Arming the Arsenal: Molybdenum’s Role in U.S. Defense and the Top 10 Global Producers

In February, Chinese officials added a little-known element to Beijing’s growing list of export-controlled minerals – a move that quickly set off alarms in Washington. The metal was molybdenum, an unassuming grayish substance tucked in the periodic table between chromium and ruthenium. For decades, it drew scant attention outside of industrial circles. But as news broke that China would require special licenses to ship molybdenum products abroad, U.S. defense planners and policymakers took notice. This obscure mineral, it turns out, is a quiet linchpin of American military might – and a potential flashpoint in the escalating strategic competition over critical resources.

Officials in the Pentagon’s supply chain office have long known what few others do: molybdenum is essential for some of the toughest and most heat-resistant materials in U.S. weapons systems. It is a refractory metal – one that melts at extremely high temperatures – and when added in small amounts to steel or superalloys, it dramatically strengthens and hardens them. “Moly,” as it’s nicknamed by metallurgists, endows ordinary steel with exceptional toughness, the ability to withstand intense heat and corrosion, and a hardness that resists wear. According to the U.S. Defense Logistics Agency, molybdenum is primarily used as an alloying agent in steel, cast iron and nickel-based superalloys to boost hardenability, strength, and corrosion resistance. In practical terms, that makes it irreplaceable in many military-grade metals. There is “little substitution for molybdenum in its major application in steels,” the U.S. Geological Survey notes, underscoring that no other element quite replicates its mix of benefits.

The U.S. Military’s Unsung Workhorse – Molybdenum’s unique properties have made it a critical ingredient in an array of defense technologies, often behind the scenes. Its applications span some of the most demanding environments in the military:

- Armor Plating: High-strength alloy steels containing molybdenum form the armor of tanks and heavy vehicles, providing the hardness and toughness needed to stop projectiles without shattering. The steel plating on an Abrams battle tank, for instance, owes part of its resilience to a small percentage of molybdenum in the mix.

- Aerospace Alloys: The latest fighter jet engines and rocket nozzles rely on molybdenum-enriched superalloys to endure searing temperatures and stresses. Turbine blades in a jet engine’s hot section may contain a few percent molybdenum to prevent softening at high heat, a factor that can make the difference between an engine running smoothly or failing under combat conditions.

- Nuclear Systems: In naval reactors and other nuclear applications, molybdenum-bearing alloys are valued for their stability under intense radiation and heat. Components in nuclear reactors – from control rods to structural supports – can use molybdenum to resist corrosion and avoid weakening over long periods of neutron bombardment.

- Missiles and Electronics: Many missile components and high-end electronics also incorporate molybdenum. Its high melting point and ability to form durable compounds (like molybdenum disulfide, a superb solid lubricant) make it useful in missile guidance systems, wiring, and even the heat shields of hypersonic weapons. In short, whenever engineers need a metal that won’t buckle, corrode, or lose strength in extreme conditions, molybdenum is often part of the solution.

These metallurgical advantages have turned molybdenum into a strategic resource, even if it lacks the name recognition of, say, titanium or rare earth elements. During the Cold War, the U.S. and Soviet Union quietly stockpiled molybdenum for its military utility. Today, however, the U.S. government holds no national stockpile of the metal, and supply concerns are rising. Modern defense manufacturing simply cannot do without a steady supply of “moly.” As one Pentagon official put it recently, virtually “every DoD system is reliant on minerals” like these, and heavy import dependence “makes us highly vulnerable to supply chain disruptions”. Molybdenum might be mined out of sight and out of mind in remote mountain pits, but it is embedded in the steel skeleton of America’s fighter jets, warships and missile tubes.

Beijing’s Mineral Leverage

The sudden spotlight on molybdenum comes amid a broader reckoning over critical minerals and national security. China’s Ministry of Commerce framed its new export controls on molybdenum, tungsten and other metals as necessary to “safeguard national security interests.” But in Washington, the move was seen as a calculated response in the tit-for-tat economic standoff between the two powers. China is by far the world’s largest producer of molybdenum, mining an estimated 110,000 metric tons last year – over one-third of global output. It also sits atop the largest reserves. By controlling exports, Beijing can tighten the spigot on a material vital to U.S. defense manufacturing, sending a pointed message about Western trade pressure.

This isn’t the first time China has wielded its dominance in critical minerals as a geopolitical tool. In the past two years, it has steadily expanded export restrictions on a range of high-tech materials. Last December, Beijing banned shipments of gallium and germanium – two obscure semiconducting elements crucial to military sensors and solar panels – to the United States, after earlier requiring licenses for all exports of those metals. In April, it placed certain rare-earth magnet alloys under export control, threatening to disrupt industries from electric vehicles to precision-guided bombs. And in early February 2025, China imposed new licensing rules on five metals used in defense and clean energy – tungsten, tellurium, bismuth, indium, and molybdenum. Each of these materials may sound esoteric, but they are embedded in products like artillery shells, solar panels, night-vision devices – and, in molybdenum’s case, the very armor and engine parts that equip the U.S. military.

