The Critical Minerals Institute Report (12.27.2023): Politics Driving Marketable Commodities into 2024

Welcome to the December 2023 Critical Minerals Institute (“CMI”) report, designed to keep you up to date on all the latest major news across the critical minerals markets. Here is the CMI List of Critical Minerals or click here to visit the CMI Library.

Global macro view

December 2023 saw a further fall in U.S. inflation from 3.2%pa in October to 3.1%pa in November. As expected the U.S. Fed left interest rates unchanged at their December meeting. Even more significant was the Fed indicated that there are potentially ‘3 interest rate cuts coming’ in 2024. This was an early Christmas present for U.S. equity markets which continued their recent rally. Year to date, as of December 26, 2023, the S&P 500 is up 25.75% and the NASDAQ is up an amazing 43.25%. Of course, this follows heavy falls in 2022.

In late December China signaled a possible early 2024 interest rate cut when they reduced bank deposit rates. As a result China 30 year government bond yields hit their lowest level since 2005. All of this recent support for China’s economy and property market looks likely to set up a potential China recovery story in 2024. If China starts to recover in 2024 it would be a positive for commodity markets including the critical minerals.

The Russia-Ukraine war drags on through the European winter. There are some very early signs that both sides may be willing to end the war in 2024. We will see. Meanwhile, the Hamas-Israel war has been contained for now. We can only hope for peace in 2024.

Global plugin electric vehicle (“EV”) update

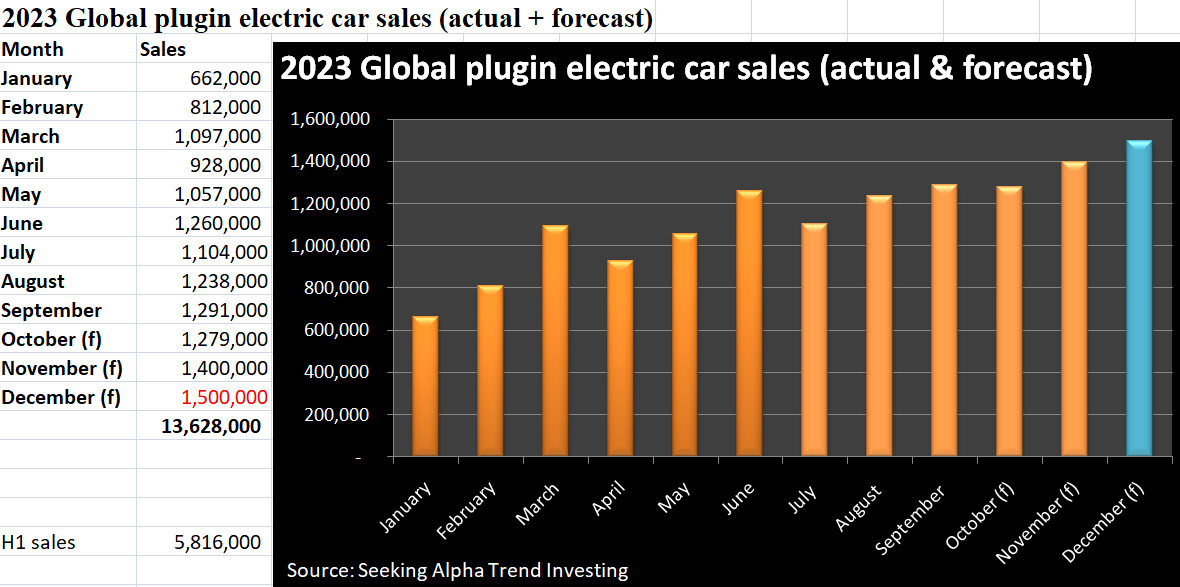

Global plugin electric car sales were 1,279,000 in October 2023 (the second-best month ever), up 37% YoY. November global sales reached 1.4 million. December should be even better. CPCA expects China’s NEV (New Energy Vehicle) retail sales in December 2023 to reach a record 940,000 units (41.4% market share), up 46.6% YoY. That should mean December global EV sales will be around 1.5 million.

This means that 2023 global plugin electric car sales should end up close to 13.6 million (~17% market share), for a growth rate of ~29% YoY (a significant slowdown from the 56% growth rate in 2022).

In other EV related news, in December Germany announced an abrupt ending to their EV subsidy. The subsidy was originally intended to apply until the end of 2024.

We also heard news that the U.S. is considering raising tariffs on Chinese EVs and Chinese solar products. The White House plans to complete a tariff review in early 2024. Chinese EVs entering the USA already have a 25% tariff. This follows the EU’s probe into China subsidies for EVs. All of this has come about due to the fact that about 60% of all global plugin EV sales are in China and the fact that China completely dominates the EV market and EV supply chain. This is now leading to a flood of compelling Chinese electric cars being exported to global markets where Western manufacturers (excluding Tesla Inc. (NASDAQ: TSLA)) are struggling to compete with China.

