“The global supply chain for heavy rare earth elements like dysprosium and terbium, essential for high-coercivity permanent magnets used in electric motors, is critically dependent on China, which controls 99% of production. Despite hype around non-Chinese mining of these elements, no commercial production has been achieved outside China due to technical, environmental, and economic challenges. Without addressing these issues, attempts to create a non-Chinese supply chain for rare earth magnets are unlikely to succeed.” — Jack Lifton, Co-Chair, Critical Minerals Institute (CMI)

The force of an argument can be greatly weakened and is often eviscerated when its basic charge is that to take the other side of the issue is just “stupid.” More often than not, the charge that those holding the opposing argument are ignorant and only “informed” by a lack of understanding of the issues and the facts does not resonate with listener-judges, who, themselves, are not aware of the facts on either side of the argument.

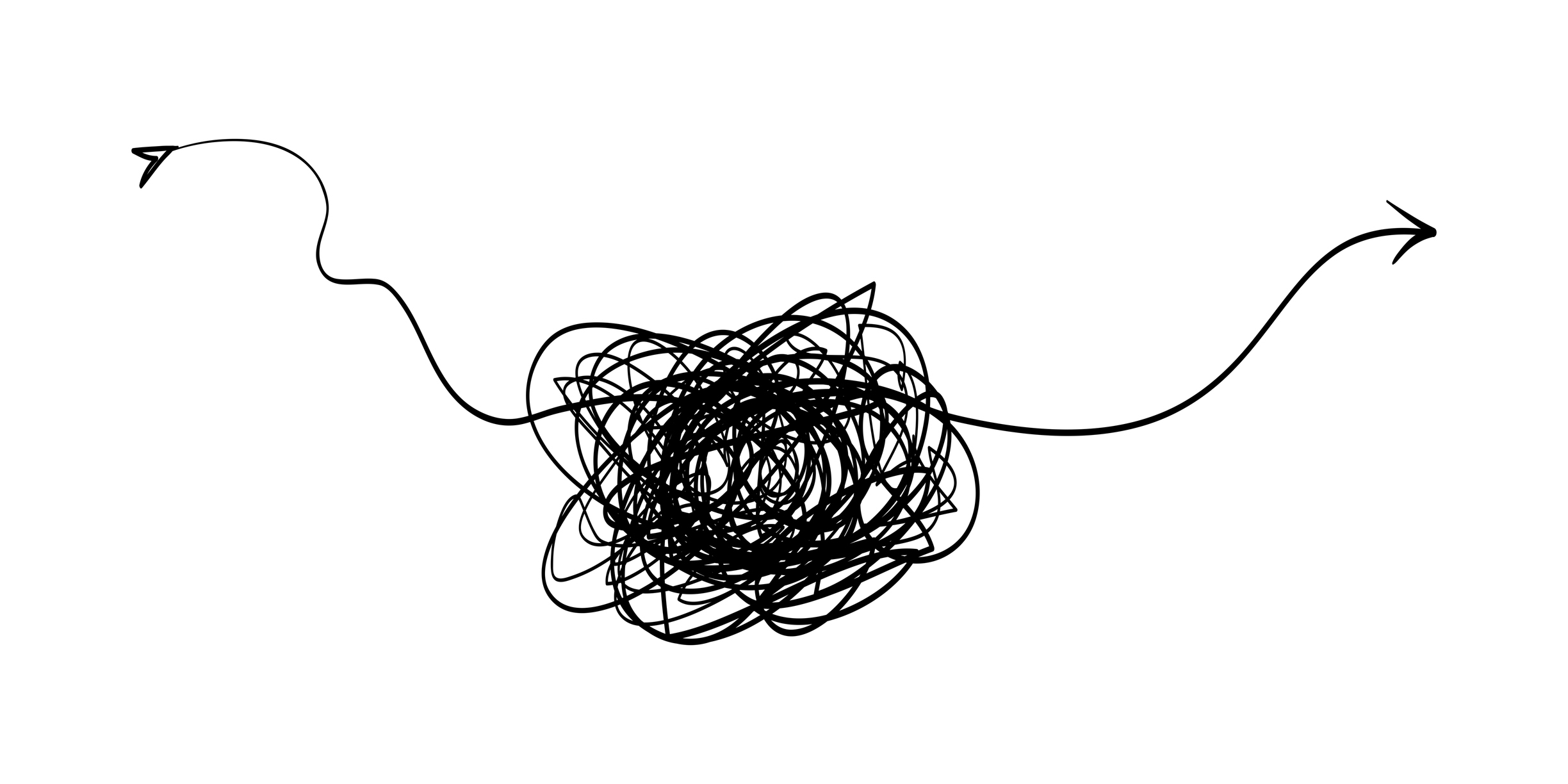

So, with the assurance that I will be condemned by most of you, I must nonetheless inform you that ignoring the issue of the lack of a sufficient and secure supply chain for dysprosium, terbium, and holmium has reduced the project to create a non-Chinese high coercivity rare earth permanent magnet motor supply chain to no chance of completion. In other words, “It’s stupid.”

“Why is that? you say. It is because you cannot make rare earth permanent magnets that can retain their properties throughout the temperature regimes in which electric motors operate (high coercivity types) without rare earth alloys that contain dysprosium and terbium, and 99% of both of those chemical elements are produced and/or controlled by entities operating solely within the PRC and their necessary refined products as raw materials are prohibited by PRC law from export as are any and all technologies related to the mining, refining, processing into end-user forms, and utilization of them in magnet making.

Dysprosium and terbium are very rare and are recovered today only from uniquely accessible “deposits” known as ionic adsorption clays, IACs (in the jargon). These types of deposits were first discovered in China and were only known and processed there until 10 years ago. It cannot be overemphasized that no-one would process IACs if they were not the only source, today, of dysprosium and terbium.

Semi-literate subject matter analysts today have allowed a hype-storm to be created for the non Chinese “mining” of “heavy rare earths,” a trade name for some of the higher (than neodymium ) atomic numbered members of the rare earth series.

But none of them have noted the following issues:

No one has ever commercially produced heavy rare earths from IACs located outside of China.