Under China’s new rules, exporters must apply for special government permission to ship out dozens of forms of molybdenum, from concentrates and powders to finished alloy products. Reuters reports that the curbs stopped short of an outright ban; they are narrowly targeted in some cases, aimed at preventing the most strategic grades of material from leaving the country. Even so, analysts warn of ripple effects. China produces such a large share of the global molybdenum supply that any restriction can tighten the market and drive up prices worldwide. “Industries dependent on these metals, including defense, [renewable] energy, electronics, and manufacturing, may experience supply chain disruptions, including delays, price increases, and bottlenecks,” Melissa “Mel” Sanderson, the Critical Minerals Institute (CMI) Co-chair noted after the announcement. In other words, even if the U.S. military doesn’t buy molybdenum directly from China, a squeeze on global supply could hit American firms – from steel mills that produce armor plate to manufacturers of jet engine parts – that do rely on Chinese molybdenum or on the higher global prices that result.

American defense contractors find themselves in an uneasy spot. The F-35 stealth fighter, for example, contains about 500 pounds of specialty alloys in its engine and airframe, many of them fortified with a dash of molybdenum or similar elements (niobium, vanadium, and so on). If molybdenum becomes harder to obtain, those alloys can’t easily be swapped out; substituting a less suitable metal could reduce a component’s performance or lifespan. “There is little substitution for molybdenum,” the USGS emphasizes in its annual commodity report. Other alloying elements – chromium, vanadium, titanium – can mimic some of its effects, but none provide the same all-around mix of high-temperature strength, hardness and corrosion resistance that critical defense steels demand. Tungsten, for instance, is even harder and boasts a higher melting point, yet it’s far heavier (nearly twice the density of molybdenum) and notoriously difficult to machine. In high-performance armor and aerospace applications, molybdenum hits the sweet spot. For China to leverage control over this metal is to put a dagger on a pressure point in the U.S. defense supply chain.

A Vulnerable Supply Chain

The United States is not entirely at China’s mercy on molybdenum – at least not yet. Thanks to significant deposits in states like Colorado, Utah, and Arizona, the U.S. retains some domestic production capacity. American mines produced roughly 33,000 tons of molybdenum in 2024, about 13% of global output. In fact, the United States and China are the only two countries in the world that mine molybdenum both as a primary product and as a byproduct of large copper mines. (Most other nations, such as Chile and Peru, recover it only while processing copper ore.) This gives the U.S. a measure of self-sufficiency – during some years, it has even been a net exporter of molybdenum. But appearances can be deceiving. American industry still relies on imported molybdenum in various forms to meet total demand. Between 2020 and 2023, the U.S. imported significant quantities of molybdenum concentrates and alloys from friendly nations like Peru (35% of imports), Chile (34%), Mexico (10%) and Canada. In essence, the U.S. supply chain is interwoven with global trade. If Chinese export controls send more molybdenum to domestic Chinese users and less to the world market, U.S. allies could see their supplies pinched – and by extension, so could American buyers.

Recent geopolitical developments have underscored the fragility of these supply lines. As one Defense Department official noted in a speech this year, “it is more urgent than ever to build capability and resilience in supply chains for critical minerals”. The Pentagon has identified dozens of minerals, from cobalt and rare earths to tungsten and molybdenum, that underpin defense technology and where excessive import dependence poses a strategic risk. In practically every modern weapons program – hypersonic missiles, armored vehicles, laser weapons, nuclear submarines – success hinges not just on design and funding, but on having reliable access to specialty materials. Any disruption, whether due to a foreign power’s embargo or a pandemic-driven logistics snarl, can delay production and “shut down production lines,” as industry executives warn. These scenarios are no longer theoretical: in 2021–22, global shortages of titanium (much of it sourced from Russia and China) forced some U.S. aerospace suppliers to slow deliveries. Defense contractors and military officials worry that a molybdenum crunch could similarly hamstring the output of critical hardware, from jet engines to armor-piercing ammunition.

Washington is starting to respond – albeit slowly. Lawmakers in both parties have raised concern that the U.S. has allowed its strategic materials stockpile to dwindle to a tiny fraction of Cold War levels. (Notably, molybdenum is currently not stockpiled at all by the National Defense Stockpile, a fact that has come under scrutiny in recent congressional hearings.) Over the past two years, the Biden administration and Congress have rolled out incentives aiming to re-shore or “ally-shore” critical mineral supply chains. Through the Defense Production Act and other authorities, federal funds have been allocated to jump-start domestic mining and refining projects for key resources. Molybdenum is among them: in 2024, a Canadian mining firm — Centerra Gold Inc. (TSX: CG | NYSE: CGAU) announced plans to reopen an idled molybdenum mine in Idaho – once one of the world’s top sources of the metal – with an expected restart by 2027. The same company is ramping up a processing facility in Pennsylvania to refine molybdenum ore on U.S. soil. If successful, these efforts could reduce America’s vulnerability by boosting local output and reducing the need for imports from overseas.

