The end of net-zero targets

Major banks pull out from net-zero initiatives as energy demand soars

At start of a new year, we normally take a step back from our weekly focus on the granular details of specific metals, individual policies, etc, and take a macro view, examining the bigger picture and underlying trends.

At the start of 2023, we projected the world had reached peak green and that “for the energy transition, 2024 will be a year of retrenchment” with:

- further pushback on net-zero deadlines

- increased tariffs vs China

- nuclear power will continue to rise as a priority

- a shift back towards traditional fossil fuel energy

This year we go further.

2025 will be a make-or-break year for many geopolitical gambits played over the past 30 years, but we want to focus on a single one projection for 2025:

The end of net-zero targets.

The end of net-zero targets will have a significant impact across the energy and mining industry.

And it has already started with major banks, including Morgan Stanley, Goldman Sachs, JP Morgan, CitiGroup, Bank of America and Wells Fargo, announcing they have left the Net-Zero Banking Alliance; and BlackRock announcing they have left the Net Zero Asset Managers initiative, one of the world’s biggest climate-investor groups, which has now announced its suspended activities.

There are five main factors driving this trend:

- AI

- high energy costs in Europe

- China (and coal)

- Interest Rates, higher for longer

- Donald Trump

Net-zero targets

The Paris Agreement is a legally binding international treaty on climate change, adopted by 196 Parties at the UN Climate Change Conference (COP21) in Paris, France, on 12 December 2015.

Its primary goal is to hold “the increase in the global average temperature to well below 2°C above pre-industrial levels”, with global leaders stressing the need for greenhouse gas emissions to peak before 2025 and decline 43% by 2030.

The nationally determined contributions to meet net-zero targets include:

- European Union (EU)’s legally binding target of climate neutrality by 2050, with an interim target of 55% reduction in greenhouse gas emissions by 2030 compared to 1990 levels

- the US rejoined the Paris Agreement in 2021 and has pledged (not legally-binding) to reduce net greenhouse gas emissions by 50-52% in 2030 and reach net-zero by 2050

- China has pledged (not legally-binding) to be carbon neutral by 2060

- India has pledged to reach net-zero by 2070

These net zero targets may not be “officially” removed from legislation, but their practical relevance is likely to critically diminish as countries struggle to meet ambitious climate goals amidst economic and political pressures.

Artificial Intelligence (AI)