Finally, in December it was announced that Canada will require all new cars and trucks to be zero-emissions vehicles by 2035. The Canadian government stated: “The Standard will ensure that Canada can achieve a national target of 100 percent zero-emission vehicle sales by 2035. Interim targets of at least 20 percent of all sales by 2026, and at least 60 percent by 2030.”

Global critical minerals update

In December we got a key U.S. political announcement that will impact EV sales and critical minerals demand in 2024 and beyond.

U.S. Foreign Entity of Concern (“FEOC”) proposal

The U.S. DoE releases proposed interpretive guidance on Foreign Entity of Concern (“FEOC”) rules. FEOC’s include China, Russia, North Korea, and Iran. Key proposals include:

- Beginning 2024, companies that have >25% ownership or control by a FEOC will not be eligible for tax credits available under the Inflation Reduction Act (IRA).

- Beginning in 2024, an eligible clean vehicle (for IRA credits) may not contain any battery components that are manufactured or assembled by a FEOC.

- Beginning in 2025, an eligible clean vehicle may not contain any critical minerals that were extracted, processed, or recycled by a FEOC.

These rules are quite strict and it is looking like the majority of EVs sold in the USA will not qualify in 2024 and hence not receive the subsidy of up to US$7,000 per vehicle. For example, the Tesla Model 3 and Model Y base range EVs use Chinese made LFP batteries, making them both ineligible to meet the FEOC rules. Things will only get harder in 2025. Of course, this is designed to motivate auto and battery OEMs to hurry up and build a new western battery supply chain, independent of FEOC.

The FEOC proposal follows last month’s news of new guidelines for the EU Critical Raw Materials Act (“CRMA”) as discussed here. A key ruling was that “not more than 65% of the Union’s consumption of each strategic raw material comes from a single third county.”

U.S. proposal to create a ‘Resilient Resource Reserve’ for key critical minerals

As reported in December, the U.S. select committee has recommended the creation of a critical mineral reserve to protect domestic industry. The Fastmarkets report stated:

“The adoption of such a reserve is intended to “insulate American producers from price volatility and (the People’s Republic of China’s) weaponization of its dominance in critical mineral supply chain. Such a reserve would be used to sustain the price of a critical mineral when prices fall below a certain threshold and would be replenished through contribution from companies when prices are “significantly” higher”…The fund would target critical metals where there is high price volatility, low US domestic production and import dependence on China. Cobalt, manganese, light and heavy rare earths, vanadium, gallium, graphite, germanium and boron are critical minerals that fall under that category, according to the report…”

Note: Bold emphasis by the author.

Lithium

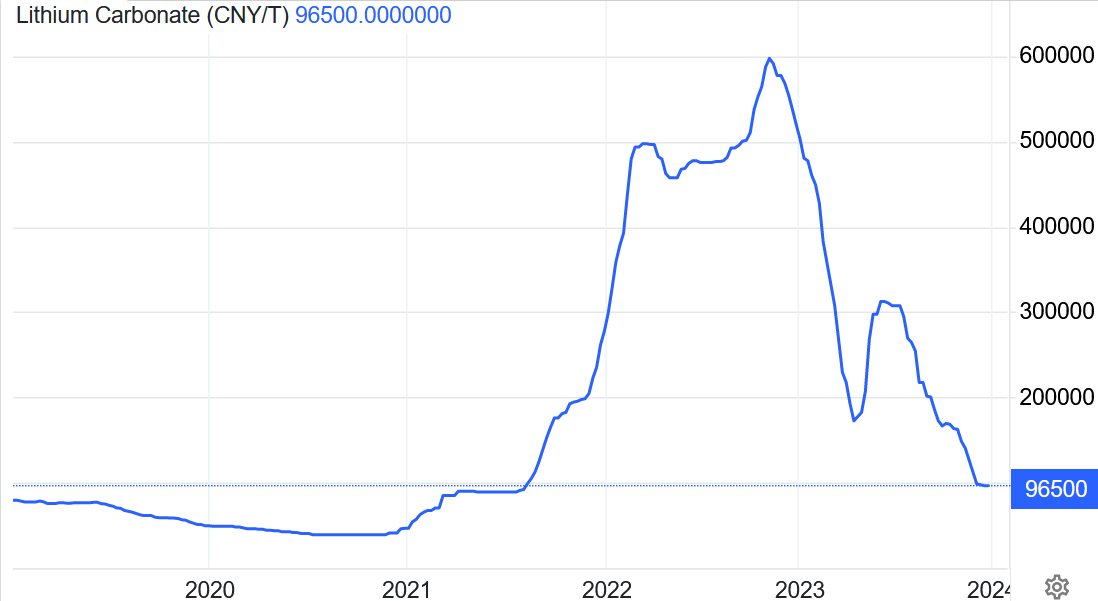

China lithium carbonate spot prices fell again in December 2023, with the price now at CNY 96,500/t (USD 13,505/t) and down 82% over the past year. Prices are now below the marginal cost of production, meaning a bottom should be found very soon (assuming EV sales hold up in 2024).