Still, building a resilient supply chain will take years, and time may not be on America’s side. China’s latest export curbs on molybdenum and other minerals come at a moment when demand for defense materials is climbing. The war in Ukraine, tensions in the Taiwan Strait, and a new era of great-power arms competition have led the U.S. and its allies to ramp up production of everything from missiles to naval ships – all of which require steady infusions of specialty metals. Molybdenum prices on international markets jumped in the wake of Beijing’s announcement, reflecting fears of a tightening supply. Minerals like these may be obscure, but they are the backbone of modern economies and militaries, and Beijing’s strategic calculus seems to recognize that. As China’s leaders look for leverage against the West, controlling the flow of critical resources is a powerful lever to pull.

National security experts say the molybdenum situation highlights a broader need for urgency. The United States benefited for decades from ample global markets that kept crucial inputs abundant and relatively cheap. But in a world where geopolitical rivals can weaponize supply chains, economic efficiency can quickly turn into strategic liability. The Pentagon’s point man for critical minerals, Adam Burstein, warned recently that America must rethink how it sources vital minerals. Stockpiling is one option, but it’s essentially a stopgap – “a band-aid… rather than a long-term solution,” as a Government Accountability Office report observed. The more profound challenge is to foster new mines, processing plants, and recycling capabilities so that metals like molybdenum remain available even if foreign doors close.

For now, molybdenum’s moment in the limelight serves as a stark reminder that high-tech weaponry still depends on raw geologic commodities pulled from the earth. An advanced fighter jet or main battle tank may represent the pinnacle of engineering, but it’s only as strong as the materials that go into it. And those materials – whether rare earth magnets or molybdenum-hardened steel – are increasingly subject to the currents of global politics. As Washington scrambles to secure its defense supply chains for an uncertain future, a once-overlooked element has emerged front and center. In the contest of great powers, even the periodic table has become a battleground, and molybdenum offers a case study in how a single metal can carry outsized strategic importance.

