In a game-changing move within the sustainable transportation sphere, Ara Partners announced its acquisition of Vacuumschmelze (VAC), a renowned global producer of advanced magnetic materials earlier today. This strategic partnership is set to reshape the future landscape of electric transportation, particularly given VAC’s partnership with automotive giant General Motors (NYSE: GM).

Earlier in the year, VAC made waves in the industry by signing a deal with GM, intending to build a dedicated North American facility for manufacturing permanent magnets for electric motors. This commitment, slated for production by 2025, is underscored by the emphasis on utilizing locally sourced raw materials, signaling a sustainable and resilient supply chain commitment.

Tuan Tran, a Partner from Ara Partners, provided insights into the acquisition journey. He revealed an extensive 18 to 24-month mapping exercise, where Ara Partners vetted numerous players across the rare earth supply chain. The conclusion? VAC emerged as the unequivocal leader in the Western world. Beyond its manufacturing prowess, VAC boasts a 100-year operating history in advanced magnetics, making it an industry stalwart.

The strategic importance of this acquisition becomes even more evident when considering the broader ramifications for the electric vehicle (EV) market. The GM-VAC partnership, which commits to sourcing rare earths locally, implies a deliberate move towards cultivating a robust North American supply chain for these critical materials. This “mine-to-magnet” strategy, as highlighted by Tran, is mission critical to meet not only GM’s needs but also the burgeoning demand from other Original Equipment Manufacturers (OEMs).

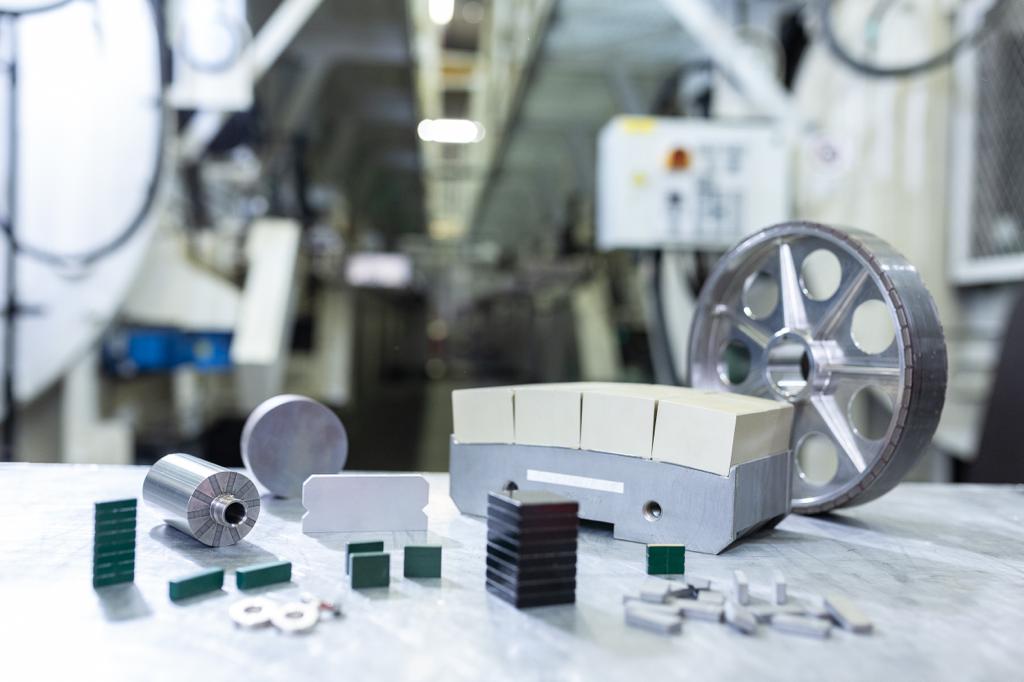

VAC’s track record is impressive. Their operations extend beyond the EV market to include robust industrial groups, energy efficiency applications, and manufacturing automation. Their scope also stretches to aerospace and defense sectors, hinting at a potential electrification of flight in the coming years. VAC’s involvement in alternative energy and their envisioned scalability, both geographically and by market, reinforces the company’s forward-looking vision.

In context, the acquisition is about more than just business growth. It’s about the sustainable transformation of the transportation industry. As GM accelerates its EV strategy, forging partnerships with other companies like MP Materials Corp. (NYSE: MP), the importance of a sustainable, reliable supply chain becomes paramount. By 2025, GM aims to launch 30 new EV models, powered by its Ultium batteries and Ultium Drive motor technology. A sustainable supply chain for rare earth magnets, like the one VAC aims to build, is integral to this vision.

Tuan sums the Ara Partners’ acquisition of Vacuumschmelze deal up aptly by stating: “With a 100-year operating history, Vacuumschmelze has a sizable business today, with revenues north of half a billion. They are not only prominent in the EV market, boasting relationships with all the major automotive OEMs, but they also have a robust industrial group focused on energy efficiency applications and the automation of manufacturing. Their prowess extends to a strong aerospace and defense group, echoing the positive trends seen in the EV market. Leveraging an already formidable P&L and financial standing, we are envisioning an opportunity to evolve into a multibillion-dollar business in the future.”

Leave a Reply