Troilus Gold’s Rise: Unveiling One of North America’s Premier Undeveloped Gold-Copper Resources

Wars, inflation, possible recessions, and a volatile world are all factors in 2023 that are helping to support the price of gold. Looking at the chart below gold continues to perform well over a long period of time.

The gold price is now at US$1,977/oz leading investors to search for well-valued gold miners, ideally those able to grow a resource and make it to production. Today’s company fits the bill with a recently announced good-sized resource in the safe jurisdiction of Canada.

The 25 year gold price chart shows gold prices rising consistently each decade

Source: Trading Economics

Troilus Gold Corp.

Troilus Gold Corp. (TSX: TLG | OTCQX: CHXMF) (“Troilus”) is focused on bringing the former Troilus gold and copper mine back into production. Troilus has a strategic land position of 435 km² in the Frôtet-Evans Greenstone Belt in Quebec, Canada.

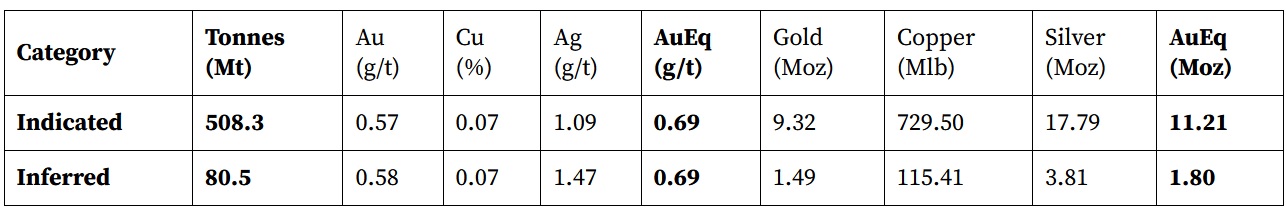

On October 16, 2023, Troilus announced an updated Mineral Resource Estimate for their Troilus Project. The result was an Indicated Resource of 11.21M Oz AuEq contained and Inferred Resource of 1.80M Oz AuEq contained, a massive 126% increase on the 2020 Resources estimate.

The Troilus gold-copper Project has a M&I Resource of 11.21 million ounces equivalent

Source: Troilus news October 16, 2023

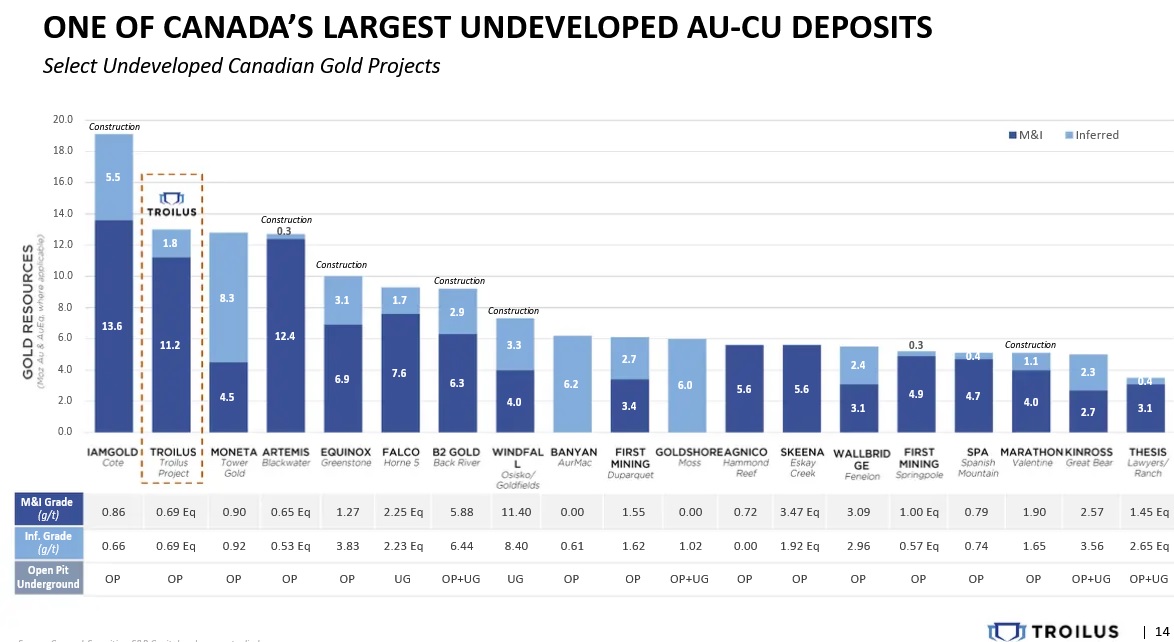

An 11.21M Oz equivalent gold exploration-development stage project in Canada is quite rare and ranks Troilus as having one of the largest gold-copper resources of any junior miner in Canada. The lower grade of 0.69g/t AuEq is the main concern; however, a well-managed open pit project with a good scale can overcome this, especially in the case of Troilus where a lot of the infrastructure is already in place due to being a former mine. The upcoming Feasibility Study will be key to watch and to get a feel for the economics of the project, in particular the forecast operating expenses. The PEA used a hybrid underground/open pit design which is no longer applicable given the latest resource showed the vast majority of the resource is accessible via the open pit.

Troilus CEO Justin Reed comments:

“With an 11.21 Moz AuEq Indicated resource, we believe our project is firmly positioned among North America’s largest undeveloped gold-copper deposits. The definition of the Southwest Zone and the recently discovered X22 Zone has been especially rewarding, with these zones contributing close to 30% of the increased resource. We are also gratified with the excellent quality of the resource, with most of our ounces appearing in the Indicated category. Furthermore, almost the entirety of these contained ounces are classified as ‘open pit’, which will form a strong foundation for our upcoming Feasibility Study, expected to be completed in early 2024. We continue to advance and de-risk our asset with a clear strategic roadmap toward a production scenario, with the goal of ultimately delivering the most value to our shareholders.”

Troilus Gold now has one of the largest undeveloped gold-copper resources for a junior miner in Canada

Source: Company presentation

The Troilus Project benefits from being a brownfield project with large infrastructure already in place

Troilus states that due to being a former mine, there is ~US$350M in inherited value in terms of infrastructure already built. This is a huge advantage for a junior gold miner as it reduces the initial CapEx to reach production.

Aerial view showing the Troilus gold and copper Project and ~US$350M of existing infrastructure

Source: Company presentation

Closing remarks

Troilus Gold is one of those quiet-achieving companies that just sneaks up on you. They have grown their gold equivalent resource by 446% since acquiring the Troilus Project to the point where it is now one of the largest undeveloped (non-producing) gold equivalent resources in North America.

All eyes will be on the upcoming Feasibility Study, expected to be completed in early 2024.

Troilus Gold Corp. trades on a market cap of only C$82M and should definitely be on your radar.