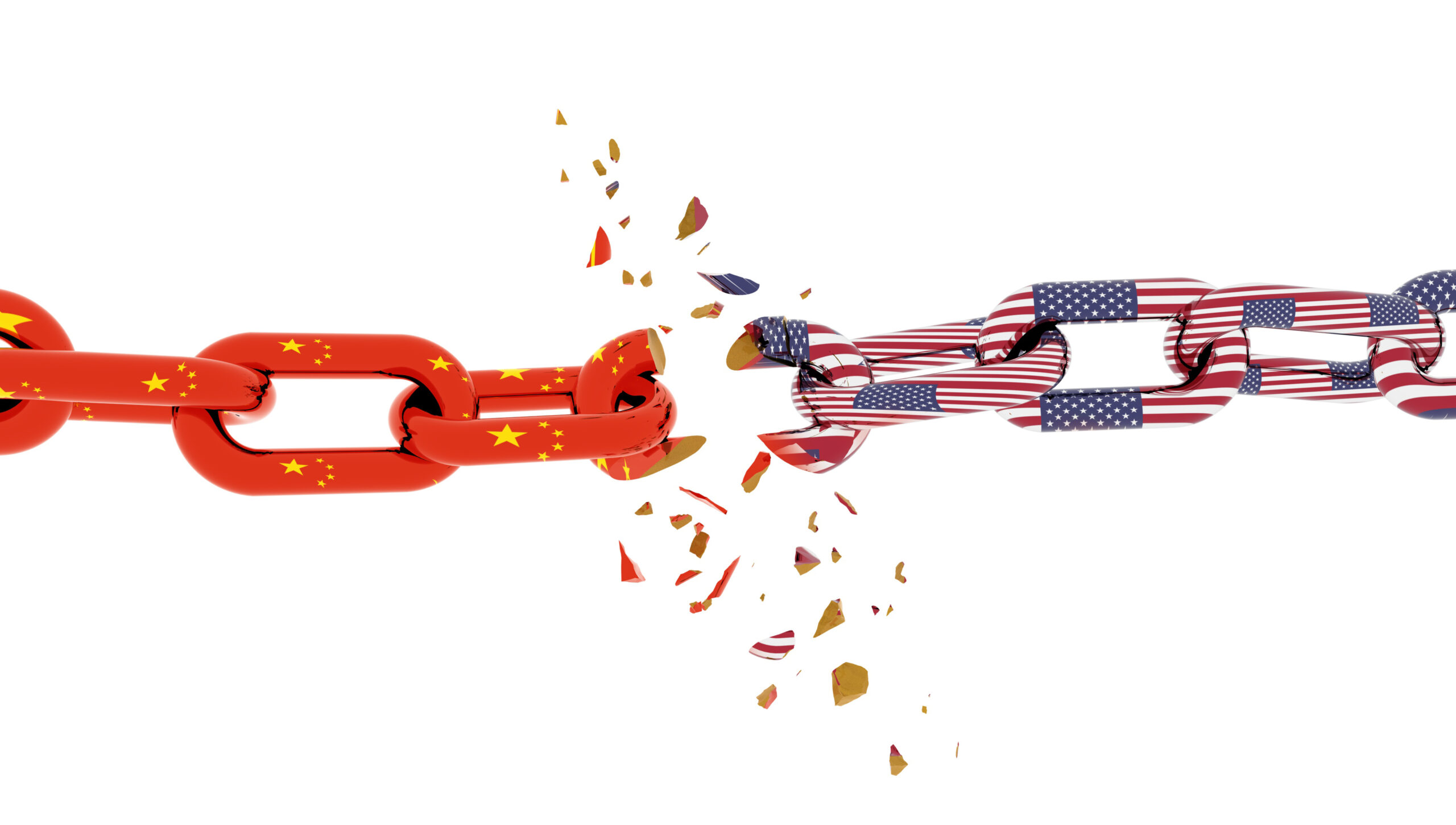

China’s recent decision to ban the export of rare earth processing technology marks a significant shift in the global rare earths market. This move, aimed at protecting China’s dominance in the strategic metals sector, encompasses technology for extracting and separating rare earths, as well as the production technology for rare earth metals, alloys, and some magnets. The ban has major implications for industries reliant on these materials, such as electronics, clean energy, and defense.

In response to this development, experts from the Critical Minerals Institute (CMI) have shared their insights. Melissa “Mel” Sanderson, a director at CMI, characterizes China’s move as predictable and in line with their stated intentions. She stresses the importance of the United States responding proactively, emphasizing the need to advance initiatives in greener, cleaner spaces like bio-extraction, and to invest in conventional technologies. Sanderson warns of the risks of over-reliance on nations like Australia, which have their own market priorities and limitations.

The consensus among experts is clear: the recent developments serve as a crucial wake-up call for the United States, emphasizing the need to prioritize technological advancements, particularly in sustainable sectors. They stress the importance of investing in traditional processing and separation technologies to prevent limitations in capacity. CMI Director Peyton Jackson further elaborates, “The U.S. government granted Lynas Rare Earths Ltd. (ASX: LYC) $300 million for a project feasibly achievable with just $30 million invested at White Mesa Utah. Production at White Mesa is expected to begin in January 2024, as scheduled. This exemplifies a vital point: often, solutions are more straightforward than they initially seem. It falls upon us to bring attention to these simpler, yet effective, approaches.”

CMI Co-Chair Jack Lifton comments: “The ban will impact mostly non-Chinese countries that are building rare earth processing and fabricating facilities de novo. Western companies, such as Solvay, Neo Performance (Sil-Met), and Lynas have been efficiently separating rare earths for some time. America’s MP and Energy Fuels are either re-starting and/or modifying existing solvent extraction processing systems to handle rare earth separations. Solvent extraction separation is a long-established practice everywhere. The issue is the production of rare earth metals and alloys and from them of rare earth permanent magnets. This is where China’s massive lead in manufacturing technology may be insurmountable. Time will tell.”

In this context, Energy Fuels Inc. (NYSE American: UUUU | TSX: EFR), a frontrunner in the industry, has embarked on an ambitious project. Jack Lifton explains: “Energy Fuels has begun construction of an up-to-date solvent extraction system with an initial capacity of 1000 tons per year of the total rare earths contained in monazite. The SX plant, designed in-house, will be among the world’s most streamlined and efficient. It will require only a fraction of the traditional number of mixer-settler stations today considered ‘necessary’ for a legacy SX system. The payable product of the EF system will be separated NdPr, also known as didymium. This first phase plant will produce enough NdPr per year for the production of 700 tons of neodymium-iron-boron type rare earth permanent magnets. Energy Fuels phase one SX plant will be operational on or before May 1, 2024.”

The ban on the export of rare earth processing technology by China and the proactive steps taken by companies like Energy Fuels underscore a larger issue: the strategic importance of rare earth elements and the technological independence of nations. The insights from CMI directors, combined with the initiatives of industry players like Energy Fuels, suggest a path forward for the U.S. to increase investment in both green and conventional technologies. This strategy is essential not only to address the immediate challenges posed by China’s policy change but also to pave the way for a more sustainable and secure future in the rare earths and broader critical minerals sector.

Leave a Reply