It has been a long and patient road for West High Yield (W.H.Y.) Resources Ltd. (TSXV: WHY | FSE: W0H), but this week the Calgary-based junior appears to be stepping into the sunlight. On October 21, 2025, the British Columbia Ministry of Mines and Critical Minerals granted the official permit to develop the Record Ridge Industrial Mineral Mine (RRIMM) near Rossland, B.C.—authorizing construction and operation under the province’s Mines Act. That approval is far more than a regulatory checkbox. It is the culmination of nearly two decades of corporate persistence, geological conviction, and methodical community engagement that many small-cap explorers never survive long enough to see through.

For CEO Frank Marasco Jr. the milestone carries personal weight. His profile outlines the arc of an operator who has weathered Canada’s resource-market cycles and emerged steady-handed, with a long game in mind. With a background spanning oil & gas, mining, real estate, and serial entrepreneurship—he built and sold 47 businesses over a 45-year career before turning his focus full-time to critical minerals development. That track record speaks not of a fast-flip speculator but of someone intimately familiar with the discipline required to bring a resource project to life. His emphasis on enduring leadership and resilience is well-founded—his company’s evolution from claim-holder to permitted-mine operator has hinged on years of regulatory, technical, and financing perseverance. When Marasco describes the RRIMM project as “a transformative step for all stakeholders,” his words reflect the poised confidence of a leader who has earned this moment—purposeful in execution and clear in intent.