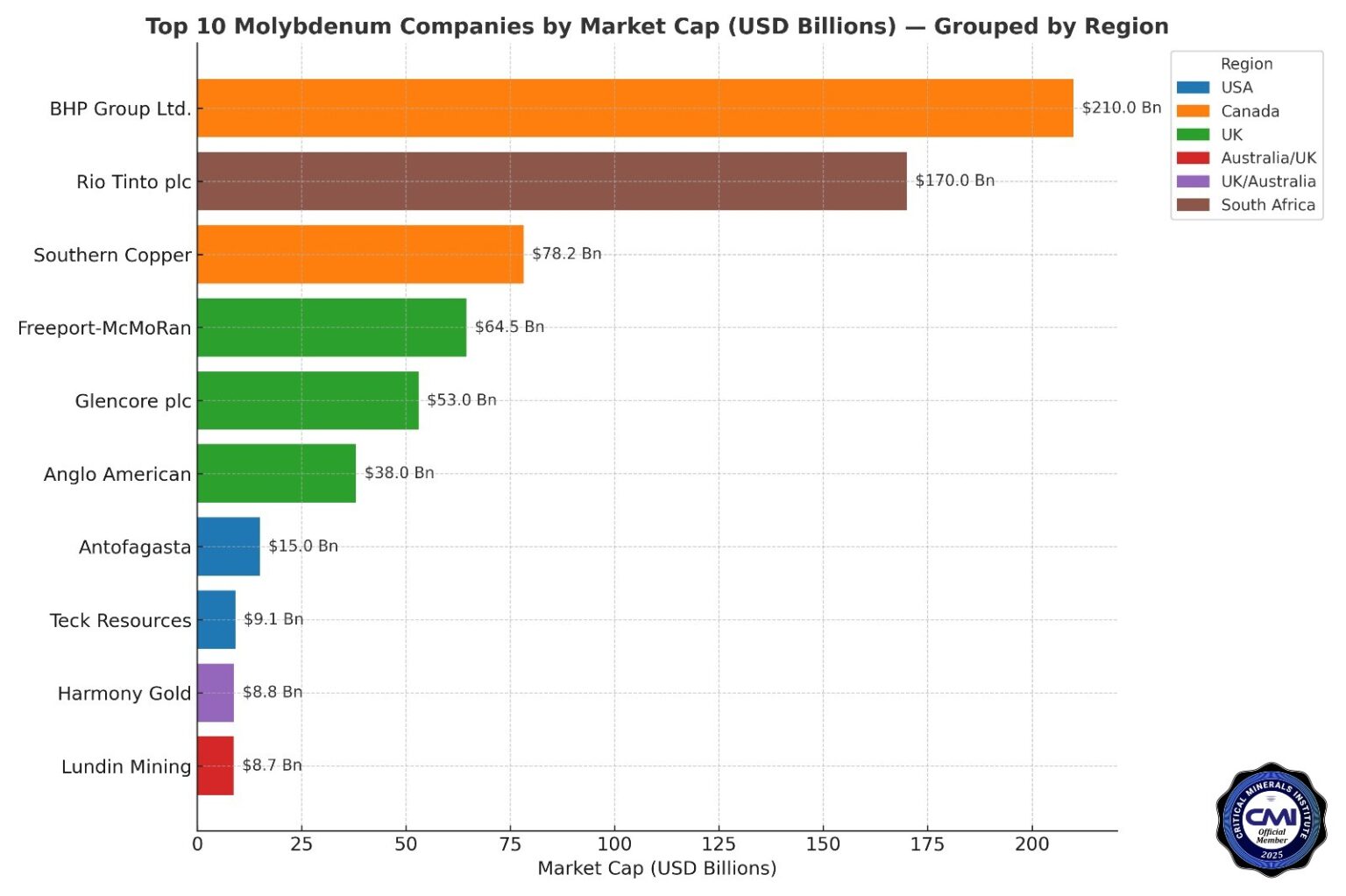

Now for the Top 10 Molybdenum companies as recognized by the Critical Minerals Institute (CMI)!

#1. BHP Group Ltd. (ASX: BHP | LSE: BHP)

No company on Earth carries the sheer geopolitical heft of BHP Group Ltd. when it comes to mining. With a market capitalization exceeding A$200 billion, BHP is not just a resource behemoth—it is an industrial keystone, shaping the contours of global supply chains from copper and iron ore to uranium and molybdenum.

While molybdenum is far from its headline act, BHP’s quiet dominance in the metal underscores a strategic reach that rivals government-led stockpiles. Through its 33.75% ownership stake in the Antamina mine in Peru—a joint venture with Glencore PLC (LSE: GLEN | JSE: GLN), Teck Resources Limited (TSX: TECK.A | TSX: TECK.B | NYSE: TECK), and Mitsubishi—BHP helps produce more than 14 million pounds of molybdenum annually. This mine is one of the world’s top five molybdenum producers, delivering the alloying element essential for high-strength steels, turbines, pipelines, and military-grade armor plating.

BHP’s exposure to molybdenum is also embedded in the metallurgical processes at its Olympic Dam facility in South Australia, where molybdenum appears in trace but valuable quantities within uranium and copper circuits. With the renewed focus on securing mineral independence in the West, these by-products—once overlooked—are rapidly ascending in strategic importance.

The company has not publicly disclosed direct contracts with the U.S. Department of Defense, yet BHP’s role as a core supplier of critical minerals indirectly supports numerous defense-related supply chains. Its uranium and copper operations are already deeply interwoven with Western nuclear fuel supply initiatives, and molybdenum’s role in armor, aerospace, and nuclear technology positions BHP as a passive yet pivotal player in Western military readiness.

CEO Mike Henry has repeatedly emphasized BHP’s commitment to “future-facing commodities,” and molybdenum quietly checks many of the same boxes as lithium or nickel: it is essential, limited in production, and increasingly geopolitically sensitive.

With China exerting control over much of the world’s molybdenum processing, the significance of Western-aligned producers like BHP cannot be overstated. Even as it expands its copper dominance in the Americas, BHP’s involvement in molybdenum-rich deposits is likely to deepen—especially if industrial and defense demand continues to outpace global supply.

In an era where commodity flows are becoming weapons of diplomacy, BHP’s footprint in molybdenum might be more strategic than the market currently acknowledges.

#2. Rio Tinto PLC (NYSE: RIO | LSE: RIO | ASX: RIO)

At first glance, Rio Tinto’s portfolio is a study in mineral diversification: aluminum, iron ore, copper, lithium. But below the surface, the London- and Sydney-listed giant is also a major—and often underappreciated—force in the global molybdenum market.

Through its Climax Molybdenum partnership and direct ownership of the Kennecott copper operation in Utah, Rio Tinto produces significant quantities of molybdenum as a by-product. Kennecott alone has emerged as one of the largest domestic U.S. sources of molybdenum concentrate, averaging over 18 million pounds of annual output in recent years. This places Rio Tinto in a small circle of companies capable of supplying the U.S. defense industrial base with domestically sourced molybdenum.

The strategic weight of Kennecott’s production cannot be overstated. In 2024, the White House highlighted Kennecott as a critical supplier in its review of the Defense Production Act, though Rio Tinto itself has not disclosed direct military contracts. Instead, the company operates as a behind-the-scenes powerhouse, funneling critical materials into infrastructure, aerospace, and defense manufacturing pipelines across North America.

Rio Tinto’s presence in Mongolia, via its Oyu Tolgoi mine, further amplifies its molybdenum credentials. This sprawling operation, co-owned with the Mongolian government, yields molybdenum as a secondary product—one that is increasingly central to Rio’s future-facing materials strategy. And with Chinese influence spreading across Central Asia, Rio’s control over this asset offers strategic leverage well beyond metallurgy.

Under CEO Jakob Stausholm, Rio Tinto has sought to rehabilitate its reputation in ESG-conscious circles, even as it doubles down on supplying metals essential to the energy transition. Molybdenum is one of the quiet workhorses in that shift—vital to both clean energy infrastructure and military-grade alloys.