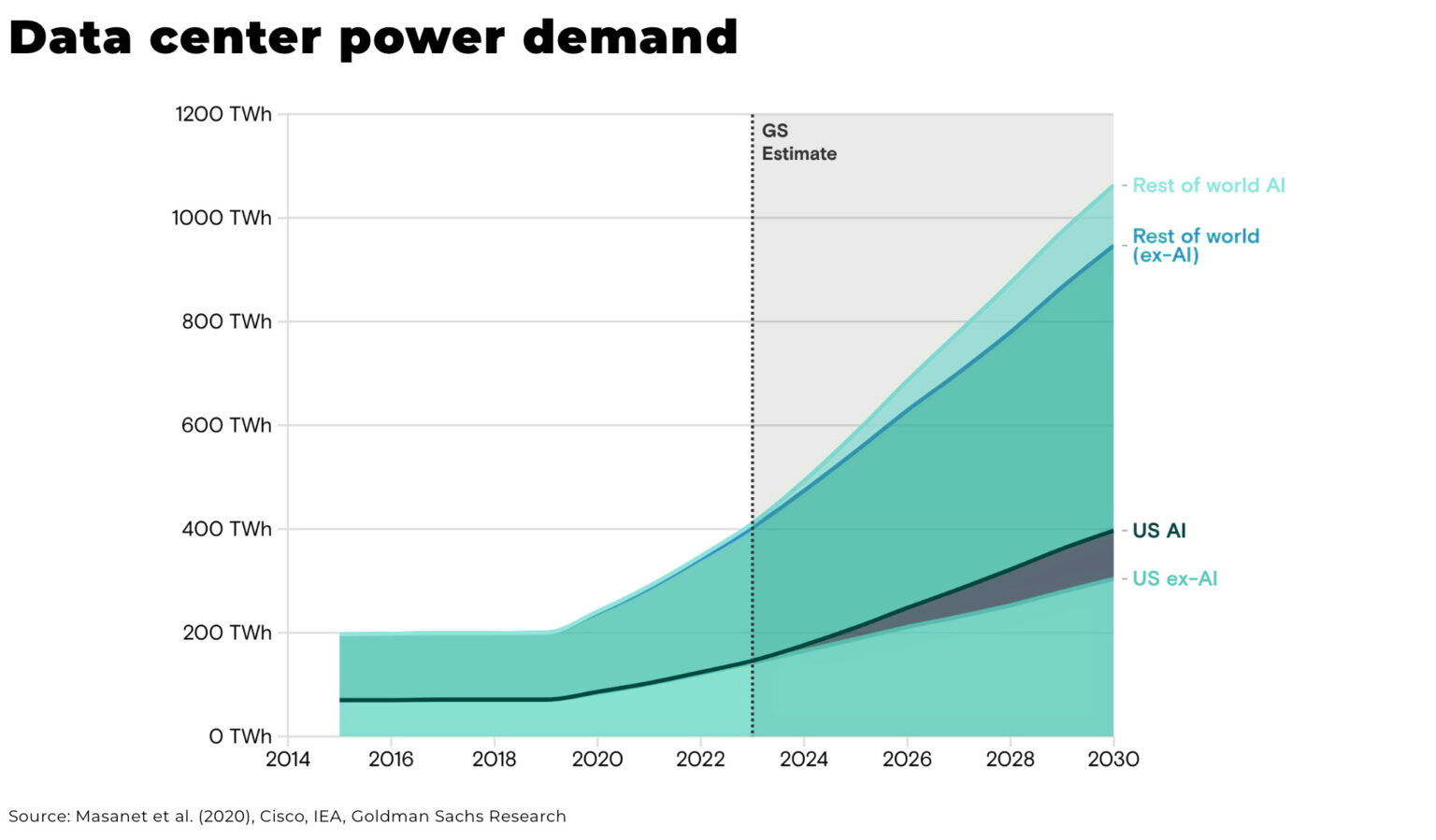

For the first time in decades, demand for energy is increasing exponentially. The reason is energy demand for data centers to run Artificial Intelligence (AI), estimated to increase 160% by 2030. Data centers worldwide currently consume 1-2% of overall power, but this percentage is expected to increase 3-4% by 2030.

What sets this growth in AI apart is that it is driven by consumer and business demand on the tech corporations, facilitated by governments, all who want to maintain their global cutting edge.

For example, Microsoft expects to spend US$80 billion on AI-enabled data centers in 2025. And, coinciding with the rise in AI energy demands, in July 2024, Google stopped claiming its operations are carbon neutral after it ended the purchase of carbon offsets.

McKinsey forecasts generative AI has the potential to generate value equivalent to US$2.6 trillion to US$4.4 trillion in global corporate profits annually.

High energy costs in Europe

Since Russia’s invasion of Ukraine, and the subsequent restrictions on natural gas exports from Russia (most recently with the halt of gas exports through Ukraine), Western Europe has been significantly impacted by volatile energy prices – a problem exacerbated by renewable energy investments that do not provide baseload electricity.

