the projects and if accepted, to obtain such licenses and approvals in a timely fashion relative to the Company’s plans and business objectives for the applicable project; the general ability of the Company to monetize its mineral resources; and changes in environmental and other laws or regulations that could have an impact on the Company’s operations, compliance with environmental laws and regulations, dependence on key management personnel and general competition in the mining industry.

SOURCE Power Nickel Inc.

For further information: Mr. Duncan Roy, VP Investor Relations, 416-580-3862, [email protected]