Yet Rio’s molybdenum footprint is still overshadowed by its iron ore empire. That may not last. With molybdenum prices rising and supply chains fragmenting, Rio Tinto’s legacy assets like Kennecott are becoming newly relevant in policy circles from Washington to Brussels. If the West is serious about reducing dependence on Chinese critical mineral processing, companies like Rio will be called upon—not as afterthoughts, but as first responders.

In molybdenum, Rio Tinto is not just a by-product beneficiary—it is a pillar of geopolitical resilience.

#3. Southern Copper Corp. (NYSE: SCCO | LSE: SCCO)

When it comes to copper, few names carry more weight than Southern Copper Corp. But beneath its sprawling Latin American holdings lies another strategic asset often overlooked: molybdenum. As the by-product of its massive porphyry copper operations in Mexico and Peru, molybdenum production at SCCO is not just incidental—it’s industrially critical.

Southern Copper, majority-owned by Grupo México, is one of the world’s top five molybdenum producers. Its Toquepala, Cuajone, La Caridad, and Buenavista del Cobre mines collectively generate tens of millions of pounds of moly annually, making the company an indispensable player in global supply chains for high-performance steels and military-grade alloys.

The company’s molybdenum operations are centered at La Caridad, where a dedicated roasting facility ensures value-added processing. According to 2024 production reports, SCCO’s annual molybdenum output topped 27,000 metric tons—second only to Freeport-McMoRan Inc. (NYSE: FCX) globally. This scale positions SCCO as a swing supplier in markets often dominated by Chinese or state-linked producers.

Though its customer base is primarily industrial, Southern Copper’s molybdenum indirectly reaches defense contractors in the United States, Japan, and Europe. The element’s role in armor plating, missile components, and nuclear containment makes SCCO a silent contributor to Western defense readiness—even without formal Pentagon contracts.

Yet the company’s geopolitical footprint comes with complications. Its major operations are situated in regions of heightened political tension, including Peru’s southern Andes—an area periodically rocked by resource nationalism, labor strikes, and community disputes. In 2023, protests near Cuajone halted molybdenum shipments for over a month, highlighting the fragility of even the most sophisticated supply networks.

CEO Oscar González Rocha has steered Southern Copper with a steady hand, emphasizing vertical integration, low production costs, and robust environmental programs. But as Western governments scrutinize their reliance on foreign-sourced critical minerals, SCCO’s Latin American base could attract increased attention—both as a strength and a vulnerability.

While its public narrative is dominated by copper, Southern Copper Corp.’s molybdenum operations are among the most consequential outside of China. As nations scramble to secure long-term supplies of strategic metals, SCCO may find itself thrust into the geopolitical spotlight, not for what it says, but for what it ships.

#4. Freeport-McMoRan Inc. (NYSE: FCX)

If there is a company that defines molybdenum in the Western Hemisphere, it is Freeport-McMoRan Inc. With operations sprawling across the Americas and Indonesia, FCX is best known for its copper and gold leadership. But it is through its Climax Molybdenum subsidiary that Freeport wears the crown: it is the world’s largest publicly traded molybdenum producer.

The company’s Colorado-based operations—Climax and Henderson—are among the only primary molybdenum mines in the world. In 2023 alone, Freeport produced over 32,000 metric tons of molybdenum, a staggering volume that accounted for more than 20% of non-Chinese global output. For the United States, Freeport is not just a supplier—it is the strategic foundation for domestic molybdenum security.

Climax Molybdenum also operates roasting and conversion facilities in the U.S. and Europe, making FCX one of the few fully integrated molybdenum producers in the West. These facilities provide high-purity moly oxide, ferromolybdenum, and chemical-grade products used in turbine blades, defense armor, pipelines, and corrosion-resistant steel alloys.

While Freeport has not confirmed direct Department of Defense contracts, it is difficult to imagine a military alloy supply chain in North America that doesn’t rely—at least indirectly—on Climax’s output. Molybdenum’s inclusion in critical systems like jet engines, missile guidance systems, and naval vessels makes FCX a de facto cornerstone of defense manufacturing.

Beyond its primary mines, Freeport also recovers molybdenum as a by-product at its massive Grasberg (Indonesia) and Cerro Verde (Peru) copper operations. This by-product strategy—combined with high-purity primary production—gives the company unmatched flexibility and pricing leverage in a metal often treated as secondary.

CEO Kathleen L. Quirk, who took the helm in 2024, has maintained FCX’s focus on long-term sustainability, announcing continued investments in mine-life extensions and environmental reclamation. But she is also tasked with navigating a tightrope: balancing shareholder value with growing geopolitical expectations for U.S.-sourced strategic materials.

As Western governments push for resource independence, Freeport’s role becomes even more pivotal. It’s not just that FCX is the largest molybdenum miner in America—it’s that, in many ways, it’s the only one. In the event of supply disruptions or international tensions, Freeport-McMoRan is the first—and perhaps only—line of defense.