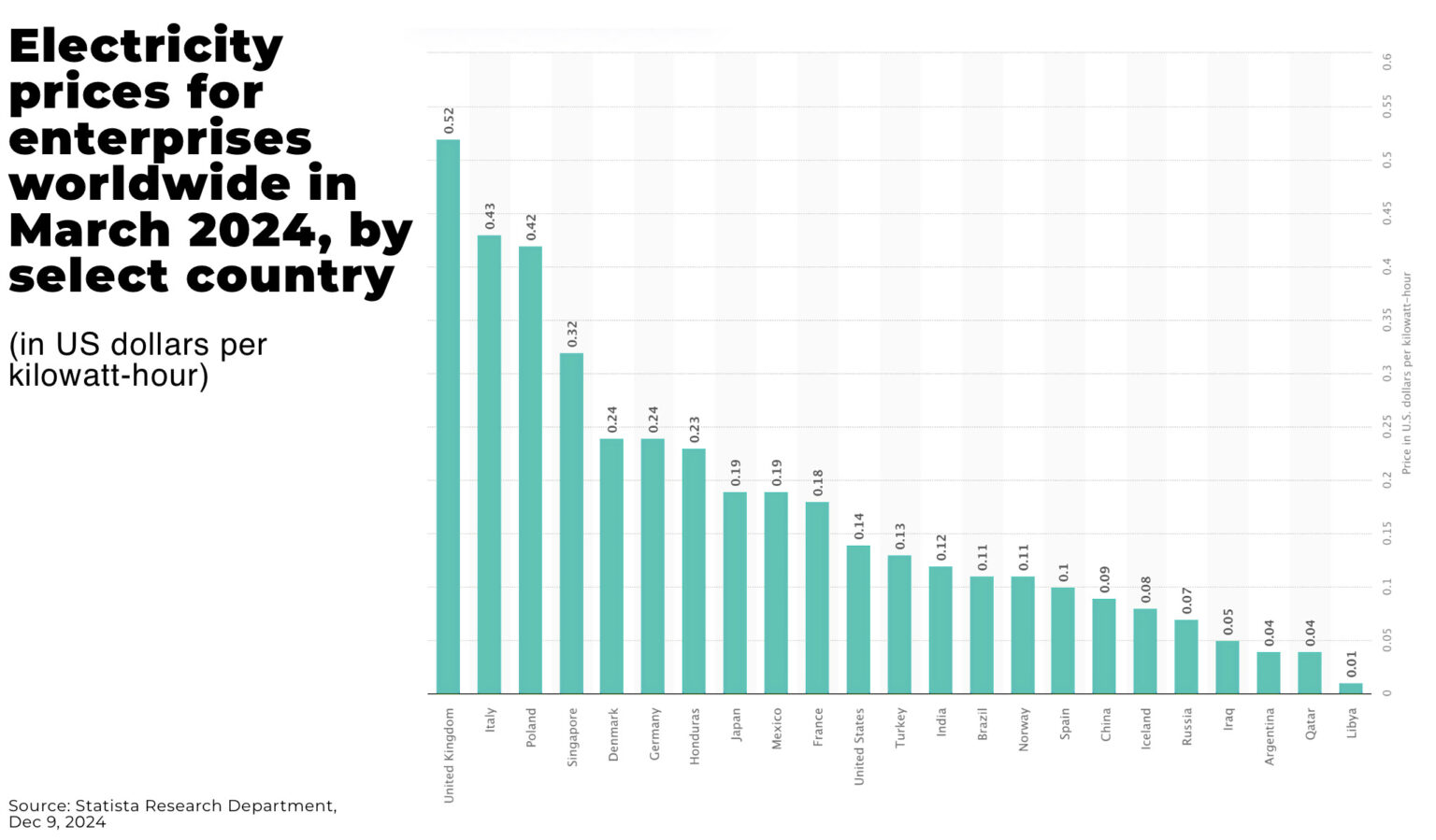

The result is that Europe is paying high electricity prices and seeing a wave of heavy industry leaving the region.

For example, the German economy is facing the longest recession since World War II, primarily due to high energy prices. And, in the UK, in January 2025, the country’s largest gas storage site warned only a week of natural gas supply remained after wind capacity across the continent fell in winter weather as the country came within a “whisker” of power blackouts.

There are a lot of dynamics behind the decline of Europe but, to put quite starkly: the countries that are benefiting from the de-industrialization of Europe (the US, China, India) as industry looks for a new home, need more energy to meet the new demand — and see the decline of the European economy due to its vulnerability to high energy costs as a warning.

China (and coal)

October 1, 2024, was the first day in nearly 150 years that power plants in the UK did not burn any coal to generate electricity.