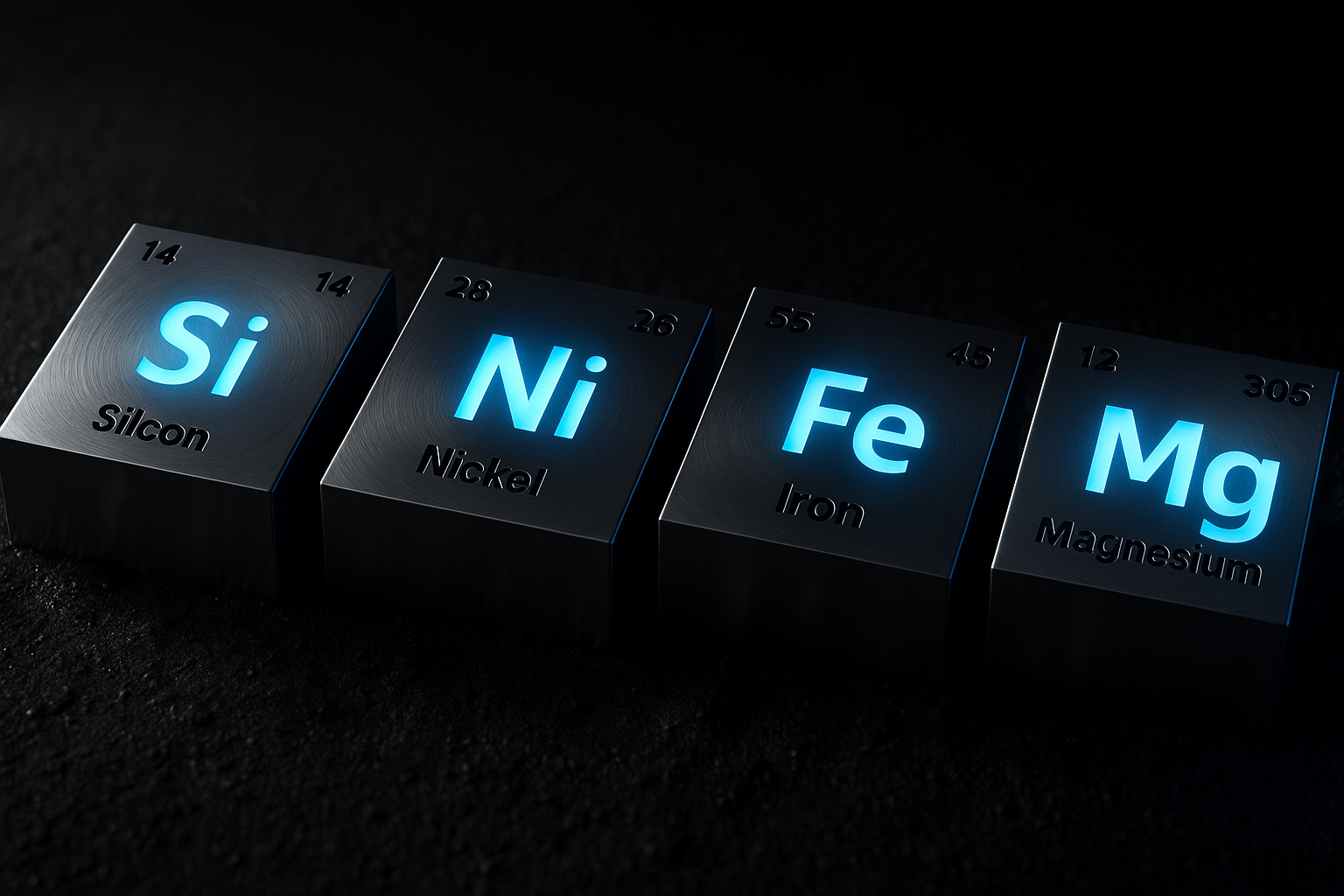

The deposit at the heart of the narrative—the Record Ridge Industrial Mineral Mine, first delineated in the early 2000s—is distinguished not by glamor but by concrete utility. With a resource base spanning magnesium, silica, nickel, and iron, the project places W.H.Y. in the business of essential materials supporting decarbonization, manufacturing capacity, and value-chain sovereignty. In a sector often transfixed by lithium or rare-earth headlines, the company’s focus lies on the industrial side of the clean-energy transition—materials that underlie infrastructure, production systems, and domestic supply chains.

Magnesium is key for human health and critical health care, magnesium alloys serve lightweight electric-vehicle components, aerospace structures, and carbon-efficient construction materials. Silica is vital to semiconductor and solar-panel manufacturing. Nickel and iron underpin stainless-steel production, energy-storage systems, and heavy-industry infrastructure. Simply put, this project sits at the intersection of materials that build the future economy rather than simply headline it. It’s a business of substance—quiet in buzz, but meaningful in foundation.

With the permit now secured, the company is moving into full development mode: site preparation and road-building will commence immediately as per conditions of the permit, followed by initial ore shipments destined for a U.S. processor, all while the longer-term objective remains a Canadian-based magnesium-refining facility to capture value on-shore. A pivotal element of the announcement is the collaboration with Skemxist Solutions—an Indigenous-led contractor affiliated with the Osoyoos Indian Band—a partnership that strengthens social licence and community credibility in tandem with the technical and financial roadmap.

From a technical perspective, the project rests on a prior NI 43-101 preliminary economic assessment citing approximately 10.6 million tonnes of contained magnesium at Record Ridge. The mine is designed to be low-impact—no chemical processing or onsite smelting emissions, minimal footprint, phased scaling from early cash flow to full-scale refining. That combination of greener design and industrial ambition is unusual among junior miners.

Execution risks such as access to construction financing, securing offtake agreements, adherence to project timelines, and maintaining community and Indigenous alignment remain relevant. In contrast to many early-stage explorers, however, W.H.Y. now holds the permit for the development of its Record Ridge Industrial Mineral Mine (RRIMM) and has publicised a defined pathway toward development.

Viewed in a broader context, W.H.Y. is an example of patient-capital deployment in Canada’s critical minerals sector. While some firms chase headline commodities, this company has taken a measured path—focusing less on high-visibility buzz and more on foundational industrial relevance. Its ambitions to integrate downstream value-chain elements and the credibility of its management team may attract attention from analysts and investors interested in structural mining plays rather than speculative bets.

As the Record Ridge project advances from permit into construction and initial operations, W.H.Y. enters a new chapter of its corporate narrative—evolving from grass roots exploration promise toward operational delivery. For those in the public-markets community focused on mining and supply-chain dynamics, the story now shifts to milestones, project execution and tangible outcomes.

Leave a Reply