No one, outside of China, therefore has any experience with the commercial extraction of heavy rare earths from the vast number of different materials know as “clays,” each variation of which requires a careful study, before it can be defined as a “mine-able” deposit.

No one, outside of China, has ever addressed the principal environmental issue, the contamination of the land and water table by the chemicals necessary to extract the clays in situ.

No one has addressed the costs of “digging up” and transporting millions of tons of clay to a processing site, then extracting the rare earths, and then neutralizing the residues and then returning them to either the original site or to a site prepared to hold them. The very low grades of payables in clays makes their digging up, transport, treatment, and re-transport to the mine site a very HIGH part of the costs.

No one, outside of China, has ever processed more than an experimental amount of dysprosium or terbium derived from IACs. The Chinese have now been doing this COMMERCIALLY for more than a generation, TWENTY-FIVE YEARS! And they are no longer sharing technical or operational data with the rest of the world about this. This work is done by informed trial and error (sometimes known as educated guessing), and outside of China it has only been addressed by a very few academics up until now, and then, as far as we know, only at laboratory scale.

I am speaking, so far, only of extracting and concentrating the rare earths in a mixture to the point where the concentration is high enough for known separation systems (solvent extraction and chromatographic techniques) to be deployed ECONOMICALLY.

Now we get to the hard part: NO ONE has purpose built and COMMISSIONED a heavy rare earth dedicated separation plant outside of China, since Solvay’s LaRochelle pioneering total rare earths separation plant 50 YEARS AGO!

I know of today a very few such projects, one in Africa and two in Malaysia. None of them has been commissioned, so we don’t yet know of their efficacy or economics. Once again, there is no Lego assembly sheet available for rare earth separation technology; it is to be accomplished, ECONOMICALLY and EFFICIENTLY, if at all, by (chemical engineering) informed trial and error.

As if that weren’t enough of a long term EXPENSIVE slog, we finally have the issue of producing heavy rare earth metals, alloys, and salts in high purity forms. NO ONE in the West has done this commercially (aka profitably) EVER. I believe that the Japanese have done it in the past when they had access to heavy rare earths, so the knowledge base and skillset still resides in that nation.

This is not the forum to discuss the necessity for heavy rare earths in magnet manufacturing, but if it is right that heavy rare earths are the sine qua non of making the type of magnets necessary for vehicle and industrial electric motors then we have a lot of catching up to do with China.

Leave a Reply