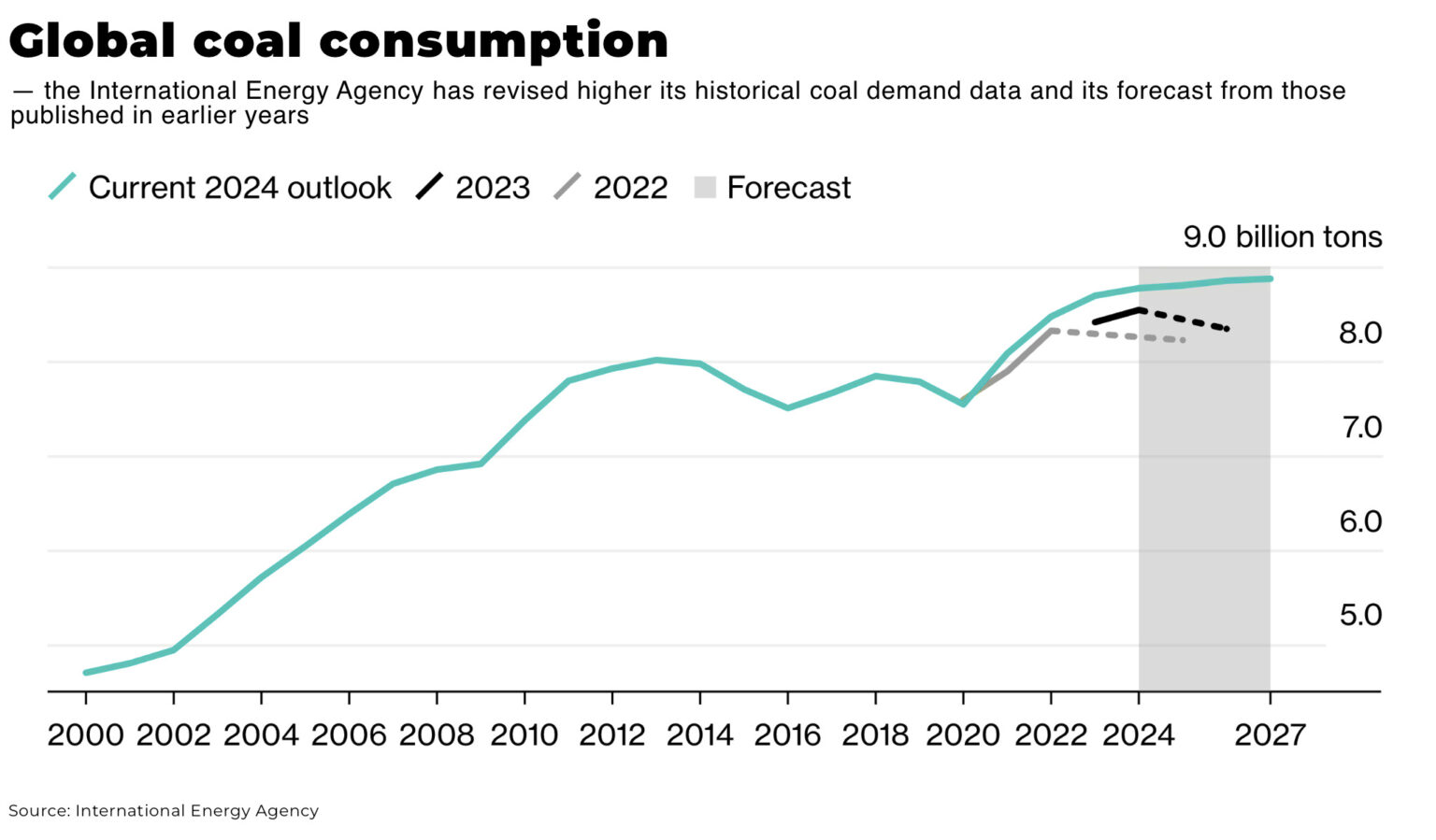

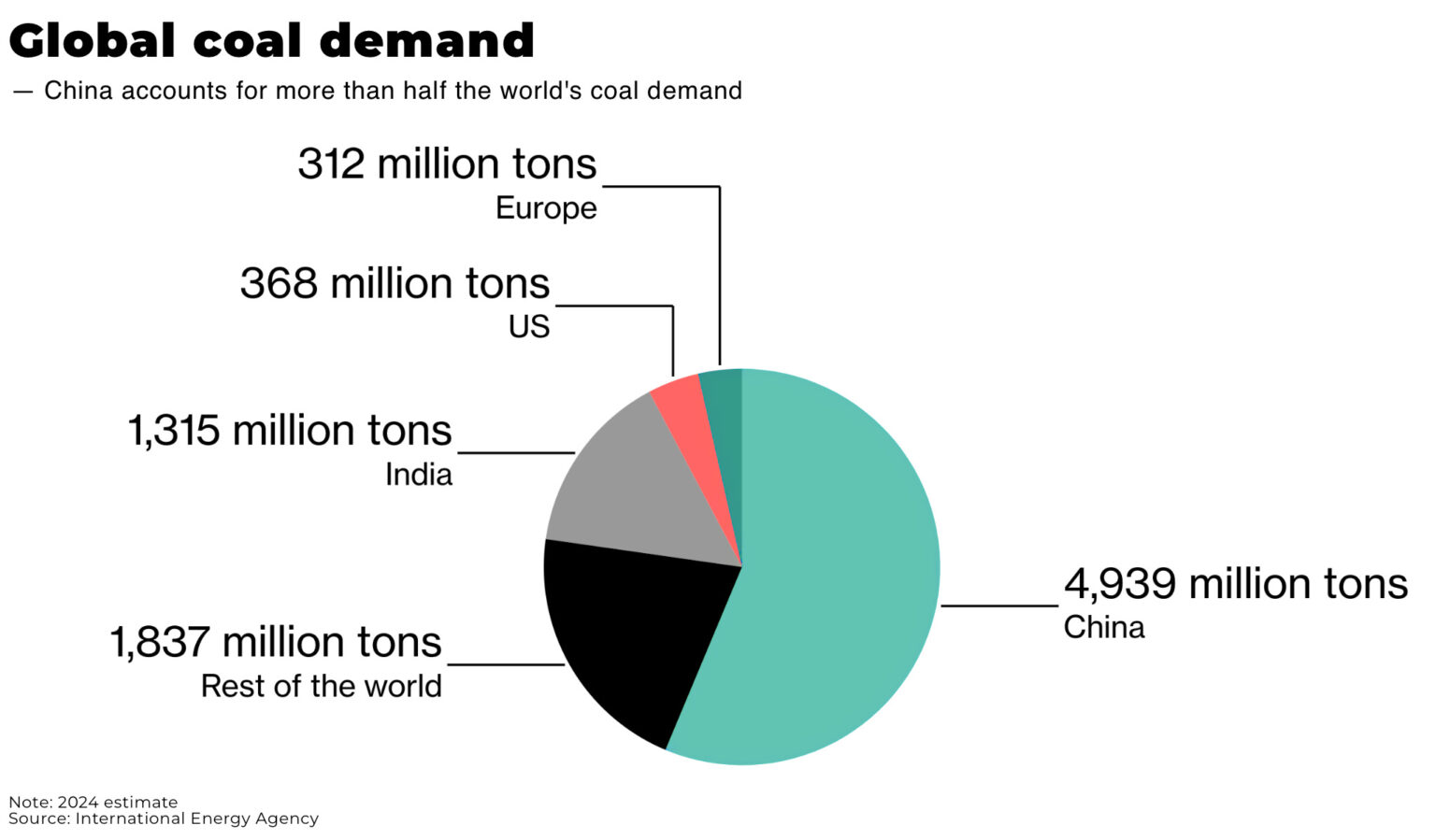

But, China is burning record amount of coal, despite the country’s pledge to reduce greenhouse gas emissions and its investment in renewable energy — accounting for more than 50% of global coal demand.

The IEA has revised up its forecast for China’s coal demand, expecting it to hit a record every year until at least 2027.