#5. Glencore PLC (LSE: GLEN | JSE: GLN)

Glencore plc is not a company that moves quietly. With a market cap north of £50 billion and tentacles extending from mining to trading floors, it is arguably the most opaque and influential force in global commodities. And when it comes to molybdenum, Glencore’s dominance is multifaceted—rooted in both physical production and market manipulation.

The Swiss-based conglomerate holds strategic stakes in two of the world’s largest molybdenum producers: the Antamina and Collahuasi mines in Peru and Chile, respectively. These sites are not bit players—they represent nearly 15% of global molybdenum production. Collahuasi alone is often cited as a top-three producer by volume. Though Glencore typically refers to these interests as “copper-focused,” the molybdenum by-product is no mere footnote.

What sets Glencore apart is its ability to influence molybdenum pricing through its global trading arm. With warehousing, shipping, and hedging capabilities, Glencore is often the buyer, the seller, and the price setter—creating a market asymmetry few can match. This reach becomes particularly important during periods of geopolitical instability, when molybdenum spot prices can spike due to sanctions or trade disruptions.

As of 2025, Glencore has not disclosed any direct supply relationships with the U.S. Department of Defense. However, its output from Antamina (co-owned with BHP, Teck, and Mitsubishi) feeds into global molybdenum supply chains that ultimately service defense contractors in the U.S., NATO, and allied countries. With molybdenum vital for armor plate, jet turbine shafts, and submarine components, Glencore’s footprint is inherently geopolitical—even when it avoids the spotlight.

Under CEO Gary Nagle, the company has maintained its posture as a profit-driven operator that shuns publicity. This extends to its molybdenum narrative, which is rarely foregrounded in investor presentations. Yet behind the scenes, Glencore’s molybdenum book is one of the most influential in the world—precisely because it straddles both mining and marketing.

Critics argue that Glencore’s dominance gives it undue influence over strategic materials pricing—an accusation the company shrugs off as the byproduct of efficiency. Still, in an era when Western governments are racing to secure critical minerals, the idea that a private Swiss firm holds this much sway over molybdenum flows is beginning to raise eyebrows.

For policymakers, Glencore is both a risk and a necessity. And for those watching the evolution of global molybdenum markets, it remains the player no one can afford to ignore.

#6. Anglo American PLC (LSE: AAL)

Anglo American is often described as a mining aristocrat—steeped in legacy, with operations spanning five continents and roots tracing back over a century. In molybdenum, as in other commodities, the company operates with quiet authority.

Through its ownership of the Los Bronces mine in Chile and a 44% stake in the Collahuasi joint venture, Anglo American is directly linked to two of the largest molybdenum-producing copper deposits in the world. While these mines are technically copper-focused, the molybdenum by-product is substantial—Collahuasi alone yields tens of millions of pounds annually, making Anglo American a top-tier molybdenum producer by association.

Yet Anglo American rarely highlights its molybdenum output. In quarterly reports and investor updates, moly appears in footnotes—listed as a “secondary contribution” rather than a core product line. This understatement masks its strategic significance. Molybdenum’s properties—high melting point, corrosion resistance, strength-to-weight ratio—make it irreplaceable in aerospace, military hardware, and nuclear energy applications.

Though not publicly listed as a Department of Defense supplier, Anglo American’s molybdenum contributes to global alloy supply chains that ultimately feed into Western defense systems. The company’s ores flow through global concentrators and refiners, and by the time they become part of jet turbines or naval propulsion systems, the origin label has long since vanished. Yet without Collahuasi’s output, many of those systems would face bottlenecks.

CEO Duncan Wanblad, who assumed the role in 2022, has taken a pragmatic stance toward critical minerals. Under his leadership, Anglo American has doubled down on “future-enabling” commodities—lithium, copper, platinum group metals. Molybdenum, while rarely spotlighted, fits squarely into that strategy, especially as NATO nations accelerate their rearmament timelines and infrastructure spending.

Political unrest in Chile remains a risk factor. Labor tensions, water access rights, and environmental disputes near Los Bronces have triggered periodic shutdowns. Yet Anglo’s deep social license and long-term capital approach have helped it weather challenges that would derail less entrenched operators.

As the West reassesses its critical mineral supply chains, Anglo American’s molybdenum operations—once considered peripheral—are gaining renewed strategic relevance. In a fragmented geopolitical environment, old-world miners like Anglo may soon find themselves at the center of new-world industrial policy.

#7. Antofagasta PLC (LSE: ANTO)

Antofagasta PLC is Chile’s copper champion—a company deeply entwined with the country’s geology, economy, and politics. Yet within its high-altitude operations lies an unsung strategic asset: molybdenum. As a by-product of its flagship Los Pelambres and Centinela copper mines, molybdenum production has quietly become a core value stream in an increasingly fractured global supply chain.

In 2022, Antofagasta produced over 11,400 tonnes of molybdenum, placing it among the top five producers outside of China. This is no coincidence. Los Pelambres, a sprawling porphyry deposit nestled in the Andes, has long been known for its rich molybdenum zones. The company has made consistent investments in its moly recovery circuits, turning what was once a metallurgical nuisance into a revenue-generating asset with strategic relevance.

