The very name Nolan´s Bore is so redolent of the Australian Outback that it might have been conjured up by “Banjo” Patterson. One can imagine some tale of woe in the vast red plains with a broken-down windmill, snakes in the house, a young housewife left to her own devices and Aborigines standing guard on one leg with a spear as their only other means of support.

The project certainly qualifies as “back of beyond” as it is located 135 kilometers north of Alice Springs in the Northern Territory.

When we first came across this name in the distant first flush of the Rare Earth boom it was, like so many others, a washed-out uranium story that sought comfort in the exotic turn of the markets to “rare” earths, whatever they might be.

Interestingly, when googling the terms Arafura+Uranium up comes the AI-generated scolding “The “Arafura Uranium Project” is a misnomer for the Arafura Nolans Rare Earths Project in the Northern Territory, Australia. While the project does involve naturally occurring radioactive elements like thorium and uranium within the ore, its primary focus is on mining and processing rare earth elements”. No folks…. The Arafura Uranium project was around well before AI and this tawdry attempt to rewrite the history books does not impress us.

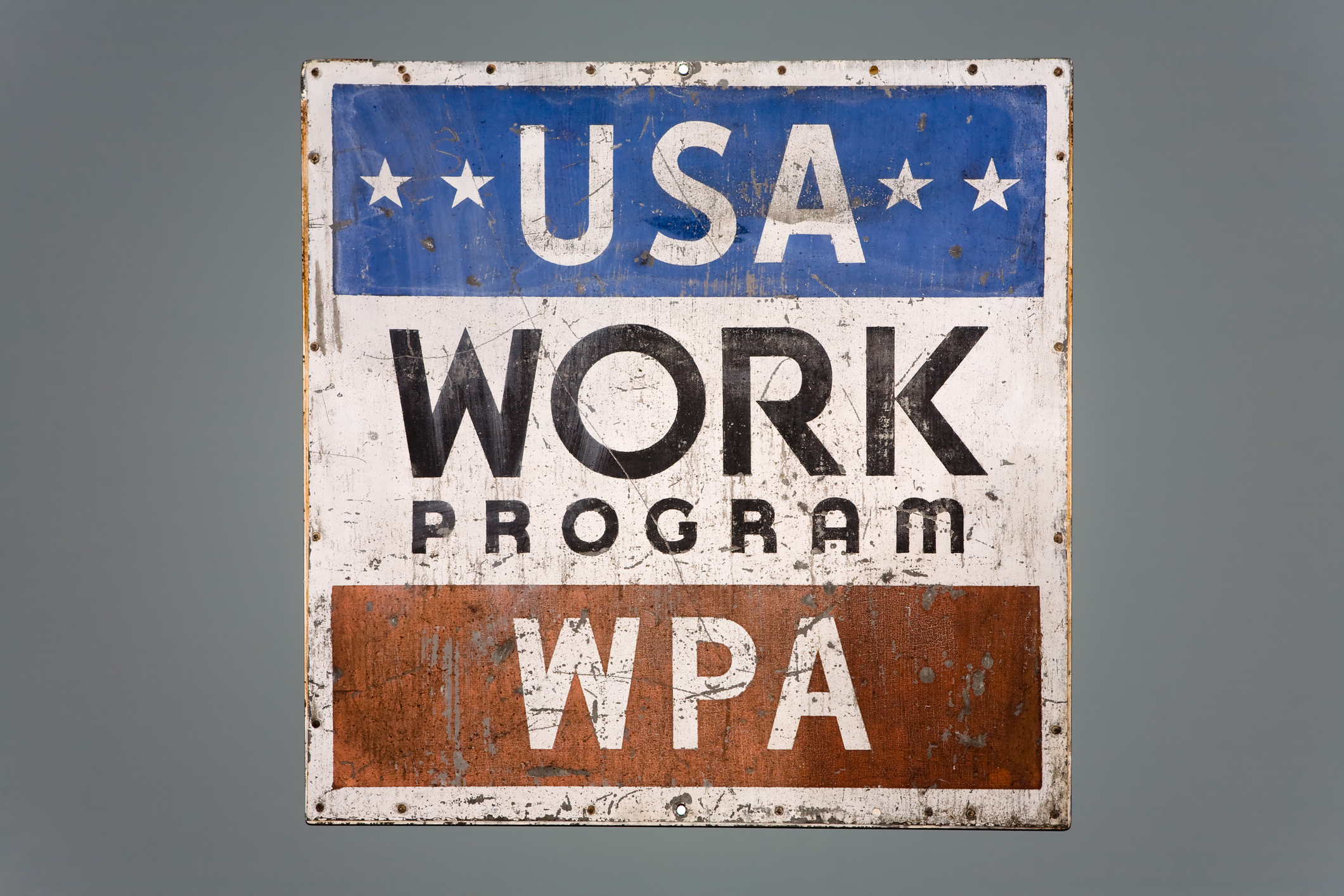

The Latin Americans have an interesting term “dedazo” which essentially means politicians pointing at the successor or “chosen ones. The Australian government seems to feel inspired (or obliged) to put its money where its mouth is and employ a dedazo in the Rare Earths space. The lucky winner in this positive form of Russian Roulette has been Arafura for its Nolans Rare Earths project. The role of Santa is played by the National Reconstruction Fund (NRF).

What is being “reconstructed is not clear as there was was nothing at the Bore previously (except may a windmill or an old codger telling tedious tales). And as Australia has never had a Rare Earth end-user industry and pretty much doesn’t have one now, the “Reconstruction” part of the name is more of a misnomer than “uranium” is.

The largesse (with emphasis on the “large”) includes:

- AUD$450 million commitment (October 2025): The National Reconstruction Fund Corporation (NRFC) committed an additional A$450 million to support the development of Arafura’s mine and processing facility.

- AUD$200 million commitment (January 2025): The NRFC committed a further AUD$200 million to the Nolans Project.

- AUD$840 million commitment (March 2024): The Australian government initially announced up to AUD$840 million in loans and grants through the NRF to help develop the Nolans Project.

It never rains but it pours in the Outback.

This funding is to develop the nation’s first integrated mine and refinery for REEs supposedly critical for renewable energy and defence technologies. Just what Australian industry has (not) been crying out for, particularly as Australia dispensed with its once mighty auto industry to glean brownie points in globalist heaven.

The project aims to produce REE oxides, including neodymium and praseodymium, essential for permanent magnets in electric vehicles and wind turbines. Neither of these items does Australia manufacture.

Arafura Rare Earths (ASX: ARU) with a market capitalisation of $837mn is still standing at lower than the amounts having been thrown at it.

The company is up a tad over 200% over five years but still less than half of its 2023 heyday.

This government glad-handing to some chosen companies (MP Materials in the US being another example) should have had the rest of the Rare Earth sector up in arms. But as the other companies are patiently waiting their turn in line to also be doled out (they hope) some petty change, they dare not open their mouths. However, as anyone who stood in a line at a bakery in Moscow in Soviet times would know sometimes one can stand in line all day just to arrive at the counter as the last stale loaf is sold off. There is no reason why any other companies should get any money whatsoever.

Indeed the more money that governments give to more projects the more production will exceed demand, losses and subsidies out of taxpayer funds will soar and the market will drown in over-production of both the sought-after and the “rubbish” REEs, like Cerium and Lanthanum.

Arafura is sitting at the top of a very heavily tilted playing field, but that does not alone secure survival if the whole scene is swamped by a tsunami of over-production of REEs in 5 years from now.

Leave a Reply