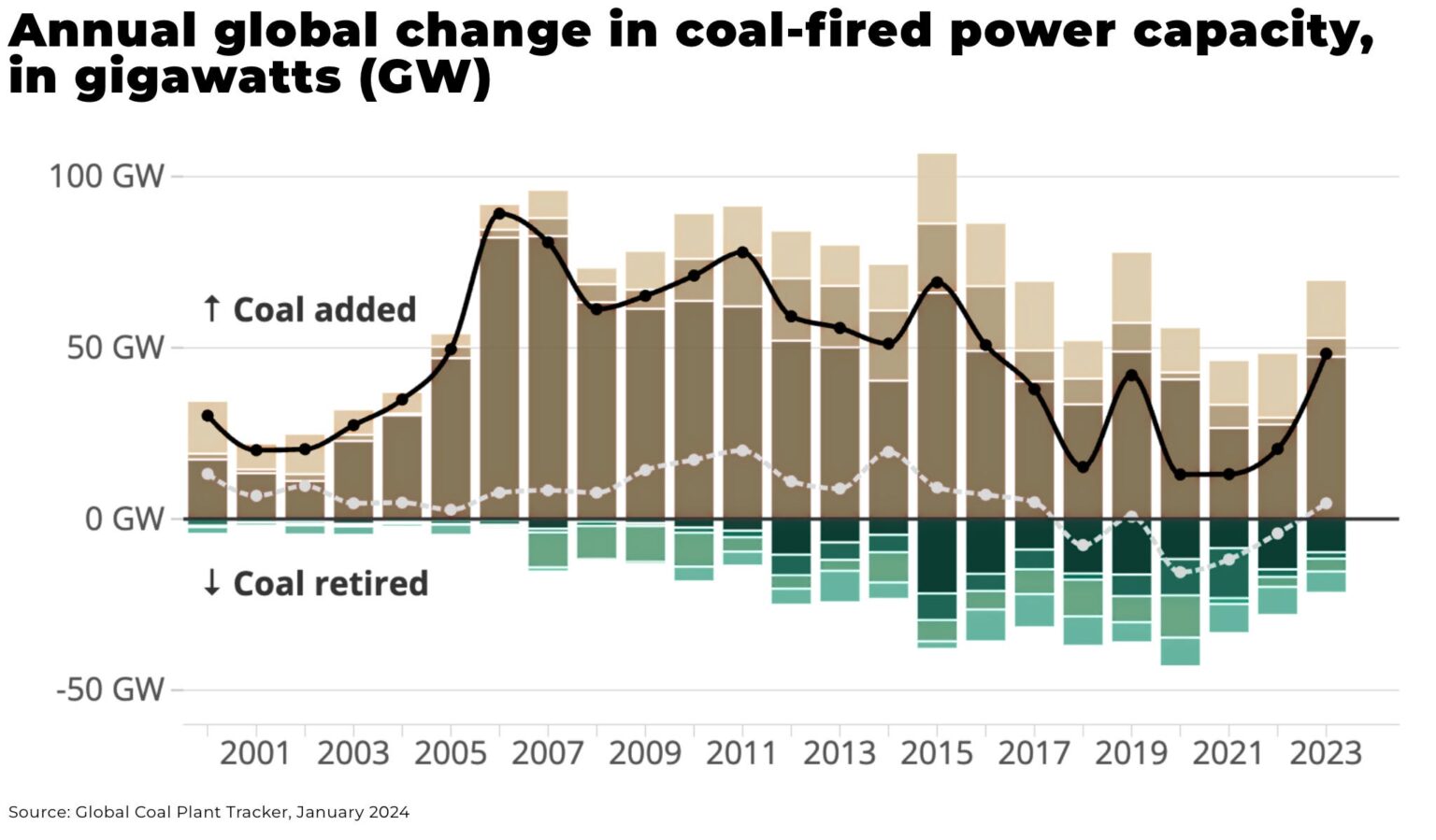

And it’s not just in China. Global operating coal capacity grew by 2% in 2023, with a small increase from countries other than China, for the first time since 2019; in particular, in Indonesia, India, Vietnam, Japan, Bangladesh, Pakistan.

As demand for cheap energy increases in China (and elsewhere) with AI and manufacturing demands, an economic slowdown, as well as geopolitical tensions and tariffs from the US, coal consumption will be a very difficult stop.