CEO Iván Arriagada has adopted a disciplined expansion approach, pushing Antofagasta toward operational efficiency while embracing the transition to “future-facing” metals. While lithium and green copper receive the public spotlight, molybdenum continues to perform behind the scenes—essential in desalination plants, gas pipelines, and advanced aerospace systems.

Although the company does not maintain public contracts with the U.S. Department of Defense, Antofagasta’s molybdenum routinely enters global industrial markets where it is alloyed into military-grade steels and corrosion-resistant applications. That indirect link to national security has not gone unnoticed by policymakers monitoring the West’s exposure to Chilean exports.

Still, there are vulnerabilities. Water scarcity, Indigenous land rights, and political volatility in Chile remain headwinds. Environmental permitting at Los Pelambres has faced scrutiny from both local communities and Santiago’s shifting political coalitions. In a 2024 investor call, Arriagada acknowledged the growing complexity: “We must align world-class production with world-class sustainability.”

Despite these pressures, Antofagasta’s molybdenum output provides Western industries with one of the most reliable alternatives to Chinese-controlled supply. As nations scramble to rewire their critical mineral procurement strategies, this low-profile by-product could vault the company into unexpected geopolitical relevance.

For now, Antofagasta remains content to let copper be its public face. But beneath the surface, molybdenum continues to anchor its long-term strategic value—quietly shaping the alloys of infrastructure, defense, and the green energy transition.

#8. Harmony Gold Mining Company Limited (NYSE: HMY)

Harmony Gold is best known for its deep-level gold mines in South Africa, but its growing presence in the critical minerals conversation is anchored thousands of miles away—in Papua New Guinea. That’s where its co-ownership of the Wafi-Golpu project places it squarely on the molybdenum map.

The Wafi-Golpu copper-gold-molybdenum deposit, a joint venture between Harmony Gold and Newmont (formerly Newcrest), contains over 47 million pounds of molybdenum in measured and indicated resources. This is not speculative mineralization—it is bankable geology, with feasibility studies confirming economic potential. In a world reorienting toward supply security, that molybdenum carries strategic weight.

In 2022, Harmony made headlines for completing Australia’s first-ever molybdenum recovery plant at its Cadia Valley Operations in New South Wales, in collaboration with its then-partner Newcrest. That facility began producing roughly 1,400 tonnes of moly concentrate annually—small by global standards, but enormous in its symbolism: a Western democracy building vertical integration into a market long dominated by China.

CEO Beyers Nel has quietly guided Harmony into this strategic transition. While the company remains fundamentally a gold producer, its molybdenum production is increasingly seen as a geopolitical asset. Harmony’s corporate messaging has emphasized the “co-product value” of molybdenum in diversified portfolios—a signal to both investors and governments that the company is paying attention to critical mineral narratives.

There are no disclosed contracts with the U.S. Department of Defense, but Harmony’s molybdenum ultimately feeds into industrial alloy streams that make their way into military supply chains across Asia and North America. With China tightening exports of high-grade molybdenum products, the potential for Australia and PNG-based sources to fill the gap is rising.

Yet regulatory risk remains a defining feature. The Wafi-Golpu project has faced permitting delays and negotiations with the Papua New Guinea government over royalties, community impact, and environmental oversight. Harmony’s history in navigating regulatory complexity in South Africa may serve it well, but the geopolitical stakes in PNG are different—this is not just about gold, but about Western access to a strategic alloy.

As molybdenum continues to gain recognition as a cornerstone of modern infrastructure and defense systems, Harmony Gold may find that its future lies not only in bullion—but in alloys hardened for the 21st century.

#9. Lundin Mining Corp. (TSX: LUN | Nasdaq Stockholm: LUMI)

Lundin Mining Corp. operates like a boutique heavyweight—selective in assets, aggressive in development, and global in ambition. While best known for its copper portfolio, the company has carved out a meaningful footprint in molybdenum, particularly through its Chilean operations.

At the heart of its molybdenum strategy lies the Caserones mine, where Lundin acquired a 51% stake in 2023. Caserones produces between 2,500 and 3,000 tonnes of molybdenum annually—among the highest outputs for a non-Chinese asset. Situated in Chile’s Atacama region, the mine benefits from existing infrastructure, stable output, and access to North Asian markets.

Lundin’s involvement with molybdenum doesn’t end there. Its Candelaria copper operation, also in Chile, yields molybdenum as a by-product. These dual operations give Lundin an advantage in portfolio optionality, allowing the company to respond dynamically to shifts in global molybdenum pricing and demand.

Under the leadership of CEO Peter Rockandel, Lundin has accelerated its pivot toward “strategic copper and critical by-products.” While lithium and cobalt dominate the headlines, Rockandel has been blunt about molybdenum’s growing importance. “It’s not about chasing buzzwords,” he remarked in a 2024 interview. “It’s about producing what the future actually needs—and molybdenum is part of that future.”