Industry participants are increasingly calling a likely bottom. For example, China Futures Co. analyst, Zhang Weixin, forecasts China’s lithium carbonate spot to bottom out between CNY 80- 90,000/t (US$11,200-US$12,600/t). Goldman Sachs is a little more bearish with a 1 year price target for China’s spot lithium carbonate of US$11,000/t.

The negative price action has not deterred SQM and Gina Reinhart’s Hancock Prospecting (private) who recently increased their bid to A$3.70 per share to takeover Australia’s Azure Minerals Limited (ASX: AZS).

In December we saw shareholders approve the Allkem Limited (ASX: AKE | TSX: AKE) – Livent Corporation (NYSE: LTHM) ‘merger of equals’ which is now expected to close by January 4, 2024. The new company is to be known as Arcadian Lithium PLC (NYSE: ALTM | ASX: LTM).

Finally, in December we got news that free markets supporter Javei Milei was elected as the new Argentina President. This is good news for those companies with mining projects in Argentina, of which there are many lithium projects under development.

The lithium carbonate spot price collapsed in 2023 and is now below the marginal cost of production and expected to form a bottom very soon

Magnet Rare Earths

Neodymium prices fell in December to CNY 560,000/t almost 1/3 the price of the February 2022 peak. The one year outlook remains quite weak; however, this will largely depend on how China’s economy performs in 2024. A strong pickup in EV sales in 2024 could quickly change the market dynamics.

The big news in December in the rare earths market this month was China’s announcement to ban the export of rare earth processing technology. As discussed in an InvestorNews article, Western companies have been efficiently separating rare earths for some time, so this ban has minimal implications. CMI Co-Chair and rare earths expert, Jack Lifton, states: “Solvent extraction separation is a long-established practice everywhere. The issue is the production of rare earth metals and alloys and from them of rare earth permanent magnets. This is where China’s massive lead in manufacturing technology may be insurmountable. Time will tell.”

Of course, the trend for Western auto OEMs is concerning, especially following China’s recent introduction of export license permits on graphite products (including synthetic graphite, flake graphite, and spherical graphite).

Cobalt, Graphite, Nickel, Manganese, and other critical minerals

Cobalt prices (currently at US$12.91/lb) were lower the past month and continue to be very depressed. China’s slowdown and the slowdown in global electronics sales have suppressed cobalt demand at the same time as new supply from the DRC and Indonesia has risen.

One glimmer of hope for the Western cobalt producers is that the U.S. government announced in December the creation of a critical mineral ‘Resilient Resource Reserve’ (as discussed above).

Flake graphite prices also remain very weak with prices near the marginal cost of production. Following the introduction of Chinese export license permits in December 2023 there has been some increased signs of buying activity and a slight graphite price improvement. However, the main concern for flake and spherical graphite is that lower energy input costs in China have lowered the cost of producing synthetic graphite, thereby dampening demand for flake and spherical graphite. Despite this, there are several analysts now forecasting graphite deficits to begin as soon as 2024/25 as you can read in a recent InvestorNews article here.

Nickel prices fell slightly in December to US$16,279/t. The 1 year outlook for nickel remains poor due to oversupply concerns from Indonesia. A recovering global economy and Chinese property sector will be needed to help balance the nickel market, which is currently in oversupply.

Manganese prices also fell slightly in December and are now at CNY29.20/MTU.

2023 has been a tough year for many critical mineral prices (except for gallium, germanium, tellurium, indium, tin, and uranium – a critical mineral in Canada) as a slowing China and global economy weighed down demand at a time where supply increased. Uranium was the standout performer in 2023 with a gain of over 75%. You can read an article here from back in April 2023 where we highlighted the coming rise of uranium.

The key to watch in 2024 will be if we see lower interest rates in China trigger a China property and economy recovery. A stronger U.S. and Europe in 2024 would also help boost the global economy and demand for critical minerals. Lower interest rates in 2024 could potentially make it a great year for the auto sector and EV metals.

Wishing you all a safe and prosperous 2024 from the Critical Mineral Institute (“CMI”).