Interest rates

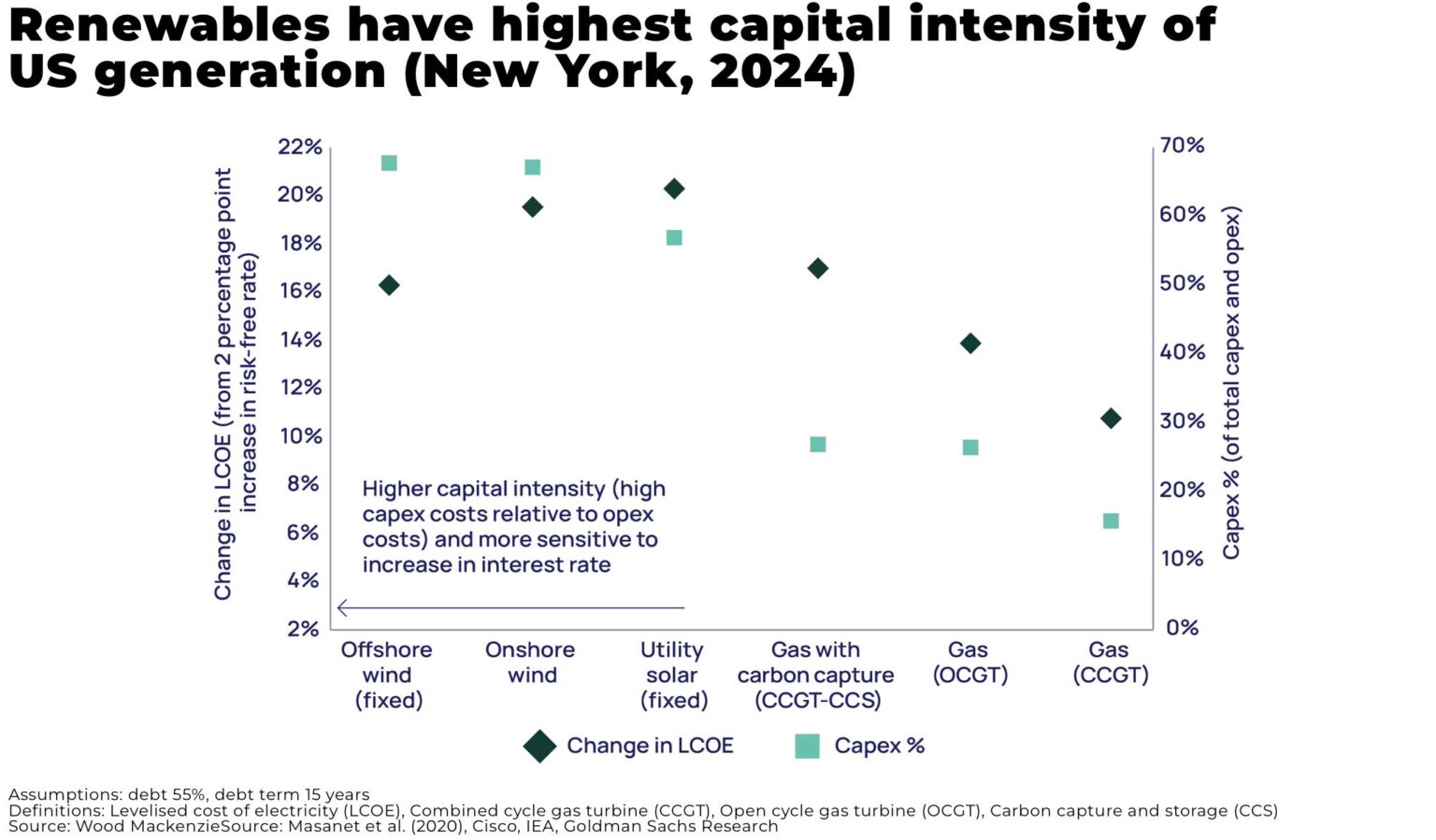

Higher interest rates disproportionately affect renewable energy projects (and nuclear power) due to the high capital intensity and low returns of the projects, despite government subsidies.

For example, analysis by Wood MacKenzie shows that a 2%-point increase in the risk-free interest rate pushes up the levelized cost of electricity (LCOE) by as much as 20% for renewables. The comparative increase in LCOE for a combined-cycle gas turbine plant is only 11%.

In North America and Europe the cost of debt for renewables was x4 higher in 2023 than in 2020, driven by increases in base interest rates.

The zero interest-rate policies deployed across the US, EU and Japan, from 2008 to 2022 saw some of the highest investments in renewable energy — hitting a record US$358 billion H1 2023, a 22% increase of H1 2022.

Despite the 25 basis point interest rate cut by the Federal Reserve on November 7, 2024, many other countries did not follow, for example, the Bank of England voted to hold rates at 4.75% in December 2024.

Barring a global financial event, we expect interest rates to hold, if not rise, over the next year or more. We are not alone: the Bank of America has revised its forecast, stating the rate cutting cycle has ended, with the next move is up, not down. Goldman Sachs and JP Morgan have also revised their expectations to reduct the number of cuts expected this year.

With all the other headwinds facing the industry, high interest rates will significantly impact investment into renewable energy.

Donald Trump

Donald Trump has pledged to redirect financing for what he described as “the green new scam” to roads, bridges and other infrastructure, promising to “drill, baby drill.”

In 2017, Trump pulled the US out of the Paris Agreement and his re-election campaign promised to do the same again in a second term.

And it’s not just Trump with concerns about net zero targets.

According to Pew Research, 87% of Republicans are concerned a transition away from fossil fuels and toward renewable energy sources would be very or somewhat likely to lead to unexpected problems for the country. Only 12% of Republicans and Republican leaners say dealing with climate change should be a top priority for the president and Congress.