Although Lundin has no known direct Department of Defense contracts, the company’s molybdenum indirectly enters global supply streams that power Western military, aerospace, and nuclear programs. The strategic utility of Caserones has not gone unnoticed by U.S. and Canadian officials eager to diversify away from Chinese sources.

Still, Lundin faces political and operational headwinds in Chile. Environmental permitting, water use conflicts, and pressure from Indigenous communities have intensified in recent years. The company has responded with enhanced ESG disclosures and expanded community investment programs—a reflection of the delicate balance it must strike in resource-rich, regulation-tight regions.

In a tightening global race for critical minerals, Lundin Mining stands out for its calculated approach: not the biggest, not the loudest, but increasingly essential. With two of its mines delivering molybdenum at commercial scale, the company is well-positioned to serve both industrial and strategic buyers in a world rapidly waking up to the metal’s importance.

For investors and policymakers alike, Lundin’s molybdenum story is no longer just a byline—it’s a headline in the making.

#10. Teck Resources Limited (TSX: TECK.A | TSX: TECK.B | NYSE: TECK)

Teck Resources is Canada’s polymetallic workhorse—a company that mines copper, zinc, and coal with the consistency of a metronome. But behind its diversified revenue streams lies one of the most strategically situated molybdenum portfolios in the Western Hemisphere.

At its Highland Valley Copper operation in British Columbia—Canada’s largest open-pit copper mine—Teck produces molybdenum concentrate as a by-product. The ore body is one of the few in North America capable of delivering consistent, scalable molybdenum output, and Teck’s integrated approach ensures downstream value from both copper and moly circuits. In addition to Highland Valley, Teck owns a 22.5% interest in Peru’s Antamina mine, one of the world’s top five molybdenum producers.

Until 2016, Teck also held ownership stakes in the Endako and Thompson Creek mines, as well as the Langeloth metallurgical facility in Pennsylvania. These assets were acquired in 2016 by Centerra Gold Inc. (TSX: CG | NYSE: CGAU) through its purchase of Thompson Creek Metals Company. Today, Langeloth remains one of the few roasting facilities in North America capable of refining molybdenum oxide to aerospace-grade specifications and, together with Thompson Creek, forms the core of Centerra’s vertically integrated Molybdenum Business Unit.

Under CEO Jonathan Price, Teck has reaffirmed its commitment to critical minerals. While the company recently sold its steelmaking coal business, it has doubled down on copper and molybdenum, emphasizing their role in the energy transition and infrastructure renewal. “Teck is positioning itself as a builder of the next economy,” Price noted in a recent address to shareholders. “And molybdenum has a critical place in that architecture.”

Teck’s molybdenum strategy is anchored by its Highland Valley and Antamina production, offering a stable supply that supports sectors from energy to defense. And while it no longer owns Langeloth or Thompson Creek, Teck’s remaining portfolio still gives it influence in the global moly market—especially as governments and industries seek resilient, non-Chinese supply chains.

In a world of fragmentation and fracture, Teck Resources offers something rarer than scale: security with a northern accent.

Strategic Standout — Centerra Gold Inc. (TSX: CG | NYSE: CGAU)

While Centerra Gold does not rank among the top 10 global molybdenum producers by market capitalization—its valuation of approximately USD 1.4 billion places it well below industry giants like BHP, Freeport-McMoRan, and Rio Tinto—it commands outsized strategic influence in North America’s molybdenum supply chain.

Centerra’s pivotal role was cemented in 2016 with its acquisition of Thompson Creek Metals Company, bringing the Endako and Thompson Creek mines and the Langeloth metallurgical facility into its portfolio. This acquisition positioned Centerra as one of the few Western companies with a vertically integrated molybdenum business unit, capable of controlling production from mine to aerospace-grade refining.

In 2024, the company announced restart activities at Thompson Creek as part of a long-term plan to strengthen domestic molybdenum security. First production remains targeted for the second half of 2027, when high-grade feed from Thompson Creek will bolster Langeloth’s output and move it toward its full annual roasting capacity.

With Langeloth being one of the few roasting facilities in North America able to produce high-purity molybdenum oxide for advanced manufacturing and defense applications, Centerra’s role extends beyond its market cap. In the race to secure resilient, non-Chinese critical mineral supply chains, Centerra Gold is a small-cap with big-league strategic value.

The Critical Minerals Institute (CMI): The Brain Trust of the Critical Minerals Economy.

The Critical Minerals Institute (CMI) is a global organization dedicated to addressing the challenges and opportunities in the critical minerals sector. CMI’s mission is to equip businesses, governments, and stakeholders with comprehensive resources and insights into the value, sustainability, and strategic importance of critical minerals essential for technological and industrial advancement. Serving as an international hub, the Institute links companies, capital markets, and experts through exclusive CMI Masterclasses, a weekly Critical Minerals Report (CMR), in depth research publications, and board level advisory services. For more information, go to CriticalMineralsInstitute.com or to secure a CMI Membership, click here