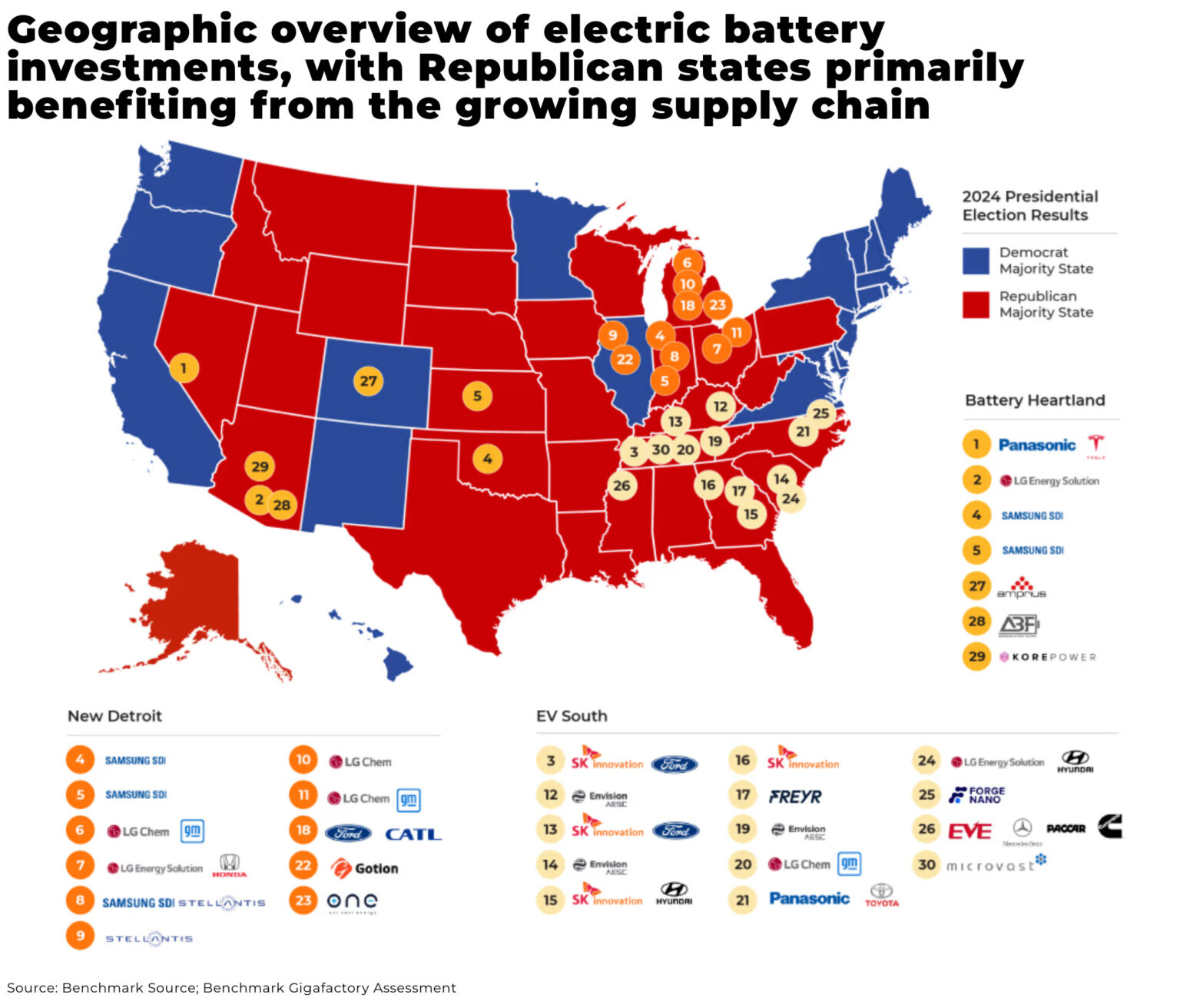

As we have outlined in our recent analysis — Trump wants to make mining American again — on the significance of the re-election of Trump for the energy transition and mining, there are significant complexities to any agenda to completely dismantle the energy transition in the US.

For example, 92% of investments from the Inflation Reduction Act went primarily into Republican states.

However, the priorities of the new Trump administration for the next four years are clear.

Geopolitical tensions between the US and China will also disrupt energy transition supply chains.

Trump has pledged 60-100% tariffs on imports from China (Biden already put a 100% tariffs on EVs from China) — a move supported by many in the industry, for example, a US graphite association has called for 920% tariffs on Chinese imports.

We expect the rollout of tariffs to develop into a highly complex negotiation between the US and the rest of the world, especially China. But, ultimately, we believe the tariffs will (continue to) pull more investment into the US (especially the dollar).

Supply chains, already vulnerable after Covid, the Ukraine war, and escalating export restrictions between the US and China over semiconductors — are expected to intensify, especially in the first half of the year.

China has already responded, with restrictions on critical minerals such as gallium, germanium and antimony, as well as possible lithium processing technology and graphite.

With China dominating much of the critical mineral mining and processing supply chain, any tariffs by Trump may accelerate the move across the West to onshore/friend-shore supply chains but, at least in the short-term, there will be significant disruption across critical mineral supply and renewable energy exports.

Conclusion

This is not the end of net-zero or the renewable energy industry, in fact, far from it.

We expect significant investment across the electric battery and electric vehicle sectors, as well as nuclear energy and some of renewable energy sectors (in particular solar, less so wind energy).

Demand for critical minerals to build out the renewable energy sector will therefore continue to grow, but there will be new dynamics including longer-term horizons, splitting of supply chains between the US and China, and new priority demands from industries such as data centers.

However, a combination of urgent, massive demand for new energy supply to power AI, just as costs are rising across the renewable sector — as well as general living costs across the world — mean governments, companies and voters have other increasingly urgent priorities.